FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

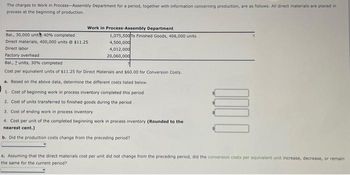

Transcribed Image Text:The charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in

process at the beginning of production.

Work in Process-Assembly Department

Bal., 30,000 unith 40% completed

Direct materials, 400,000 units @ $11.25

Direct labor

Factory overhead

Bal., 2 units, 30% completed

Cost per equivalent units of $11.25 for Direct Materials and $60.00 for Conversion Costs.

1,075,500 To Finished Goods, 406,000 units

4,500,000

4,012,000

20,060,000

a. Based on the above data, determine the different costs listed below.

1. Cost of beginning work in process inventory completed this period

2. Cost of units transferred to finished goods during the period

3. Cost of ending work in process inventory

4. Cost per unit of the completed beginning work in process inventory (Rounded to the

nearest cent.)

b. Did the production costs change from the preceding period?

0000

c. Assuming that the direct materials cost per unit did not change from the preceding period, did the conversion costs per equivalent unit increase, decrease, or remain

the same for the current period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Meaning of process costing and work in process :

VIEW Step 2: Determining the different cost stated in part a :

VIEW Step 3: Stating whether the production cost changes from the preceding period :

VIEW Step 4: Determining conversion cost per equivalent unit increase, decrease, or remain the same :

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: acountingarrow_forward? Cost of Units Completed and in Process The charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Bal., 4,000 units, 30% completed Direct materials, 94,000 units @ $1.4 Direct labor Factory overhead Bal., ? units, 70% completed Work in Process-Assembly Department 10,160 To Finished Goods, 92,000 units 131,600 280,400 109,100 Cost per equivalent units of $1.40 for Direct Materials and $4.10 for Conversion Costs. a. Based on the above data, determine the different costs listed below. 1. Cost of beginning work in process inventory completed this period 2. Cost of units transferred to finished goods during the period 3. Cost of ending work in process inventory 4. Cost per unit of the completed beginning work in process inventory (Rounded to the nearest cent.) 0000arrow_forwardCost of Units Completed and in Process The charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 6,400 units, 40% completed Direct materials, 116,000 units @ $6.25 45,760 To Finished Goods, 119,400 units 725,000 145,160 90,020 Direct labor Factory overhead Bal. 2 units, 25% completed a. Based on the above data, determine the different costs listed below. 1. Cost of beginning work in process inventory completed this period. 2. Cost of units transferred to finished goods during the period. 3. Cost of ending work in process inventory. 4. Cost per unit of the completed beginning work in process inventory, rounded to the nearest cent. b. Did the production costs change from the preceding period? 0000 ? c. Assuming that the direct materials cost per unit did not change from the preceding period, did the…arrow_forward

- Cost per Equivalent Unit The cost of direct materials transferred into the Rolling Department of Oak Ridge Steel Company is $462,800. The conversion cost for the period in the Rolling Department is $286,700. The total equivalent units for direct materials and conversion are 2,600 tons and 4,700 tons, respectively. Determine the direct materials and conversion costs per equivalent unit. Direct materials cost per equivalent unit: $fill in the blank 1 per ton Conversion cost per equivalent unit: $fill in the blank 2 per tonarrow_forwardEntries for Flow of Factory Costs for Process Costing Keoni Inc. manufactures a sugar product by a continuous process, involving three production departments—Refining, Sifting, and Packing. Assume that records indicate that direct materials, direct labor, and applied factory overhead for the first department, Refining, were $900,000, $375,000, and $2,860,000, respectively. Also, work in process in the Refining Department at the beginning of the period totaled $175,000, and work in process at the end of the period totaled $220,000. a. Journalize the entries to record the flow of costs into the Refining Department during the period for (1) direct materials, (2) direct labor, and (3) factory overhead. If an amount box does not require an entry, leave it blank. b. Journalize the entry to record the transfer of production costs to the second department, Sifting. If an amount box does not require an entry, leave it blank.arrow_forwardA production department within a company received materials of $11,632 material of $20,944 and conversion costs of $47,607. The equivalent units for conversion? Round to the nearest penny, two decimal places. are 29,937 for material and 18,214 for conversion. What is the unit cost and conversion costs of $10,660 from the prior department. It addedarrow_forward

- Cost per Equivalent Unit The cost of direct materials transferred into the Rolling Department of Kraus Company is $459,000. The conversion cost for the period in the Rolling Department is $303,800. The total equivalent units for direct materials and conversion are 2,700 tons and 4,900 tons, respectively. Determine the direct materials and conversion costs per equivalent unit. Direct materials cost per equivalent unit: $fill in the blank 1 per ton Conversion cost per equivalent unit: $fill in the blank 2 per tonarrow_forwardThe charges to Work in Process—Baking Department for a period as well as information concerning production are as follows. The Baking Department uses the average cost method, and all direct materials are placed in process during production.Work in Process – Baking DepartmentBeginning balance 900 units, 40% completed $2,466 To finished goods, 8,100 units ?Direct materials, 8,400 units 43,500Direct labor 18,200Factory overhead 7,504Ending balance 1,200 units, 60% completed ?Determine the following: a. The number of whole units to be accounted for and to be assigned costs b. The number of equivalent units of production c. The cost per equivalent unit d. The cost of units transferred to Finished Goods e. The cost of units in ending Work in Processarrow_forwardIn the manufacture of 9,400 units of a product, direct materials cost incurred was $177,400, direct labor cost incurred was $106,100, and applied factory overhead was $43,600. What is the total conversion cost? Oa..$149,700 Ob. $327,100 Oc. $43,600 Od. $177,400arrow_forward

- Equivalent Units of Production and Related Costs The charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 8,000 units, 65% completed 31,880 To Finished Goods, 184,000 units ? Direct materials, 188,000 units @ $2.10 394,800 Direct labor 404,400 Factory overhead 157,320 Bal., ? units, 20% completed ? Determine the following: a. The number of units in work in process inventory at the end of the period. units b. Equivalent units of production for direct materials and conversion. If an amount is zero or a blank, enter in "0". Work in Process-Assembly Department Equivalent Units of Production for Direct Materials and Conversion Costs WholeUnits Equivalent UnitsDirect Materials Equivalent UnitsConversion Inventory in process, beginning…arrow_forwardThe charges to Work in Process-Baking Department for a period as well as information concerning production are as follows. The Baking Department uses the avera cost method, and all direct materials are placed in process during production. Work in Process-Baking Department Bal., 2,500 units, 40% completed Direct materials, 18,300 units Direct labor 5,275 To Finished Goods, 18,000 units 56,364 29,458 15,175 Factory overhead Bal., 2,800 units, 60% completed If required, round cost per equivalent unit answer to two decimal places. a. Determine the number of whole units to be accounted for and to be assigned costs. units b. Determine the number of equivalent units of production. units c. Determine the cost per equivalent unit. X per equivalent unit d. Determine the cost of the units transferred to Finished Goods. Determine the cost of units in ending Work in Process.arrow_forwardThe charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department 21,200 To Finished Goods, 115,000 units 153,400 370,300 144,050 Bal., 5,000 units, 70% completed Direct materials, 118,000 units @ $1.3 Direct labor Factory overhead Bal., ? units, 35% completed Cost per equivalent units of $1.30 for Direct Materials and $4.50 for Conversion Costs. a. Based on the above data, determine the different costs listed below. 1. Cost of beginning work in process inventory completed this period 2. Cost of units transferred to finished goods during the period 3. Cost of ending work in process inventory 4. Cost per unit of the completed beginning work in process inventory (Rounded to the nearest cent.) b. Did the production costs change from the preceding period? 0000 c. Assuming that the direct materials cost per unit did…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education