FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

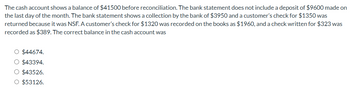

Transcribed Image Text:The cash account shows a balance of $41500 before reconciliation. The bank statement does not include a deposit of $9600 made on

the last day of the month. The bank statement shows a collection by the bank of $3950 and a customer's check for $1350 was

returned because it was NSF. A customer's check for $1320 was recorded on the books as $1960, and a check written for $323 was

recorded as $389. The correct balance in the cash account was

O $44674.

O $43394.

O $43526.

O $53126.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vikarmarrow_forwardWhich of the following items will not appear on the Books side of the reconciliation? A a non-sufficient funds check of $75 was returned to the bank and deduct it from the bank balance. Be a deposit was in transit in not yet deposited in the bank. See the bank charge a service fee of $20 on the bank statement. D the bank collected in notes receivable of $1000 for the businessarrow_forwardcash account for Norwegian Medical Co. at April 30 indicated a balance of $403,784. The bank statement indicated a balance of $468,460 on April 30. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: a. Checks outstanding totaled $73,870. b. A deposit of $51,230, representing receipts of April 30, had been made too late to appear on the bank statement. c. The bank collected $50,630 on a $48,220 note, including interest of $2,410. d. A check for $9,160 returned with the statement had been incorrectly recorded by Norwegian Medical Co. as $916. The check was for the payment of an obligation to Universal Supply Co. for a purchase on account. e. A check drawn for $680 had been erroneously charged by the bank as $860. f. Bank service charges for April amounted to $170. Required: 1. Prepare a bank reconciliation. Be sure to complete the statement heading. Refer to the Labels and…arrow_forward

- The cash account for Norwegian Medical Co. at April 30 indicated a balance of $12,195. The bank statement indicated a balance of $13,760 on April 30. Comparing the bank statement and the accompanying canceled checks and memos with the records revealed the following reconciling items: Checks outstanding totaled $4,950. A deposit of $5,160, representing receipts of April 30, had been made too late to appear on the bank statement. The bank collected $2,680 on a $2,550 note, including interest of $130. A check for $660 returned with the statement had been incorrectly recorded by Norwegian Medical Co. as $600. The check was for the payment of an obligation to Universal Supply Co. for a purchase on account. A check drawn for $90 had been erroneously charged by the bank as $900. Bank service charges for April amounted to $35. Required: Question Content Area 1. Prepare a bank reconciliation. Norwegian Medical Co.Bank ReconciliationApril 30 Cash balance according to bank statement…arrow_forwardThe Cash account of ReeseCorporation had a balance of $3,540 at October 31, 2018. Included were outstanding checkstotaling $1,800 and an October 31 deposit of $300 that did not appear on the bank statement.The bank statement, which came from Turnstone State Bank, listed an October 31 balance of$5,570. Included in the bank balance was an October 30 collection of $600 on account froma customer who pays the bank directly. The bank statement also showed a $30 service charge,$10 of interest revenue that Reese earned on its bank balance, and an NSF check for $50.Prepare a bank reconciliation to determine how much cash Reese actually had at October 31.arrow_forwardFor which of the following errors would the appropriate amount be added to the balance per books on a bank reconciliation? Deposit of $770 recorded by the bank as $77. O Check written for $73, but recorded by the company as $37. O A returned $470 check recorded by the bank as $47. Check written for $57, but recorded by the company as $75.arrow_forward

- JW Company’s cash balance at the end of the month was $4,500. After comparing the company’s records with the monthly bank statement, JW’s accountant identified the following reconciling items: outstanding checks, $800; deposits in transit, $700; bank service charge, $30; NSF check, $200. The cash receipt of the NSF check was previously wrongly recorded by the JW company as $250. What is the adjusted bank balance? (Assumption, no fraud in this case)arrow_forwardHunter Company bank statement indicated a cash balance of $9,610, while the cash 11. chut ledger account on that date shows a balance of $7,430 in July 31. Outstanding checks totaled $2,417. A $500 check mailed to the bank for deposit had not reached the bank at the statement date. The bank returned a customer's NSF check for $225 received as payment of an account receivable. 2016092 FAT 2019302296 The bank statement showed $30 interest earned on 201504 20130022 2019002295 the bank balance for the month of July. 7090022 2019002295 20120arrow_forwardKameron Gibson's bank statement showed a balance of $612.85. Kameron's checkbook had a balance of $215.20. Check Number 104 for $139.80 and check Number 105 for $19.55 were outstanding. A $799.30 deposit was not on the statement. He has his payroll check electronically deposited to his checking account-the payroll check was for $1,069.10. There was also a $10.80 teller fee and an $20.70 service charge. Prepare Kameron Gibson's bank reconciliation. Note: Input all amounts as positive values. Round your answers to 2 decimal places. Kameron's checkbook balance Add: Subtotal Deduct Subtotal Reconciled balance BANK RECONCILIATION Bank balance Add: Subtotal Deduct: + Reconciled balancearrow_forward

- Kameron Gibson's bank statement showed a balance of $1,020.35. Kameron's checkbook had a balance of $282.10. Check Number 104 for $150.70 and check Number 105 for $16.35 were outstanding. A $666.60 deposit was not on the statement. He has his payroll check electronically deposited to his checking account-the payroll check was for $1,260.90. There was also a $10.70 teller fee and an $12.40 service charge. Prepare Kameron Gibson's bank reconciliation. Note: Input all amounts as positive values. Round your answers to 2 decimal places. Kameron's checkbook balance Add: Subtotal Deduct: Subtotal Reconciled balance BANK RECONCILIATION Bank balance Add: Subtotal Deduct: Reconciled balancearrow_forwardPlease provide Solutionarrow_forwardThe cash account shows a balance of $86000 before reconciliation. The bank statement does not include a deposit of $5200 made on the last day of the month. The bank statement shows a collection by the bank of $2400 and a customer's check for $600 was returned because it was NSF. A customer's check for $940 was recorded on the books as $1080, and a check written for $131 was recorded as $193. The correct balance in the cash account was O $88400. O $87660. O $87722. O $96726.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education