Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

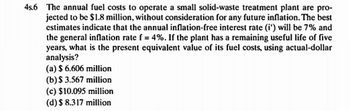

Transcribed Image Text:4s6 The annual fuel costs to operate a small solid-waste treatment plant are pro-

jected to be $1.8 million, without consideration for any future inflation. The best

estimates indicate that the annual inflation-free interest rate (i') will be 7% and

the general inflation rate f = 4%. If the plant has a remaining useful life of five

years, what is the present equivalent value of its fuel costs, using actual-dollar

analysis?

(a) $ 6.606 million

(b) $ 3.567 million

(c) $10.095 million

(d) $ 8.317 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a 200,000 SF office building complex, with NOI of $25/SF/year with rents and operating expenses paid in arrears (at the end of the year) annually, and no capital expenditures. The rent will increase by 3% per year. The discount rate is 10%/year. a. What is the value of this office building, assuming that the building is sold at the end of year 10 and the cap rate at that time is expected to be 10%? What is the cap rate at time 0? b. What is the value of this office building, assuming that the building will be held and rented indefinitely (perpetually)? What is the implied cap rate at time 0? c. What is the value if the rents are paid in advance (at the beginning of the year) and the building is rented perpetually?arrow_forwardA project that provides annual cash flows of $11322 for eight years costs $80145 today. At what discount rate would you be indifferent between accepting the project and rejecting it? (Enter your answer as a percentage, omit the "%" sign in your response, and round your answer to 2 decimal places. For example, 0.12345 or 12.345% should be entered as 12.35.)arrow_forwardHeedy Inc. is considering a capital investment proposal that costs $460,000 and has an estimated life of four years, and no residual value. The estimated net cash flows are as follows: Net Cash Flow $195,000 160,000 120,000 80,000 Year 1 2 3 4 The minimum desired rate of return for net present value analysis is 10%. The present value of $1 at compound interest rates of 10% for 1, 2, 3, and 4 years is 0.909, 0.826, 0.751, and 0.683, respectively. Determine the net present value. Enter negative values as negative numbers. 5,825 Xarrow_forward

- Lipsion Ltd company is thinking about investing in one of two potential new productsfor sale. The projections are as follows: year revenue/ product s revenue/ product v0 (150,000) outlay (150000) outlay1 14000 150002 24000 253333 44000 520004 84000 63333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%arrow_forwardSolve c) What is the payback period (PB) for this project?arrow_forwardGenerro Company is considering the purchase of equipment that would cost$60,000and offer annual cash inflows of$16,300over its useful life of 5 years. Assuming a desired rate of return of10%, is the project acceptable? (PV of \$1 and PVA of \$1) (Use appropriate factor(s) from the tables provided.) Mitiple Choice The answer cannot be detergined. No, since the negative net present value indicates the investmeot will yield a fate of retum below the desred tate of return. Yes, since the investment will generate$81.500in future cosh flows, which is gremer than the purchase cont of$60,000Yes, since the positve net present valse ind cates the investment will eam a rate of return greater than10 h.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education