FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

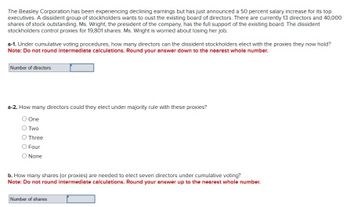

Transcribed Image Text:The Beasley Corporation has been experiencing declining earnings but has just announced a 50 percent salary increase for its top

executives. A dissident group of stockholders wants to oust the existing board of directors. There are currently 13 directors and 40,000

shares of stock outstanding. Ms. Wright, the president of the company, has the full support of the existing board. The dissident

stockholders control proxies for 19,801 shares. Ms. Wright is worried about losing her job.

a-1. Under cumulative voting procedures, how many directors can the dissident stockholders elect with the proxies they now hold?

Note: Do not round intermediate calculations. Round your answer down to the nearest whole number.

Number of directors

a-2. How many directors could they elect under majority rule with these proxies?

○ One

○ Two

O Three

O Four

○ None

b. How many shares (or proxies) are needed to elect seven directors under cumulative voting?

Note: Do not round intermediate calculations. Round your answer up to the nearest whole number.

Number of shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Similar questions

- Big Tractor, Inc.'s best salesperson is Misty Hammond. Hammond's largest sales have been to Farmer's Cooperative, a customer she brought to the company. Another salesperson, Bob Blanchette has been told in confidence by his cousin (an employee of Farmer's Cooperative) that Farmer's Cooperative is experiencing financial difficulties and may not be able to pay Big Tractor Inc. what is owed. Both Hammond and Blanchette are being considered for a promotion to a new sales manager position. What are the ethical considerations that Bob Blanchette faces? What alternatives do you think he has?arrow_forwardYou may attempt this question 2 more times for credit. Santos Unlimited (SU) was originally unlevered with 4600 shares outstanding. However, after a major financial restructure, SU now has $35000 of debt, with an annual interest expense of 11 percent. The restructuring has reduced the number of shares to 3700. A group of shareholders of SU are not convinced that this move towards adopting financial leverage is a good idea. Their main argument is that there is now some range of EBIT, however low, that will make the shareholders worse off than before. Help understand the situation better by computing the level of earnings before interest and tax (EBIT) that would make shareholders indifferent between being unlevered (i.e. not having any debt) and levered (i.e. having debt). Assume a 31 percent corporate tax rate. Answer: $ Place your answer to the nearest dollar without a dollar sign or a comma (if applicable).arrow_forward2. An analyst for Acme, R. Runner, has recommended that Peter the Anteater purchase shares in a private firm (a firm that is not traded on any exchange) called Dynamite Corp. Dynamite has 30% debt and 70% equity. R. Runner believes that Dynamite will generate a return of 10% over the next year. Since Y. Lee is new to the job, he decides to do a little research on his own. He finds a company, Explosions Unlimited, that has very similar business as Dynamite. Explosions has an equity beta of 1.05 and is composed of 40% debt and 60% equity. Should Peter the Anteater buy the stock? The expected return on the market is 12% and the expected risk-free rate is 5%.arrow_forward

- Larry Nelson holds 1,000 shares of General Electric's (GE) common stock. The annual stockholder meeting is being held soon, but as a minor shareholder, Larry doesn't plan to attend. Larry did not sell his shares but gave his voting rights to the management group running General Electric (GE). Larry must have signed a that gives the management group control over his shares. Larry also holds 2,000 shares of common stock in a company that only has 20,000 shares outstanding. The company's stock currently is valued at $43.00 per share. The company needs to raise new capital to invest in production. The company is looking to issue 5,000 new shares at a price of $34.40 per share. Larry worries about the value of his investment. Larry's current investment in the company is If the company issues new shares and Larry makes no additional purchase, Larry's investment will be worth . Larry could be protected if the firm's corporate charter includes a This scenario is an example of provision. If…arrow_forwardWhen Owens Corning emerged from bankruptcy in 2006, the debtholders became the sole owners of the company. But the old stockholders were not left entirely empty handed. Suppose they were given warrants to buy the new common stock at any point in the next seven years for $45.25 a share. Because the stock in the restructured firm was worth about $30 a share, the stock needed to appreciate by 50% before the warrants would be worth exercising. The standard deviation of Owens Corning stock was 41% a year and the interest rate when the warrants were issued was 5%. Owens Corning did not pay a dividend. Ignore the problem of dilution. Calculate the call value of Owens Corning warrants. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Call value $arrow_forwardYour company's dividend has remained at $2.80 for several years. The board shows no signs of wanting to change it. If shareholders have a required return of, say, 12.5%, what is an estimate of the value of your stock? Your company's dividend has remained at $2.80 for several years. The board shows no signs of wanting to change it. If shareholders have a required return of, say, 12.5%, what is an estimate of the value of your stock? about $35.00 about $44.64 about $22.40arrow_forward

- After learning how to value a stock in his Corporate Finance class, Mark Stark decided to put his knowledge into practice and use the constant growth rate model to value El Tomate Feliz Co. He found that the company was severely undervalued. The stock was trading at $50 per share, but he valued it at $120 per share. Mark complained: “I thought that El Tomate Feliz was a steal and bought as many shares as I could, but the price didn’t go up. I have waited a year, and the price has not changed that much.” Lower necessary rate of return - Mark would have estimated his cost of equity or required rate of return at lower levels, resulting in better intrinsic values as a result of the lower discount rate. What does this mean,” …Mark would have estimated his cost of equity or required rate of return at lower levels"arrow_forwardBruce buys $9,000 of Sketchy Corporation stock. Unfortunately, a major newspaper reveals the very next day that the company is being investigated for accounting fraud, and the stock price falls by 62%. What is the percentage increase now required for the value of Bruce's stock to get back to what he paid for it?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education