FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

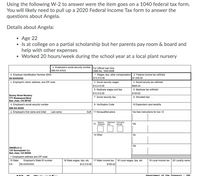

Transcribed Image Text:Using the following W-2 to answer were the item goes on a 1040 federal tax form.

You will likely need to pull up a 2020 Federal Income Tax form to answer the

questions about Angela.

Details about Angela:

Age 22

• Is at college on a partial scholarship but her parents pay room & board and

help with other expenses

• Worked 20 hours/week during the school year at a local plant nursery

a Employee's social security number For Official Use Only

085-XX-XXXX

OMB No. 1545-0008

b Employer Identification Number (EIN)

55-XXXXXXX

1 Wages, tips, other compensation 2 Federal income tax withheld

$13,312.00

$1,535.55

c Employer's name, address, and ZIP code

3 Social security wages

4 Social secuity tax withheld

$13,312.00

$825.34

5 Medicare wages and tips

6 Medicare tax withheld

$193.02

$13,312.00

Sunny Grow Nursery

777 Rosewood Blvd.

San Jose, CA 95102

7 Social security tips

8 Allocated tips

d Employee's social security number

085-XX-XXXX

9 Verification Code

10 Dependent care benefits

e Employee's first name and initial

Last name

Suff. 11 Nonqualfied plans

12a See instructions for box 12

Statutory

13 employee

Retirement Third-party

plan

sick pay

12b

14 Other

12c

12d

ANGELA LI

123 Sunnytown Ln.

San Jose, CA 94204

f Employee's address and ZIP code

15 State

Employer's State ID number

18 Local wages, tips, etc.

16 State wages, tips, etc.

$13,312.00

17 State income tax

19 Local income tax

20 Locality name

CA

55-XXXXXXX

$190.42

Department of the Treasury - IRS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject - account Please help me. Thankyou.arrow_forwardNonearrow_forwardDetermine from the tax table or the tax rate schedule, whichever is appropriate, the amount of the income tax for each of the following taxpayers for 2020. Please show all work and calculations where appropriate. Taxpayer(s) Filing Status Taxable Income Income Tax Macintosh Single $35,700 Hindmarsh MFS $62,000 Kinney MFJ $143,000 Rosenthal H of H $91,500 Wilk Single $21,400arrow_forward

- Please use the tables below to help you calculate 2023 tax liability (or refund) in each of the following independent scenarios. Please assume that a taxpayer who is eligible for the Earned Income Tax Credit will be able to take the maximum credit amount, even if the taxpayer's AGI puts her in the phaseout range. In other words, for purposes of this problem only, a taxpayer is either not eligible for the credit or eligible for the maximum credit. Also, please use only the two credits below in your calculation. No. of Children 0 1 2 3 or more Credit Rate 50% of your contribution 20% of your contribution 10% of your contribution 0% of your contribution Earned Income Credit (for Single Taxpayers & Head of Household) Tax Year 2023 Maximum Credit Income at Max Credit $7,840 $11,750 Married Filing Jointly AGI not more than $43,500 $43,501 - $47,500 $47,501 - $73,000 more than $73,000 $600 $3,995 $6,604 $7,430 Taxpayers with investment income of more than $11,000 are not eligible for the…arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardIn February 2021 Jin (a single taxpayer) filed her 2020 federal income tax return, claiming a refund of $1,200. Jin received the refund in March 2021. Which of the following is true in regards to how that refund will be reflected in Jin's 2021 federal income tax return? Answers: The refund will excluded from gross income. The refund will only be included in gross income if Jin used itemized deductions (including the deduction for relevant taxes) in the prior year. The refund will only be included in gross income if Jin used the standard deduction in the prior year. The refund will definitely be included in gross income, regardless of the details of Jin's prior year return.arrow_forward

- For each of the following businesses, determine the applicable FUTA tax rate for 2020 based on the locations listed below: 1. A business operating in Seatlle, WA. 2. A business operating in Charlotte, NC. 3. A business operating in Sacramento, CA. 4. A business operating in Bangor, ME. 5. A business operating in the U.S. Virgin Islands.arrow_forwardi need the answer quicklyarrow_forwardQuestion 1 Jahid (a mechanic) paid for the following items during the current tax year (2019-2020) and has approached you asking which of them are deductible from his salary income. He is a single tax resident for the year: Protective shoes and sunglasses with the cost of $600 all together Non-compulsory uniforms with the cost of $300 Compulsory uniforms with the cost of $700 Explain in detail (using a table for all the items above) with relevant tax laws and cases. Kindly use the four sections below for each case in your table. Facts of the scenario Relevant laws and cases Application of laws and cases Conclusionarrow_forward

- 2: Michael Kolk (single; 3 federal withholding allowances) earned biweekly gross pay of $935. He participates in a flexible spending account, to which he contributes $100 during the period. Federal income tax withholding = $ 3: Anita McLachlan (single; 0 federal withholding allowances) earned monthly gross pay of $2,510. For each period, she makes a 401(k) contribution of 9% of gross pay. Federal income tax withholding = $ 4: Stacey Williamson (married; 3 federal withholding allowances) earned semimonthly gross pay of $1,250. She participates in a cafeteria plan, to which she contributes $150 during the period. Federal income tax withholding = $arrow_forwardFor each employee listed, use the wage-bracket method to calculate federal income tax withholding, assuming that each has submitted a pre-2020 Form W-4. Then calculate both the state income tax withholding (assuming a state tax rate of 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax withholding. Refer to the Federal Tax Tables in Appendix A of your textbook.NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. Jay Monroe (single; 2 federal withholding allowances) earned weekly gross pay of $1,110. For each period, he makes a 401(k) retirement plan contribution of 10% of gross pay. The city in which he works (he lives elsewhere) levies a tax of 2.4% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents and 1.8% of an employee's taxable pay on nonresidents.…arrow_forward! Required information [The following information applies to the questions displayed below.] In 2023, Juanita is married and files a joint tax return with her husband. What is her tentative minimum tax in each of the following alternative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Input all values as positive. Leave no answer blank. Enter zero if applicable. d. Her AMT base is $422,500, which includes $13,000 of qualified dividends. Description (1) AMT base (2) Dividends taxed at preferential rate (3) Tax on dividends (4) AMT base taxed at regular AMT rates (5) Tax on AMT base taxed at 26% rate (6) Tax on AMT base taxed at 28% rate Tentative minimum tax Amountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education