FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

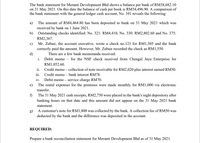

Transcribed Image Text:The bank statement for Meranti Development Bhd shows a balance per bank of RM38,682.10

on 31 May 2021. On this date the balance of cash per book is RM34,496.90. A comparison of

the bank statement with the general ledger cash account, No. 101 reveals the following:

a) The amount of RM4,464.80 has been deposited to bank on 31 May 2021 which was

received by bank on 1 June 2021.

b) Outstanding checks identified: No. 321: RM4,410, No. 330: RM2,802.60 and No. 375:

RM2,367.

c) Mr. Zubair, the account executive, wrote a check no.123 for RM1,505 and the bank

correctly paid the amount. However, Mr. Zubair recorded the check as RM1,550.

d)

i. Debit memo - for the NSF check received from Chengal Jaya Enterprise for

There are a few bank memoranda received:

RM1,052.60.

ii. Credit memo – collection of note receivable for RM2,020 plus interest earned RM50.

iii. Credit memo – bank interest RM78.

iv. Debit memo – service charge RM70.

e) The rental expenses for the premises were made monthly for RM1,000 via electronic

transfer.

f) The 31 May 2021 cash receipts, RM2,750 were placed in the bank's night depository after

banking hours on that date and this amount did not appear on the 31 May 2021 bank

statement.

g) A customer's note for RM1,800 was collected by the bank. A collection fee of RM50 was

deducted by the bank and the difference was deposited in the account.

REQUIRED:

Prepare a bank reconciliation statement for Meranti Development Bhd as of 31 May 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Universal Bhd had a debit balance of RM56,500 in the cashbook on 31 December 2021. TheBank Statement received for the month showed a credit balance of RM76,710. On comparingthe cashbook with the Bank Statement, the following were discovered:A deposit entry of RM19,500 which appears in the cashbook at 31 December 2021 hadnot yet been credited in the bank statement.The bank had collected on the firm's behalf a check for RM30,360 being proceeds of asale.A check amounting to RM10,500 which was recorded as a receipt in the cashbook wasreturned to the firm by the bank, stamped with the word"insufficient funds'The last check entered in the cash payment, No 1234, for RM3,630 appears in the bankstatement as RM3,600. An examination of the cashbook reveals that the bank figure iscorrect.Check No 1236 for RM3,180 has been correctly debited in the bank statement but notshown in the cashbook of the firm.6The checks No1237 RM9,000 and No1238 RM21,000 drawn by the firm have not yetbeen presented to…arrow_forwardBelow is information about Lisa Ltd’s cash position for the month of June 2019.1. The general ledger Cash at Bank account had a balance of $21,200 on 31 May.2. The cash receipts journal showed total cash receipts of $292,704 for June.3. The cash payments journal showed total cash payments of $265,074 for June.4. The June bank statement reported a bank balance of $41,184 on 30 June.5. Outstanding cheques at the end of June were: no. 3456, $1,448; no. 3457, $84; no. 3460, $70 andno. 3462, $410.6. Cash receipts of $10,090 for 30 June were not included in the June bank statement.7. Included on the bank statement were: a dishonoured cheque written by a client James Ltd, $136 a credit for an electronic transfer from a customer of $644 interest earned, $44 account and transaction fees, $120Required:a) Update the cash receipts and cash payments journals by adding the necessary adjustments andcalculate the total cash receipts and cash payments for June. b) Post from cash receipts and cash…arrow_forwardThe following information pertains to Fish Cake Company on December 31, 2021: Bank statement balance- P5,000,000; Checkbook balance- P5,600,000; Deposit in transit- P2,000,000; Outstanding checks, including P100,000 certified check- P500,000. In Fish Cake’s December 31, 2021 statement of financial position, cash should be reported at: a. P6,500,000 b. P7,100,000 c. P6,600,000 d. P7,200,000arrow_forward

- Read and understand the transaction. Prepare a Bank Reconciliation Statement using the following methods: Adjusted Method Book-to-bank Method Bank-to-book Method Use the space provided for each method for you answer. Moonlight Company maintains cash in ODB Bank. The following information was made available for the month of October 2021: The bank statement at the of the month shows ₱10,000. Deposits not yet reflected in the bank statement, ₱84,000. Checks issued but not yet encashed by the payees, ₱65,000. The bank made an error of debiting the account of Moonlight Company, which was actually a debit for Crescent Company, ₱4,000. The ledger shows a cash-in-bank balance of ₱12,000. Notes receivable collected by the bank for Moonlight Company amounted to ₱16,000. Interest earned by Moonlight Company from keeping their cash at ODB Bank is ₱5,000. ODB Bank charged Moonlight Company ₱1,000 service charges directly debited to their account as seen in the…arrow_forwardOn July 31, 2022, Crane Company had a cash balance per books of $6,245.00. The statement from Dakota State Bank on that date showed a balance of $7,795.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was $16.00. 2. The bank collected $1,625.00 from a customer for Crane Company through electronic funds transfer. 3. The July 31 receipts of $1,307.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. Company check No. 2480 issued to L. Taylor, a creditor, for $284.00 that cleared the bank in July was incorrectly entered in the cash payments journal on July 10 for $245.00. 5. Checks outstanding on July 31 totaled $1,965.10. 6. On July 31, the bank statement showed an NSF charge of $680.00 for a check received by the company from W. Krueger, a customer, on account. Prepare the necessary adjusting…arrow_forwardABC Group of Industries reports the following information concerning cash balances and cash transactions for the month of April: A Cash balance per bank statement as of April 30 was Rs 22,992.50 Two debit memoranda accompany the bank statement: one for Rs: 9 was for service charges for the month; the other for Rs 62.50 was attached to an NSF check from Rizwan. Included with the bank statement was Rs 3123.25 credit memorandum for interest earned on the bank account in April. The paid checks returned with the April bank statement disclosed an error in ABC cash records. Check no.751 for Rs 67.35 for telephone expense had erroneously been listed in the cash payments journal as Rs 76.35. A collection charge for Rs 25 (not applicable to Daytona) was erroneously deducted from the account by the bank. Notice that this was the bank’s error. Cash receipts of April 30 amounting to Rs 484.75 were mailed to the bank too late to be included in the April bank statement. Checks outstanding as of…arrow_forward

- The accountant of Universe Manufacturing collected the following information: The balance as per bank statement is $2,560.32 on 30 June 2020. On this date, the balance of the company’s book is $3,730.32. In addition, the accountant found the following items: a) Deposits in transit $1,460 b) Outstanding checks: $730 c) Bank statement shows a bank collection from bill receivables $1,000 d) Bank statement shows Interest received of $150 e) Bank service charge in the bank statement is $340 Required: prepare bank reconciliation statement at 30 June 2020.arrow_forwardOn July 31, 2022, Cullumber Company had a cash balance per books of $6,250.00. The statement from Dakota State Bank on that date showed a balance of $7,800.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was $20.00. 2. The bank collected $1,630.00 from a customer for Cullumber Company through electronic funds transfer. 3. The July 31 receipts of $1,308.30 were not included in the bank deposits for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. Company check No. 2480 issued to L. Taylor, a creditor, for $394.00 that cleared the bank in July was incorrectly entered in the cash payments journal on July 10 for $349.00. 5. Checks outstanding on July 31 totaled $1,979.10. 6. On July 31, the bank statement showed an NSF charge of $685.00 for a check received by the company from W. Krueger, a customer, on account. Prepare the…arrow_forwardThe cash account of Sheffield Co. showed a ledger balance of $7,088.13 on June 30, 2020. The bank statement as of that date showed a balance of $7,470. Upon comparing the statement with the cash records, the following facts were determined. 1. 2. 3. 4. 5. 6. 7. (a) There were bank service charges for June of $45. A bank memo stated that Bao Dai's note for $2,160 and interest of $64.80 had been collected on June 29, and the bank had made a charge of $9.90 on the collection. (No entry had been made on Sheffield's books when Bao Dai's note was sent to the bank for collection.) Receipts for June 30 for $6,102 were not deposited until July 2. Checks outstanding on June 30 totaled $3,844.89. The bank had charged the Sheffield Co.'s account for a customer's uncollectible check amounting to $455.76 on June 29. A customer's check for $162 (as payment on the customer's Accounts Receivable) had been entered as $108 in the cash receipts journal by Sheffield on June 15. Check no. 742 in the amount…arrow_forward

- On July 31, 2022, Ivanhoe Company had a cash balance per books of $6,310.00. The statement from Dakota State Bank on that date showed a balance of $7,860.80. A comparison of the bank statement with the Cash account revealed the following facts. The bank service charge for July was $18.00. The bank collected $1,690.00 for Ivanhoe Company through electronic funds transfer. The July 31 cash receipts of $1,370.30 were not included in the bank statement for July. These receipts were deposited by the company in a night deposit vault on July 31. 1. 2. 3. Company check No. 2480 issued to L. Taylor, a creditor, for $354.00 that cleared the bank in July was incorrectly recorded as a cash payment on July 10 for $345.00. Checks outstanding on July 31 totaled $2,003.10. On July 31, the bank statement showed an NSF charge of $745.00 for a check received by the company from W. Krueger, a- 4. 5. 6. customer, on account. (a) Prepare the bank reconciliation as of July 31. (List items that increase…arrow_forwardThe bank statement for Meranti Development Bhd shows a balance per bank of RM38,682.10 on 31 May 2021. On this date the balance of cash per book is RM34,496.90. A comparison of the bank statement with the general ledger cash account, No. 101 reveals the following: a) The amount of RM4,464.80 has been deposited to bank on 31 May 2021 which was received by bank on 1 June 2021. Outstanding checks identified: No. 321: RM4,410, No. 330: RM2,802.60 and No. 375: RM2,367. c) Mr. Zubair, the account executive, wrote a check no.123 for RM1,505 and the bank correctly paid the amount. However, Mr. Zubair recorded the check as RM1,550. d) There are a few bank memoranda received: i. Debit memo - for the NSF check received from Chengal Jaya Enterprise for RM1,052.60. Credit memo- collection of note receivable for RM2,020 plus interest earned RM50. Credit memo – bank interest RM78. v. Iree per boob) (+) Debit memo - service charge RM70. (- ) The rental expenses for the premises were made monthly for…arrow_forwardPrepare a bank reconciliation for Piston Limited as at 30 September 2022.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education