FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:nces

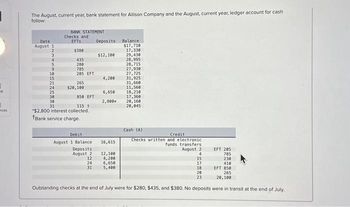

The August, current year, bank statement for Allison Company and the August, current year, ledger account for cash

follow:

Date

August 1

2

3

4

5

9

10

15

21

24

25

30

BANK STATEMENT

30

31

Checks and

EFTS

$380

435

280

785

205 EFT

265

$20,100

850 EFT

115 1

*$2,800 interest collected.

*Bank service charge.

Debit

August 1 Balance

Deposits

August 2

12

24

31

Deposits

$12, 100

4,200

6,650

2,800*

16,615

Balance

$17,710

17,330

29,430

28,995

12,100

4,200

6,650

5,400

28,715

27,930

27,725

31,925

31,660

11,560

18,210

17,360

20,160

20,045

Cash (A)

Credit

Checks written and electronic

funds transfers

August 2

4

EFT 205

785

230

410

EFT 850

265

20,100

Outstanding checks at the end of July were for $280, $435, and $380. No deposits were in transit at the end of July.

15

17

18

20

23

Transcribed Image Text:2253988ಕ

15

21

24

30

30

31

265

$20,100

115 1

*$2,800 interest collected.

*Bank service charge.

850 EFT

Debit

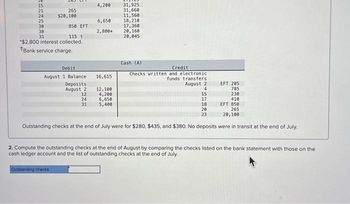

August 1 Balance

Deposits

August 2

Outstanding checks

12

24

31

4,200

6,650

2,800*

16,615

12,100

4,200

6,650

5,400

31,925

31,660

11,560

18,210

17,360

20,160

20,045

Cash (A)

Credit

Checks written and electronic

funds transfers

August 2

4

15

17

18

230

410

EFT 850

20

265

23

20,100

Outstanding checks at the end of July were for $280, $435, and $380. No deposits were in transit at the end of July.

EFT 205

785

2. Compute the outstanding checks at the end of August by comparing the checks listed on the bank statement with those on the

cash ledger account and the list of outstanding checks at the end of July.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- From the give Problem 2, What is the adjusted cash in bank on December 31?arrow_forwardPlease provide correct solutionarrow_forwardThe August bank statement and cash T-account for Martha Company follow: BANK STATEMENT Date Checks Deposits Other Balance August 1 $ 13,170 August 2 $ 100 13,070 August 3 $ 9,000 22,070 August 4 200 21,870 August 5 150 21,720 August 9 490 21,230 August 10 110 21,120 August 15 3,000 24,120 August 21 200 23,920 August 24 14,900 9,020 August 25 5,500 14,520 August 30 600 13,920 August 30 Interest earned $ 20 13,940 August 31 Service charge 10 13,930 Cash (A) Debit Credit August 1 Balance 13,170 Deposits Checks written August 2 9,000 100 August 1 August 12 3,000 200 August 2 August 24 5,500 150 August 3 August 31 4,000 110 August 4 490 August 5 190 August 15 250 August 17 600 August 18 200 August 19 14,900 August 23 August 31 Balance 17,480 No deposits were in transit and no checks were…arrow_forward

- Bank reconciliation and entries The following information was available to reconcile Nelson Company's book cash balance with its bank statement as of September 30, 2021: The September 30 cash balance according to the accounting records was $21,870. Oustanding checks from August's bank reconciliation: Check # 356 $1,240 Check # 357 775 Check # 359 3,280 Check # 360 924 Below is a record of the cash receipts and cash payments for September: Cash Deposits Cash Payments Date Amount Check# Amount Sep 2 $8,359 361 $3,268 Sep 4 11,250 362 7,140 Sep 6 4,371 363 4,257 Sep 12 5,260 364 3,525 Sep 15 12,118 365 4,160 Sep 18 7,493 366 1,789 Sep 22 5,395 367 6,285 Sep 27…arrow_forwardI need help with question is solutionarrow_forward1arrow_forward

- Hills Company's June 30 bank statement and the June ledger account for cash are summarized here: BANK STATEMENT Balance, June 1 Deposits during June Checks cleared during June Bank service charges Balance, June 30 Cash (A) Debit June 1 Checks $ 19,900 Deposits Other $ 18,800 Credit Balance 7,360 June Deposits 20,600 20,200 Checks written June June 30 Balance 7,760 $31 Balance $ 7,360 26,160 6,260 6,229 6,229 1. In addition to the balance in its bank account, Hills Company also has $420 of petty cash on hand. This amount is recorded in a separate account called Petty Cash on Hand. What is the total amount of cash that should be reported on the balance sheet at June 30?arrow_forwardWhat is the cash balance per books at November 30, 2021?arrow_forwardHills Company’s June 30 bank statement and the June ledger account for cash are summarized here: BANK STATEMENT Checks Deposits Other Balance Balance, June 1 $ 7,320 Deposits during June $ 18,600 25,920 Checks cleared during June $ 19,700 6,220 Bank service charges $ 31 6,189 Balance, June 30 6,189 Cash (A) Debit Credit June 1 Balance 7,320 June Deposits 20,200 20,000 Checks written June June 30 Balance 7,520 E5-5 (Algo) Part 1 Required:1. Prepare a bank reconciliation. A comparison of the checks written with the checks that have cleared the bank shows outstanding checks of $300. Some of the checks that cleared in June were written prior to June. No deposits in transit were noted in May, but a deposit is in transit at the end of June.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education