FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please dont provide answer in image fromat thank you

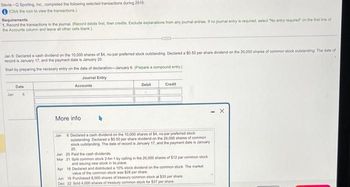

Transcribed Image Text:Stevie - Sporting, Inc., completed the following selected transactions during 2018:

(Click the icon to view the transactions)

Requirements

1. Record the transactions in the journal. (Record debits first, then credits. Exclude explanations from any journal entries. If no journal entry is required, select "No entry required" on the first line of

the Accounts column and leave all other cells blank.)

Jan 6: Declared a cash dividend on the 10,000 shares of $4, no-par preferred stock outstanding. Declared a $0.50 per share dividend on the 20,000 shares of common stock outstanding. The date of

record in January 17, and the payment date is January 20

Start by preparing the necessary entry on the date of declaration-January 6. (Prepare a compound entry),

Journal Entry

Accounts

Jan

Date

6

More info

Con

Debit

Credit

Jan 6 Declared a cash dividend on the 10,000 shares of $4, no-par preferred stock

outstanding Declared a $0.50 per share dividend on the 20,000 shares of common

stock outstanding. The date of record is January 17, and the payment date is January

20.

Jan 20 Paid the cash dividends

Mar 21 Split common stock 2-for-1 by calling in the 20,000 shares of $12 par common stock

and issuing new stock in its place.

Apr 18 Declared and distributed a 10% stock dividend on the common stock. The market

value of the common stock was $28 per share

Jun 10 Purchased 8,000 shares of treasury common stock at $33 per share

Dec 22 Sold 4,000 shares of treasury common stock for $37 per share

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education