ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

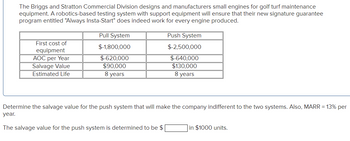

Transcribed Image Text:The Briggs and Stratton Commercial Division designs and manufacturers small engines for golf turf maintenance

equipment. A robotics-based testing system with support equipment will ensure that their new signature guarantee

program entitled "Always Insta-Start" does indeed work for every engine produced.

First cost of

equipment

AOC per Year

Salvage Value

Estimated Life

Pull System

$-1,800,000

$-620,000

$90,000

8 years

Push System

$-2,500,000

$-640,000

$130,000

8 years

Determine the salvage value for the push system that will make the company indifferent to the two systems. Also, MARR = 13% per

year.

The salvage value for the push system is determined to be $

in $1000 units.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Any help would be appreciated, thanks!arrow_forward5.24 You and your partner have become very interested in cross-country motorcycle racing and wish to purchase entry-level equipment. You have identified two alternative sets of equipment and gear. Package K has a first cost of $160,000, an operating cost of $7000 per quarter, and a salvage value of $40,000 after its 2-year life. Package L has a first cost of $210,000 with a lower operating cost of $5000 per quarter, and an estimated $26,000 salvage value after its 4-year life. Which package offers the lower present worth analysis at an interest rate of 8% per year, compounded quarterly?arrow_forwardKk.7.arrow_forward

- Nonearrow_forward5.24 For the cash flows below, use an annual worth comparison to determine which alternative is best at an interest rate of 1% per month. First cost, $ M&O costs, $/month Overhaul every 10 years, $ Salvage value, $ Life, years X -90,000 -400,000 -30,000 -20,000 - Y 7000 3 - 25,000 10 Z -900,000 -13,000 -80,000 200,000 8arrow_forwardQUESTION 3 For the below ME alternatives, which machine should be selected based on the AW analysis. MARR=10% Machine A Machine B Machine C First cost, $ 15,828 30000 10000 Annual cost, $/year Salvage value, s Life, years 8,753 6,000 4,000 4,000 5,000 1,000 Answer the below questions: A- AW for machine A= QUESTION 4 For the below ME alternatives, which machine should be selected based on the AW analysis. MARR=10% Machine A Machine B Machine C First cost, $ 15000 21,344 10000 Annual cost, $/year 8,314 6,000 4,000 Salvage value, $ Life, years 4,000 5,000 1,000 Answer the below questions: B- AW for machine B=arrow_forward

- Required information PEMEX, Mexico's petroleum corporation, has an estimated budget for oil and gas exploration that includes equipment for three offshore platforms as shown. Use PW analysis to select the best alternative at a MARR of 16% per year. Platform First cost, $ million Y Z -300 -450 -510 M&O, $ million per year -320 -290 -230 Salvage value, $ million 75 50 90 Estimated life, years 20 20 20 Select platform X, Y, or Z using tabulated factors. The present worth of platform X is $- 2298.4 worth of platform Z is $- 1944.14 million, the present worth of platform Y is $- 2262.15 million, and the present million. The platform selected based on the present worth is platform Zarrow_forwardSolve without using Excel (economics factor table is okay)arrow_forwardThe Briggs and Stratton Commercial Division designs and manufacturers small engines for golf turf maintenance equipment. A robotics-based testing system with support equipment will ensure that their new signature guarantee program entitled "Always Insta-Start" does indeed work for every engine produced. First cost of equipment AOC per Year Salvage Value Estimated Life Pull System $-1,250,000 $-700,000 $105,000 8 years Push System $-2,350,000 $-500,000 $90,000 8 years Determine the salvage value for the push system that will make the company indifferent to the two systems. Also, MARR = 13% per year. The salvage value for the push system is determined to be $ in $1000 units.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education