FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

- What is the total amount of manufacturing

overhead applied to production during the year? (Show complete calculations) - What is the total

manufacturing cost added to Work in Process during the year? - What is the

journal entry to record the transfer of completed jobs that is referred to above?

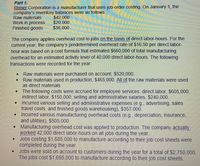

Transcribed Image Text:Part 1.

Rhiner Corporation is a manufacturer that uses job-order costing. On January 1, the

company's inventory balances were as follows:

Raw materials

Work in process

Finished goods

$42,000

$20,000

$36,000

The company applies overhead cost to jobs on the basis of direct labor-hours. For the

current year, the company's predetermined overhead rate of $16.50 per direct labor-

hour was based on a cost formula that estimated $660,000 of total manufacturing

overhead for an estimated activity level of 40,000 direct labor-hours. The following

transactions were recorded for the year:

Raw materials were purchased on account, $520,000.

Raw materials used in production, $465,000. All of the raw materials were used

as direct materials.

The following costs were accrued for employee services: direct labor, $605,000,

indirect labor, $150,000, selling and administrative salaries, $240,000.

Incurred various selling and administrative expenses (e.g., advertising, sales

travel costs, and finished goods warehousing), $357.000.

• Incurred various manufacturing overhead costs (e g., depreciation, insurance,

and utilities), $505,000.

• Manufacturing overhead cost was applied to production. The company actuallV.

worked 42,000 direct labor-hours on all jobs during the year.

Jobs costing $1,685,000 to manufacture according to their job cost sheets were

completed during the year.

Jobs were sold on account to customers during the year for a total of $2,750,000.

The jobs cost $1,695,000 to manufacture according to their job cost sheets.

Expert Solution

arrow_forward

Step 1

PLEASE LIKE THE ANSWER

- Total amount of manufacturing overhead applied to production during the year is =

=FORMULA= direct Labor hours actually worked * per direct Labor hour

= 42,000 * $ 16.50

= $ 693,000

2. Total manufacturing cost added to work in progress is

Formula = Raw Materials + Direct Labor + Manufacturing overhead

= $ 465,000 + $ 605,000 + $ 693,000

= $ 1763,000

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 17.) In a job order system, the ending Work in Process account balance should equal the sum of: A.) the Pokémon from all nine regions B.) all manufacturing costs for the period dloun C.) the open job cost sheets D.) the over or under-applied balance in Manufacturing Overhead for the periodarrow_forwardTrying to figure out how to calculate manufacturer compute cost of goods manufactured and cost of goodssoldarrow_forwardJournalizing the entry for a job completed would include a debit to a.Work in Process b.Factory Overhead c.Finished Goods d.Cost of Goods Soldarrow_forward

- What document is used to determine the actual amount of direct labor to record on a job cost sheet? a. Wages payable account O b. Payroll register c. Time ticket d. Production orderarrow_forward1. How much overhead would have been charged to the company’s Work-in-Process account during the year? 2. Comment on the appropriateness of the company’s cost drivers (i.e., the use of machine hours in Machining and direct-labor cost in Assembly).arrow_forwardWhat journal entry is recorded when a material manager recieves a materials requisiton andthen issues materials (both direct and indirect) for use in the factory?arrow_forward

- What journal entry is recorded when a materials manager receives a materials requisition and then issues materials (both direct and indirect) for use in the factory?arrow_forwardIndicate whether the accounts below are used in the cost flow for a manufacturer, a service provider, or both. Cost of Services Cost of Goods Sold Factory Overhead Finished Goods Materials Overhead Supplies Wages Payable Work in Processarrow_forwardDetermine whether each of the following costs should be classified as product costs or period costs. Depreciation on office equipment. Salary to painting supervisor. Wages paid to production workers. Insurance on office equipment and machinery. Materials purchased.arrow_forward

- Question: In a job order cost accounting system, which journal entry would be made when raw materials are transferred into production during the month? a. Debit Goods in Process Inventory and Credit Materials Expense. b. Debit Factory Overhead and Credit Raw Materials Inventory. c. Debit Goods in Process Inventory and Credit Raw Materials Inventory. d. Debit Raw Materials Inventory and Credit Goods in Process Inventory. e. Debit Finished Goods Inventory and Credit Goods in Process Inventory.arrow_forwardWhy must a company estimate the amount of factory overhead assigned to individual jobs or job lots?arrow_forwardNumber the following in the order of the flow of manufacturing costs for a company: a. Closing under/overapplied factory overhead to cost of goods sold b. Materials purchased c. Factory labor used and factory overhead incurred in production d. Completed jobs moved to finished goods e. Factory overhead applied to jobs according to the predetermined overhead rate f. Materials requisitioned to jobs g. Selling of finished product h. Preparation of financial statements to determine gross profitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education