FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

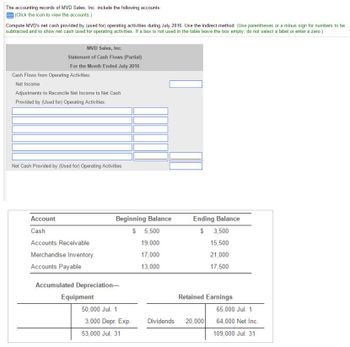

Transcribed Image Text:The accounting records of MVD Sales, Inc. include the following accounts:

(Click the icon to view the accounts.)

Compute MVD's net cash provided by (used for) operating activities during July 2016. Use the indirect method. (Use parentheses or a minus sign for numbers to be

subtracted and to show net cash used for operating activities. If a box is not used in the table leave the box empty; do not select a label or enter a zero.)

MVD Sales, Inc.

Statement of Cash Flows (Partial)

For the Month Ended July 2016

Cash Flows from Operating Activities:

Net Income

Adjustments to Reconcile Net Income to Net Cash

Provided by (Used for) Operating Activities:

Net Cash Provided by (Used for) Operating Activities

Account

Cash

Accounts Receivable

Merchandise Inventory

Accounts Payable

Beginning Balance

$ 5,500

19,000

17,000

13,000

Accumulated Depreciation-

Equipment

50,000 Jul. 1

3,000 Depr. Exp.

53,000 Jul. 31

Dividends

Ending Balance

$ 3,500

15,500

21,000

17,500

Retained Earnings

20,000

65,000 Jul. 1

64,000 Net Inc.

109,000 Jul. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following selected account balances appeared on the financial statements of Washington Company: Accounts Receivable, January 1 Accounts Receivable, December 31 Accounts Payable, January 1 Accounts Payable, December 31 $14,013 6,449 5,841 7,294 10,420 15,188 Sales 62,580 Cost of Merchandise Sold 36,279 Washington Company uses the direct method to calculate net cash flow from operating activities. Cash payments for merchandise were Merchandise Inventory, January 1 Merchandise Inventory, December 31 a. $42,500 Ob. $30,058 c. $39,594 Od. $65,895 Check My Work 1 more Check My Work uses remaining. Previousarrow_forwardWhat was the amount of net cash provided by operating activities for the year ended September 26, 2015? For the year ended September 27, 2014? What was the amount of increase or decrease in cash and cash equivalents for the year ended September 26, 2015? For the year ended September 27, 2014? Which method of computing net cash provided by operating activities does Apple use? From your analysis of the 2015 statement of cash flows, did the change in accounts receivable require or provide cash? Did the change in inventories require or provide cash? Did the change in accounts payable require or provide cash? What was the net outflow or inflow of cash from investing activities for the year ended September 26, 2015? What was the amount of income taxes paid in the year ended September 26, 2015?arrow_forwardPlease don't give image formatarrow_forward

- View previous at Required information Assume a company prepares the statement of cash flows using the indirect method. The company purchases its Inventory on credit from suppliers. How should a decrease in accounts payable be reflected In the section that reconciles net income to cash flow from operating activitles? Multiple Choice It would be added if the section starts with net income and subtracted if it starts with a net loss It would be added in reconciling net income to cash flow from operafing activities It would be subtracted in reconciling net income to cash flow from operating activities A change in accounts payable does not affect the reconciliation of net income to cash flow from operating activities < Prev 15 of 15 Next Form 1040Sch...pdf 6 Form1040 Sch...pdf B1040 Sohedul...pdf Form8829 (1).pdf MacBook Airarrow_forwardCromwell Company has the following trial balance account balances, given in no certain order, as of December 31, 2018. Using the information provided, prepare Cromwell’s annual financial statements (omitthe Statement of Cash Flows)arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please no image upload without plagiarismarrow_forwardPlease see attached pic from our hw answer key. I don't understand why question d,e,and f are consider income. Orignally, I left them blank. I also don't understand why the unused on question e and the unpaid on question f calcuated diffrenlty. Thank you.arrow_forwardi did most part, not sure if its correct. how do i find the cash at the begining of the year? i got $ -5500 as net decraese in casharrow_forward

- Required information [The following information applies to the questions displayed below.] The general ledger of Zips Storage at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: January 9 February 12 April 25 May 6 July 15 September 10 October 31 November 20 December 30 Provide storage services for cash, $135, 100, and on account, $52, 700. Collect on accounts receivable, $51, 600. Receive cash in advance from customers, $13,000. Purchase supplies on account, $9, 400. Pay property taxes, $8,600. Pay on accounts payable, $11,500. Pay salaries, $124, 600. Issue shares of common stock in exchange for $28,000 cash. Pay $2,900 cash dividends to stockholders.Prepare an unadjusted trial balance.arrow_forwardPlease do not give solution in image format thankuarrow_forwardGolden Corp.'s current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit, (4) all debits to Accounts Payable reflect cash payments for inventory, (5) Other Expenses are all cash expenses, and (6) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. GOLDEN CORPORATIONComparative Balance SheetsDecember 31 Current Year Prior Year Assets Cash $ 164,000 $ 107,000 Accounts receivable 83,000 71,000 Inventory 601,000 526,000 Total current assets 848,000 704,000 Equipment 335,000 299,000 Accum. depreciation—Equipment (158,000 ) (104,000 ) Total assets $ 1,025,000 $ 899,000 Liabilities and Equity…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education