FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

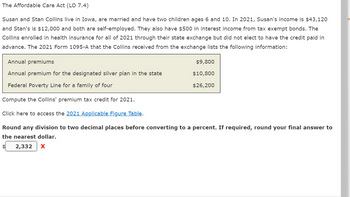

Transcribed Image Text:The Affordable Care Act (LO 7.4)

Susan and Stan Collins live in Iowa, are married and have two children ages 6 and 10. In 2021, Susan's income is $43,120

and Stan's is $12,000 and both are self-employed. They also have $500 in interest income from tax exempt bonds. The

Collins enrolled in health insurance for all of 2021 through their state exchange but did not elect to have the credit paid in

advance. The 2021 Form 1095-A that the Collins received from the exchange lists the following information:

Annual premiums

$9,800

Annual premium for the designated silver plan in the state

$10,800

Federal Poverty Line for a family of four

$26,200

Compute the Collins' premium tax credit for 2021.

Click here to access the 2021 Applicable Figure Table.

Round any division to two decimal places before converting to a percent. If required, round your final answer to

the nearest dollar.

2,332 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For 2020 not 2016 please Kia Lopez is single (SSN 412-34-5670) and resides at 101 Poker Street, Apt. 12A, Hickory, FL 34714. Her W-2 shows the following: Wages $ 56,500 Federal withholding 5,100 Social security wages 56,500 Social security withholding 3,503 Medicare withholding 819 State withholding -0- In 2020, Kia contributed cash of $7,000 to Apartment Rentals Limited Partnership (ARLP) in return for a 13% limited partnership interest. She is an active participant. Kia’s shares of ARLP income and losses for the year per her K-1 were as follows: Interest $ 35 Dividends (qualified) 290 Capital gains (long-term) 700 Rental loss (8,300) ARLP had no liabilities. Kia does not itemize and has no other investments or passive activities. Prepare Form 1040 for Kia Lopez for 2020. The taxpayer had qualifying health care coverage at all times during the tax year. You will need Form 1040, Schedule E (page 2), Form 6198, and Form 8582arrow_forward7arrow_forwardThe Affordable Care Act (LO 7.4) Susan and Stan Collins live in Iowa, are married and have two children ages 6 and 10. In 2022, Susan's income is $43,120 and Stan's is $12,000 and both are self- employed. They also have $500 in interest income from tax-exempt bonds. The Collins enrolled in health insurance for all of 2022 through their state exchange but did not elect to have the credit paid in advance. The 2022 Form 1095-A that the Collins received from the exchange lists the following information: Annual premiums Annual premium for the designated benchmark plan in the state $9,800 $10,800 Table for Repayment of the Credit Amount Less than 200% Single $325 Taxpayers Other Than Single $650 At least 200% but less than 300% 825 1,650 At least 300% but less than 400% 1,400 At least 400% No limit 2,800 No limit Click here to access the 2022 FPL table. Click here to access the 2022 Applicable Figure Table to use for this problem. Assume that the Collins' Form 1095-A also indicated that the…arrow_forward

- Susan and Stan Collins live in Iowa, are married and have two children ages 6 and 10. In 2020, Susan's income is $43,120 and Stan's is $12,000 and both are self-employed. They also have $500 in interest income from tax exempt bonds. The Collins enrolled in health insurance for all of 2020 through their state exchange and elected to have the credit paid in advance. The 2020 Form 1095-A that the Collins received from the exchange lists the following information: Annual premiums $9,800 Annual premium for the designated silver plan in the state $10,800 Total advance payment of the premium tax credit $9,200 The Federal Poverty Line for a family of four is $25,750. Table for Repayment of the Credit Amount Single Taxpayers OtherThan Single Less than 200% $325 $650 At least 200% but less than 300% 800 1,600 At least 300% but less than 400% 1,350 2,700 At least 400% No limit No limit Click here to access the 2020 Applicable Figure Table to use for this…arrow_forwardJada (age 53) and Elijah (age 60) are married, and both are self-employed. In 2022, they participate in a health insurance plan with a $3,000 annual deductible and out-of-pocket maximum of $9,000. The only other health plan they have is a vision insurance plan. Required: a1. Are they eligible to contribute to a health savings account? a2. If they can contribute to an HSA what is their maximum contribution and deduction? Complete this question by entering your answers in the tabs below. Required A1 Required A2 Answer is not complete. If they can contribute to an HSA what is their maximum contribution and deduction? Maximum HSA contribution/deductionarrow_forwardBenny is supported by the people listed below. 19-year-old child 15-year-old child 67-year-old mother In 2021, how many of these dependents will be eligible for the $500 nonrefundable Other Dependents Credit?arrow_forward

- Susan and Stan Collins live in Iowa, are married and have two children ages 6 and 10. In 2019, Susan’s income is $41,214 and Stan’s is $12,000 and both are self-employed. They also have $500 in interest income from tax-exempt bonds. The Collins enrolled in health insurance for all of 2019 through their state exchange but did not elect to have the credit paid in advance. The 2019 Form 1095-A that the Collins received from the exchange lists the following information:Annual premiums $9,800Annual premium for the designated silver plan in the state $10,800 Compute the Collins’ premium tax credit for 2019.arrow_forwardQuestion 27 of 50. Mark and Carrie are married, and they will file a joint return. They both work full-time, and their 2021 income totaled $89,000, all from wages. They have one dependent child, Aubrey (5). During the year, they spent $9,000 for Aubrey's child care. Neither Mark nor Carrie received any dependent care benefits from their employer. What amount may they use to calculate the Child and Dependent Care Credit? $0 $3,000 $8,000 $9,000 Mark for follow uparrow_forwardSherina Smith (Social Security number 785-23-9873) lives at 536 West Lapham Street, Milwaukee, WI 53204, and is self-employed for 2020. She estimates her required annual estimated income tax payment for 2020 to be $8,468. She was required to pay $254 when she timely filed her prior year tax return. Complete the first quarter voucher below for Sherina for 2020. Form1040-ESDepartment of the TreasuryInternal Revenue Service 2020 Estimated Tax Payment Voucher 1 OMB No. 1545-0074 File only if you are making a payment of estimated tax by check or money order. Mail this voucher with your check or money order payable to “United States Treasury.” Write your social security number and “2020 Form 1040-ES” on your check or money order. Do not send cash. Enclose, but do not staple or attach, your payment with this voucher. Calendar year—Due April 15, 2020 Amount of estimated tax you are paying by check or money order. Dollars Cents fill in the blank 1arrow_forward

- Required information Problem 8-70 (LO 8-4) (Algo) [The following information applies to the questions displayed below.] Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with his spouse. What amount of child tax credit (either as a child or a qualifying dependent) will Trey be able to claim in 2023 for his daughters under each of the following alternative situations? Use Exhibit 8-8. Problem 8-70 Part a (Algo) a. His AGI is $104,000. Amount of child tax creditarrow_forward• Matthew is a 6th grade teacher at a public school. Matthew and Rebecca are married and choose to file Married Filing Jointly on their 2023 tax return. Matthew worked a total of 1,500 hours in 2023. During the school year, he spent $733 on unreimbursed classroom expenses. • Rebecca retired in 2020 and began receiving her pension on November 1st of that year. She explains that this is a joint and survivor annuity. She has already recovered $1, 259 of the cost of the plan. Matthew settled with his credit card company on an outstanding bill and brought the Form 1099 - C to the site. They aren't sure how it will impact their tax return for tax year 2023. The Monroes determined that they were solvent as of the date of the canceled debt. • Rebecca received $200 from Jury duty. Their daughter, Safari, is in her second year of college pursuing a bachelor's degree in Biochemistry at a qualified educational institution. She received a scholarship and the terms require that it be used to pay…arrow_forwardMunabhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education