FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Prepare

Prepare the

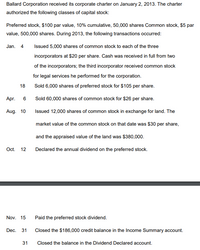

Transcribed Image Text:Ballard Corporation received its corporate charter on January 2, 2013. The charter

authorized the following classes of capital stock:

Preferred stock, $100 par value, 10% cumulative, 50,000 shares Common stock, $5 par

value, 500,000 shares. During 2013, the following transactions occurred:

Jan. 4

Issued 5,000 shares of common stock to each of the three

incorporators at $20 per share. Cash was received in full from two

of the incorporators; the third incorporator received common stock

for legal services he performed for the corporation.

18

Sold 6,000 shares of preferred stock for $105 per share.

Aprг.

Sold 60,000 shares of common stock for $26 per share.

Aug. 10

Issued 12,000 shares of common stock in exchange for land. The

market value of the common stock on that date was $30 per share,

and the appraised value of the land was $380,000.

Oct. 12

Declared the annual dividend on the preferred stock.

Nov. 15

Paid the preferred stock dividend.

Dec. 31

Closed the $186,000 credit balance in the Income Summary account.

31

Closed the balance in the Dividend Declared account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2022, the stockholders' equity section of Bridgeport Corporation shows common stock ($4 par value) $1,200,000; paid- in capital in excess of par $1,000,000; and retained earnings $1,240,000. During the year, the following treasury stock transactions occurred. 1 Purchased 50,000 shares for cash at $15 per share. July 1 Sold 11,000 treasury shares for cash at $17 per share. Sept. 1 Sold 9,500 treasury shares for cash at $14 per share. Mar. (a) Journalize the treasury stock transactions. (List all debit entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Creditarrow_forwardPrepare journal entries to record the following transactions for Emerson Corporation. July 15 Declared a cash dividend payable to common stockholders of $160,000. August 15 Date of record is August 15 for the cash dividend declared on July 15. August 31 Paid the dividend declared on July 15.arrow_forwardWhy is the statement of stockholders equity prepared before the June 39, 29Y9 balance sheet?arrow_forward

- EQUITY TRANSACTIONS JOURNAL ENTRIES Use the following stock and equity transactions to record journals and prepare a partial Balance Sheet: HINT: you will need to keep track of the various equity accounts. I will give you two of the accounts you will need: CS, Par and APIC, but there are a few others. You may use a schedule/table, T accounts, or your own method. 1. Equity Financing Inc (EFI) is formed on Jan 1, 2020 and establishes 50,000 shares of common stock authorized with a par value of $.50 per share. 2. EFI issues 4000 shares of CS to the founding owner in exchange for land with a FMV of $5000 AND cash of $10,000. 3. On January 31, EFI sells 2000 shares of Common Stock for cash at $15 per share. 4. On March 31, EFI completes a 1 for 2 FORWARD stock split. 5. On June 15th EFI repurchases 1,000 shares of its own stock for $10 per share. 6. On November 15th, EFI declares a cash dividend payable in the next accounting period of $1 per share outstanding. 7. Net income for the…arrow_forwardplease answer it with complete and correct working and steps answer in textarrow_forwardeBook Show Me How Video Question Content Area Statement of stockholders' equity Financial information related to All Seasons Company for the month ended June 30, 20Y7, is as follows: Common stock, June 1, 20Y7 $54,000 Stock issued in June 46,000 Net income for June 103,480 Dividends during June 11,380 Retained earnings, June 1, 20Y7 789,600 Prepare a statement of stockholders' equity for the month ended June 30, 20Y7. If an amount box does not require an entry, leave it blank. Enter negative value for dividends. All Seasons CompanyStatement of Stockholders' EquityFor the Month Ended June 30, 20Y7 blank Common Stock Retained Earnings Total $- Select - $- Select - $- Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - - Select - $- Select - $- Select - $- Select -arrow_forward

- Required: Prepare the stockholders' equity section of the balance sheet for For Feet's Sake as of December 31, 2024. (Amounts to be deducted should be indicated by a minus sign.) FOR FEET'S SAKE Balance Sheet (Stockholders' Equity Section) December 31, 2024 Stockholders' equity: Retained earnings Common stock Additional paid-in capital Total paid-in capital Total stockholders' equity S 0arrow_forwardPlease help mearrow_forwardThe equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow.5. How much net income did the company earn this year?arrow_forward

- The following events occurred Gargantuan's first year of operations: 1. Acquired $36,000 cash from the issue of common stock on January 1, 2018. 2. Purchased $1,600 of supplies on account. 3. Paid $6,120 cash in advance for a one-year lease on office space. 4. Earned $44,350 of revenue on account. 5. Incurred $14,900 of other operating expenses on account. 6. Collected $32,000 cash from accounts receivable. 7. Paid $9,800 cash on accounts payable. 8. Paid a $4,600 cash dividend to the stockholders. Adjusting Entries information 9. There was $310 of supplies on hand at the end of the accounting period. 0. The lease on the office space covered a one-year period beginning November 1. 11. There was $5,200 of accrued salaries at the end of the period.arrow_forwardOn May 1, Year 1, Love Corporation declared a $97,400 cash dividend to be paid on May 31 to shareholders of record on May 15. a. Prepare journal entries for all events associated with the dividend. Prepare the closing entry on December 31 for dividends.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education