ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

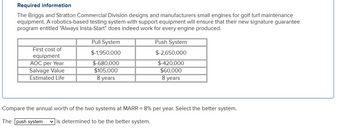

Transcribed Image Text:Required information

The Briggs and Stratton Commercial Division designs and manufacturers small engines for golf turf maintenance

equipment. A robotics-based testing system with support equipment will ensure that their new signature guarantee

program entitled "Always Insta-Start" does indeed work for every engine produced.

First cost of

equipment

AOC per Year

Salvage Value

Estimated Life

Pull System

$-1,950,000

$-680,000

$105,000

8 years

Push System

$-2,650,000

$-420,000

$60,000

8 years

Compare the annual worth of the two systems at MARR = 8% per year. Select the better system.

The push system ✓is determined to be the better system.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Given the following information for an insurance company that writes 24-month term policies: Number of Vehicles 50 100 Policy Group A B Effective Date January 1, 2010 Expiration Date December 31, 2011 July 1, 2010 June 30, 2012 All policies within each group have the same effective date. (a) Calculate the earned car-years for calendar year 2011. (b) Calculate the earned car-years for policy year 2010 evaluated as of December 31, 2010 and as of December 31, 2011. (c) Assume Policy Group B cancels on January 1, 2011. Calculate the 2010 policy year written car- years evaluated as of December 31, 2010 and as of December 31, 2011 for Policy Group B. (d) Assume Policy Group B cancels on July 1, 2011. Calculate the 2010 and 2011 calendar year written car-years for Policy Group B.arrow_forwardM2.arrow_forwardYou can earn 10% a year on your savings. Your dad offers you a Holiday Gift of $1000 this year, $2000 next Holiday, $3000 Holiday 2021. If instead he offered you $6,000 Holiday 2020 (next year). Which should you pick, the single payment or the 3 payments. SHOW YOUR WORK Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- 1 Uniform Annual Cash Flow An engineer has an Huct uating fut ure budget for the maint enance of a particular machine. During cach of the first 5 years, $10,000 per year will he budget ed. During the second 5 years, the annual budget will be $15,000 per year. In addition, $5000 will be budgeted for an overhaul (major repair) of the machine at end of the 4th year, and again at the end of the 8th year. What uniform annual expenditure (EUAC) would be equivalent, if interest rate is 8% per year?arrow_forward4:09 470 3 of 3 Assignment 2-2022.pdf 420 ct the cash flow diagram for A mechanical device will cost $20,000 when purchased. Maintenance will cost $1000 per year. The device will generate revenues of $5000 per year for 5 years. The salvage value is $7000. 8. Each year Exxon-Mobil expends large amounts of funds for mechanical safety features throughout its worldwide operations. Carla Ramos, a lead engineer for Mexico and Central American operations, plans expenditures of $1 million now and each of the 2 next 4 years just for the improvement of field-based pressure- release valves. Construct the cash flow diagram and find the equivalent value of these expenditures at the end of year 4, using a cost of capital estimate for safety-related funds of 12% per year. 9. An electrical engineer wants to deposit an amount P now such that she can withdraw an equal annual amount of A1 $2000 per year for the first 5 years, starting 1 year after the deposit, and a different annual withdrawal of A2 =…arrow_forwardA company wants to replace a current machine. It will cost$1,076,124. and 7years from now. If they save$9,039 a month in an account that gives them 0.28 per month, how much money will they still need to pay for the machene. i will 20 upvotes don't use chatgpt answer .arrow_forward

- Current Attempt in Progress A small manufacturer has net annual cash flows as follows over the first 4 years of business. The applicable interest rate varies from year to year. End of Year Cash Flow Interest Rate During Year 0 Present Worth -$100,000 Future Worth Click here to access the TVM Factor Table calculator. $ 1 $ $80,000 Uniform Series Annual Equivalents $ 4% 2 3 -$15,000 $70,000 6% Determine the present worth, future worth, and uniform series annual equivalents for each of the 5 flows in the series. Determine a uniform series from t=0 to t=4. 5% 4 $130,000 4%arrow_forwardConsider five years of monthly pro fit for a company Month Sales Jan-16 747 Feb-16 697 Mar-16 1014 Apr-16 1126 May-16 1105 Jun-16 1450 Jul-16 1639 Aug-16 1711 Sep-16 1307 Oct-16 1223 Nov-16 975 Dec-16 953 Jan-17 1024 Feb-17 928 Mar-17 1442 Apr-17 1371 May-17 1536 Jun-17 2004 Jul-17 1854 Aug-17 1951 Sep-17 1516 Oct-17 1642 Nov-17 1166 Dec-17 1106 Jan-18 1189 Feb-18 1209 Mar-18 1754 Apr-18 1843 May-18 1769 Jun-18 2207 Jul-18 2471 Aug-18 2288 Sep-18 1867 Oct-18 1980 Nov-18 1418 Dec-18 1333 Jan-19 1333 Feb-19 1370 Mar-19 2142 Apr-19 2138 May-19 2078 Jun-19 2960 Jul-19 2616 Aug-19 2861 Sep-19 2237 Oct-19 2225 Nov-19 1590 Dec-19 1659 Jan-20 1613 Feb-20 1605 Mar-20 2349 Apr-20 2468 May-20 2532 Jun-20 3127 Jul-20 3288 Aug-20 3285 Sep-20 2485 Oct-20 2723 Nov-20 1835 Dec-20 1894 question: Forecast monthly sales for 2022 choosing an appropriate method.arrow_forward2. Zharie's Fashion Boutique is an online selling business specializes in ready to wear clothes for teens and young adults. The average t-shirts sold every day is 15 and the average number of dresses sold every day is 10. She gets her supplies at a local RTW dèaler in' the city. The cost per t-shirt is 95 pesos whole the dresses cost 200 pesos per piece. She then adds 50% mark-up to every piece of RTW sold. Calculate how much mark-up she should add, determine how much should be the selling price for 20 liters bottled water and compute the projected revenue. Projected Projected Volume Revenue Type of RTW Cost per Unit Mark-up Selling Price Average No. of Item Sold Daily Totalarrow_forward

- ENGINEERING ECONOMICSMenchie bought his brother a laptop 5 years ago which has a cost of around 25,000PhP. The laptop’s life span willlast until 5 years. She has a friend which is a computer technician who advised her that the laptop’s life span couldextend until 10 years if she could spend semi-annual maintenance of 100Php with a 10Php increase rate startingthe next period of maintenance inspection. How much is the total future cost assuming that the money will havea rate of 2% compounded semi-annually if she decided to enjoy using her laptop beyond the expected life spanupon purchasing?arrow_forwardNo Excel please, need help, thank youarrow_forwardDRAW ALL CASH FLOW DIAGRAMS 1. Barbara wants to triple the money currently in her account that earns 3.5% per year interest. How long does she need to wait? 2. Joe deposits S8,000 right now and another $3,000 5 years from now. How much money will be in the account 12 years from now? Rate is 4% per year 3. Joe (the same one above) deposits $8,000 now and withdraws $3,000 5 years from now. How much money will be in the account 12 years from now? 4. Jane deposits $2,500 into an account that carns 4.5% per year. 3 years later, the interest rate goes up to 6.5% How much money she will have 8 years after the initial investment? 5. Tim starts his freshman year and would like to take a trip to Europe upon graduation that will cost $5,600. How much he should be saving every year, including his senior year to be able to afford this trip. His bank account earns 4.5% per year interest.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education