Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

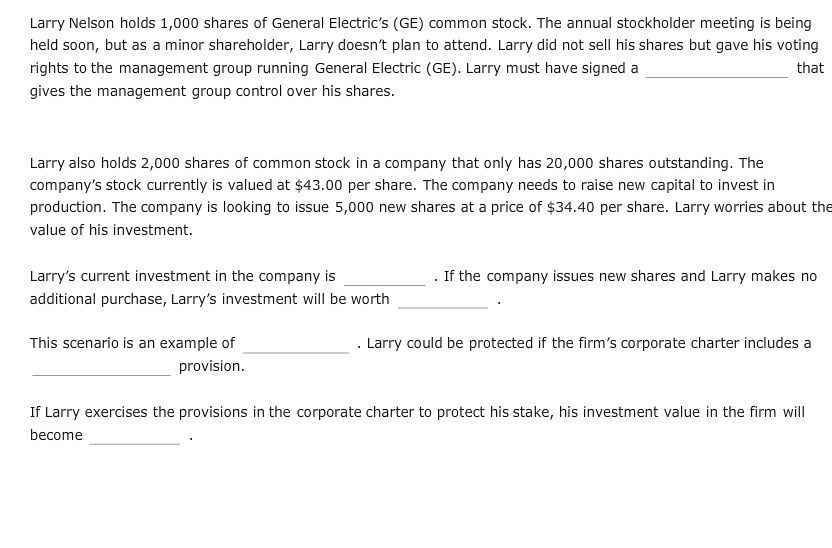

Transcribed Image Text:Larry Nelson holds 1,000 shares of General Electric's (GE) common stock. The annual stockholder meeting is being

held soon, but as a minor shareholder, Larry doesn't plan to attend. Larry did not sell his shares but gave his voting

rights to the management group running General Electric (GE). Larry must have signed a

that

gives the management group control over his shares.

Larry also holds 2,000 shares of common stock in a company that only has 20,000 shares outstanding. The

company's stock currently is valued at $43.00 per share. The company needs to raise new capital to invest in

production. The company is looking to issue 5,000 new shares at a price of $34.40 per share. Larry worries about the

value of his investment.

Larry's current investment in the company is

If the company issues new shares and Larry makes no

additional purchase, Larry's investment will be worth

. Larry could be protected if the firm's corporate charter includes a

This scenario is an example of

provision.

If Larry exercises the provisions in the corporate charter to protect his stake, his investment value in the firm will

become

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- The Board of Directors of CYZ Corporation votes to issue two shares of stock for each share held as a stock dividend to shareholders. Just prior to the dividend, Cheryl owns 100 shares of CYZ Corporation stock that she purchased for $10 per share. She receives 200 new shares as a result of the dividend. How much gross income must Cheryl report as a result of the dividend and what is her stock basis after the dividend?arrow_forwardG is employed by a Canadian-controlled private corporation. In year 1, G was granted a stock option to acquire 4,000 shares from the treasury of his employer’s corporation for $11 a share. At the time of receiving the option, the shares were valued at $13 per share. In year 3, G exercised his option and purchased 4,000 shares for $44,000. At the purchase date in year 3, the shares were valued at $12 per share. In year 5, G sold 4,000 shares for $17 per share. What amount is included in G’s employment income for tax purposes in year 1?arrow_forwardChandra was the sole shareholder of Pet Emporium, which was originally formed as an S corporation. When Pet Emporium terminated its S election on August 31, 2021, Chandra had a stock basis and an at-risk amount of $0. Chandra also had a suspended loss from Pet Emporium of $9,600. What amount of the suspended loss is Chandra allowed to deduct, and what is her basis in her Pet Emporium stock, at the end of the post-termination transition period under the following alternative scenarios (assume Pet Emporium files for an extension to file its tax returns)? Note: Leave no answer blank. Enter zero if applicable. a. Chandra makes capital contributions of $7,900 on August 30, 2022, and $4,720 on September 14, 2022.arrow_forward

- please see attached problemarrow_forwardAble owns 100% of ABC Corporation, which operates a restaurant. Able founds the corporation with $1,000 in capital. ABC has its own bank account, and Able does not commingle the corporation's funds with his own. ABC has never had a directors' meeting or a shareholders' meeting. ABC does not employ a bookkeeper, and its financial records are incoherent. ABC operates for six months and does not generate a profit. Shortly thereafter, a customer dies of food poisoning due to contaminated ham served by ABC. Can the customer's estate hold Able personally liable for any judgment rendered against ABC?arrow_forwardLarry also holds 2,000 shares of common stock in a company that only has 20,000 shares outstanding. The company’s stock currently is valued at $48.00 per share. The company needs to raise new capital to invest in production. The company is looking to issue 5,000 new shares at a price of $38.40 per share. Larry worries about the value of his investment. Larry’s current investment in the company is . If the company issues new shares and Larry makes no additional purchase, Larry’s investment will be worth . This scenario is an example ofdilution . Larry could be protected if the firm’s corporate charter includes apreemptive right provision. If Larry exercises the provisions in the corporate charter to protect his stake, his investment value in the firm will becomearrow_forward

- Damarcus is a 50 percent owner of Hoop (a business entity). In the current year, Hoop reported a $100,000 business loss. Answer the following questions associated with each of the following alternative scenarios. (Leave no answer blank. Enter zero if applicable.) a. Hoop is organized as a C corporation and Damarcus works full-time as an employee for Hoop. Damarcus has a $20,000 basis in his Hoop stock. How much of Hoop’s loss is Damarcus allowed to deduct against his other income? Allowable deduction of lossarrow_forwardRandall Bradwick's share of his S corporation net operating loss is $230,000 this year. His stock basis is $200,000, and he loaned the corporation $180,000, which created a debt basis for him of $180,000. Mr. Bradwick does not materially participate in the corporation or its activities. He does not meet the rental income exception. From other sources, Bradwick reports $100,000 of passive income. How much of the corporate net operating loss can Bradwick deduct?arrow_forwardWhat will be the Compensation for officers in the 1120, 2020 form? Please show the calculation as well. EC is owned by four related shareholders from the same family for the entire year: Raphael Giordano (father) and his three children Silvia, Andrea, and Marco. None of EC’s shareholders are non-U.S. persons. There are currently 10,000 shares of EC common stock issued and outstanding (EC has never issued preferred stock). The shareholders are also employees of EC and its only corporate officers. The relevant shareholder and officer information for the current year is provided below. Officer compensation is included in Employee Salaries on the income statement. Given in Income Statement for the period ending December 31, 2020 Salaries & Wages: $743,500. Their personal information is provided below. Raphael Giordano, Shares owned 5,500, 100% of time devoted to the business, compensation of $150,000 Silvia Giordano Costa, Shares owned 1,500, 100% of time devoted to the business,…arrow_forward

- Wilcox, chief executive officer and chairman of the board of directors, owned 60 percent of the shares of Sterling Corporation. When the market price of Sterling’s shares was $22 per share, Wilcox sold all of his shares in Sterling to Conrad for $29 per share. The minority shareholders of Sterling brought suit against Wilcox, demanding a pro rata share of the amount Wilcox received in excess of the market price. a. What are the arguments to support the minority shareholders’ claim for a pro rata share of the amount Wilcox received in excess of the market price? b. What are the arguments to reject the minority shareholders’ claim for a pro rata share of the amount Wilcox received in excess of the market price? c. Which side should prevail?arrow_forwardMichael has decided to retire from his business and pass the business on to his oldest child, Taylor. He does not want the value of his shares to grow over time. Michael’s shares have an ACB and PUC of $200 and a FMV of $300,000. He plans to use an estate freeze using Section 86. If Michael plans only to take shares as consideration for the exchange, describe the shares that he’ll take as exactly as you can. The type of shares, what happens to their value over time, their attributes such as ACB/PUC/FMV.arrow_forwardKhalil founded the "Taco Factory" 20 years ago as a family-oriented restaurant. Over the years as they grew the business, he incorporated and sold stock to outside investors. Recently the stockholders voted to seek liquor licenses and to sell beer and hard liquor in the restaurants. Khalil opposed this, citing the history of the restaurant's "family" environment, but was voted down. Khalil has experienced which drawback of the corporate form of ownership? The potential for diminished managerial incentives. The inability to accumulate capital. The potential loss of control. Legal requirements and red tape.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education