ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

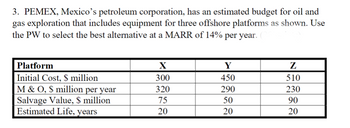

Transcribed Image Text:3. PEMEX, Mexico's petroleum corporation, has an estimated budget for oil and

gas exploration that includes equipment for three offshore platforms as shown. Use

the PW to select the best alternative at a MARR of 14% per year.

Platform

X

Y

Ꮓ

Initial Cost, $ million

300

450

510

M&O, $ million per year

320

290

230

Salvage Value, $ million

75

50

90

Estimated Life, years

20

20

20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Car A costs $800 more than Car B, but it consumes 0.035 gallons/mile versus 0.06 gallons/mile for Car B. Both vehicles last 10 years and B's salvage value is $175 smaller than A's. Fuel costs $2.30/gallon. Other things being equal, beyond how many miles of use per year (x) does A become preferable to B?arrow_forwardProblem 05.017 Alternative Comparison - Different Lives Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with tribological (i.e., low friction) properties for creating custom bearings for 3-D printers. The estimates associated with each alternative are shown below. Using a MARR of 19% per year, which alternative has the lower present worth? Method First Cost M&O Cost, per Year Salvage Value Life DDM $-160,000 $-40,000 $10,000 2 years The present worth for the DDM method is $ The present worth for the LS method is $ The (Click to select) method is selected. LS $-500,000 $-10,000 $33,000 4 yearsarrow_forward5.24 You and your partner have become very interested in cross-country motorcycle racing and wish to purchase entry-level equipment. You have identified two alternative sets of equipment and gear. Package K has a first cost of $160,000, an operating cost of $7000 per quarter, and a salvage value of $40,000 after its 2-year life. Package L has a first cost of $210,000 with a lower operating cost of $5000 per quarter, and an estimated $26,000 salvage value after its 4-year life. Which package offers the lower present worth analysis at an interest rate of 8% per year, compounded quarterly?arrow_forward

- A production plant manager has been presented with two proposals for automating an assembly process. Proposal A involve an initial cost of $15000 and an annual operating cost of $2000 per year for the next 4 years. Thereafter, the operating cost is expected to be $2700 per year. This equipment is expected to have a 20- year life with no salvage value. Proposal B requires an initial investment of $25000 and an annual operating cost of $1200 per year for the first 3 years. Thereafter, the operating cost is expected to increase by $120 per year. This equipment is expected to last 20 years and have a salvage value of $2000. If the company's MARR is 10%, which should be accepted using ROR analysis?arrow_forwardI need the answer in 10 minutes pleasearrow_forwardCan some one please help me to answer each question correctly? please and thank you.arrow_forward

- S Required information A remotely located air sampling station can be powered by solar cells or by running an above ground electric line to the site and using conventional power. Solar cells will cost $16,800 to install and will have a useful life of 5 years with no salvage value. Annual costs for inspection, cleaning, and other maintenance issues are expected to be $2,900. A new power line will cost $24,500 to install, with power costs expected to be $1,000 per year. Since the air sampling project will end in 5 years, the salvage value of the line is considered to be zero. NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. At an interest rate of 10% per year and using an AW analysis, which alternative should be selected? The annual worth of installing solar cells is $- a new power line is $- The alternative to be selected is (Click to select) and the annual worth of installingarrow_forwardIf the MARR=10%, compute the value of X that makes the alternatives equally desirable. Do not use spreadsheets. Alternatives Machine A Machine B First cost $12,000 $20,000 Annual Operating cost $1,400/year X Salvage value $2,000 $3,000 Life 4 years 8 yearsarrow_forwardRaytheon wishes to use an automated environmental chamber in the manufacture of electronic components. The chamber is to be used for rigorous reliability testing and burn-in. It is installed for $800,000, $350,000 of which is borrowed at 11% for 5 years, and will have a salvage value of $150,000 after 8 years. Its use will create an opportunity to increase sales by $650,000 per year and will have operating expenses of $250,000 per year. Corporate income taxes are 40%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR, if the chamber is kept for 8 years. After-tax MARR is 10%. Use 7 years class depreciation for MARCSarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education