Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

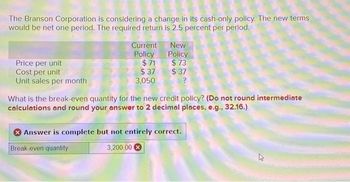

Transcribed Image Text:The Branson Corporation is considering a change in its cash-only policy. The new terms

would be net one period. The required return is 2.5 percent per period.

Price per unit

Cost per unit

Unit sales per month

Current

Policy

$71

$37

3,050

New

Policy

$73

$37

?

What is the break-even quantity for the new credit policy? (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

Answer is complete but not entirely correct.

Break-even quantity

3,200.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 19) Can i get help with this question pleasearrow_forwardWontaby Ltd. is extending its credit terms from 45 to 60 days. Sales are expected to increase from $4.75 million to $5.85 million as a result. Wontaby finances short - term assets at the bank at a cost of 12 percent annually. Calculate the additional annual financing cost of this change in credit terms. (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to the nearest whole dollar. Enter answer in whole dollar not in million.) Annual financing costNarrow_forwardProvide correct solutionarrow_forward

- Jamboo Corporation is considering extending trade credit to some customers previously considered poor risks. Sales would increase by $230009 if credit is extended. Of the new accounts receivable generated, 10 percent will prove to be uncollectible. Additional collection costs will be 5 percent of sales, and production and selling costs will be 75 percent of sales. The firm needs to pay 1,500 tax on additional sales. Compute Net income after tax. ANSWER FORMAT: 1234.56 Answer:arrow_forwardes Little Kimi Clothiers can borrow from its bank at 20 percent to take a cash discount. The terms of the cash discount are 3/25 net 85. a. Compute the cost of not taking the cash discount. (Use 365 days in a year. Do not round the intermediate calculations. Round the final answer to 2 decimal places.) Cost of not taking a cash discount b. Should the firm borrow the funds? % 00 Yes O Noarrow_forward3arrow_forward

- i need the answer quicklyarrow_forwardWontaby Ltd. is extending its credit terms from 30 to 45 days. Sales are expected to increase from $4.90 million to $6.00 million as a result. Wontaby finances short-term assets at the bank at a cost of 10 percent annually. Calculate the additional annual financing cost of this change in credit terms. (Use 365 days in a year. Do not round intermediate calculations. Round the final answer to the nearest whole dollar. Enter answer in whole dollar not in million.) Annual financing cost $arrow_forwardA holder of a 90-day bill with 40 days left to maturity and a face value of $ 100, 000 chooses to sell it into the market. If bills maturing in 40 days are currently yielding 1.75% per annum, what price will be obtained? (Assume there are 365 days in a year, and answers must be rounded to two decimal places) $ Please only use a plain number as your answer and don't insert a comma. For example, if you get 1000, please use 1000, and don't use 1,000.arrow_forward

- Suppose that over the next year, one of three things could happen to a company's credit rating. It could remain investment grade, drop to non-investment grade or default. The value of a credit derivative that pays $100 in 1-year if the company's credit rating remain investment grade is $93. The value of a credit derivative that pays $200 in 1-year if the company's credit rating drops to non-investment grade is $7. The value of a credit derivative that pays $300 in 1-year if the company defaults is $6. Calculate the risk-free rate and the risk-neutral probability of default. (answers to 4 decimal places)arrow_forward23) Can i get help with this question pleasearrow_forwardson.2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education