Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is Evergreen's total stockholder's equity on these general accounting question?

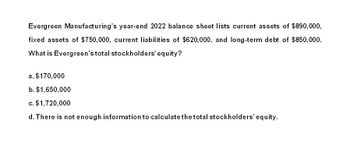

Transcribed Image Text:Evergreen Manufacturing's year-end 2022 balance sheet lists current assets of $890,000,

fixed assets of $750,000, current liabilities of $620,000, and long-term debt of $850,000.

What is Evergreen's total stockholders' equity?

a. $170,000

b. $1,650,000

c. $1,720,000

d. There is not enough information to calculate the total stockholders' equity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Barger Corporation has the following data as of December 31, 2024: Total Stockholders' Equity Total Current Liabilities Total Current Assets $ 36,210 58,200 181,630 Other Assets Long-term Liabilities Property, Plant, and Equipment, Net Compute the debt to equity ratio at December 31, 2024. (Round your answer to two decimal places, X.XX.) = = C $? 45,600 269,640 Debt to equity ratioarrow_forwardhas the following balance sheet (December 31, 2023). The figures are in $ million. Cash Short-term investments Accounts receivable Inventory Current assets Gross fixed assets Accumulated deprec. Net fixed assets $40 30 30 70 170 250 50 200 Total assets Accounts payable Accruals Notes payable $370 Current liabilities Long-term debt Common stock (par value=$1) Retained earnings Total common equity Total liab. & equity Note that only 50% of "cash" (shown in the balance sheet above) is used in operation. $30 50 10 90 70 30 180 210 Use the above information to answer questions 8 8. What is its total operating capital for 2023? $240 m $370arrow_forwardFinney Corporation has the following data as of December 31, 2018: Compute the debt to equity ratio at December 31,2018. Total Current Liabilities $36,210 Total Stockholders' Equity $ ? Total Current Assets 32,670 Other Assets 33,500 Long-term Liabilities 204,970 Property, Plant, and Equipment, Net 330,610arrow_forward

- Answer it as early as possible?arrow_forwardOn January 1, 2024 Palk Corp. and Spraz Corp. had condensed balance sheets as follows: Current assets Palk Corp. Spraz Corp. $ 99,000 $28,000 125,000 56,000 Noncurrent assets Total assets Current liabilities Long-term debt 224,000 84,000 42,000 14,000 70,000 70,000 Time left 3:54:49 Stockholders' equity 112,000 Total liabilities and stockholders' equity $224,000 $ 84,000 On January 1, 2024, Palk borrowed the entire $72,000 it needed to acquire 80% of the outstanding common shares of Spraz. Sha4res of Spraz are not actively traded on the market. The loan is to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2024. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 35% to inventory and 65% to goodwill. What is the amount attributable to consolidated noncurrent assets at January 1, 2024? O a. $196,000 O b. $181,000 Oc $223,000 Od. $218,500 O e. $194,000arrow_forwardMinnesota Manufacturing's balance sheet showed total common equity of $3,000,000 and 500,000 shares of stock outstanding on 12/31/2019. During 2020, the firm had $630,000 of net income, and it paid out $150,000 in dividends. What was the book value per share on 12/31/2020, assuming no common stock was issued or retired during 2020?arrow_forward

- The financial statements of Friendly Fashions include the following selected data (in millions): ($ in millions except share data) 2021 2020 Sales $ 9,843 $ 10,934 Net income $ 280 $ 798 Stockholders' equity $ 1,710 $ 2,290 Average Shares outstanding (in millions) 665 - Dividends per share $ 0.38 - Stock price $ 8.50 - Required:Calculate the following ratios for Friendly Fashions in 2021. (Enter your Dividend yield and Price-earning ratio values to 2 decimal places. Enter your answers in millions (i.e. 5,500,000 should be entered as 5.5).)arrow_forwardThe following information pertains to Maxwell Corporation. Assume that all balance sheet amounts represent both average and ending figures. Maxwell Corporation had 6,000 shares of common stock issued and outstanding. The market price of Maxwell common stock on December 31, 2019, was $20. Jasmin paid dividends of $0.90 per share during 2019. What is the debt to equity ratio for this corporation? Round your answer to 1 decimal place. Maxwell Corporation Partial Balance Sheet December 31, 2019 Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Stockholders' equity Total liabilities and stockholders' equity Maxwell Corporation Income Statement For the Year Ended December 31, 2019 Net sales Cost of goods sold Gross margin Operating expenses Income before income taxes Income taxes expense Net income $ 60,000 90,000 150,000 $300,000 $80,000 45,000 $35,000 15,000 $20,000 5,000 $15.000arrow_forwardPlease do not give image formatarrow_forward

- You find the following financial information about a company: net working capital = $7, 809; total assets $11,942; and long-term debt Multiple Choice $9, 115 $4, 507 $10, 339 $6, 129 $4, 133 = = = $1, 287; fixed assets $4,589. What is the company's total equity?arrow_forwardOn January 1, 2022, Palk Corporation and Spraz Corporation had condensed balance sheets as follows: Palk Spraz Current assets $ 99,000 $ 28,000 Noncurrent assets 125,000 56,000 Total assets 224,000 84,000 Current liabilities 42,000 14,000 Long-term debt 70,000 0 Stockholders' equity 112,000 70,000 Total liabilities and stockholders' equity $ 224,000 $ 84,000 On January 2, 2022, Palk borrowed the entire $84,000 it needed to acquire 80% of the outstanding common shares of Spraz. Shares of Spraz are not actively traded on the market. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2022. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill. What is the amount attributable to consolidated noncurrent assets at January 2, 2022?arrow_forwardGeneral accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning