FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

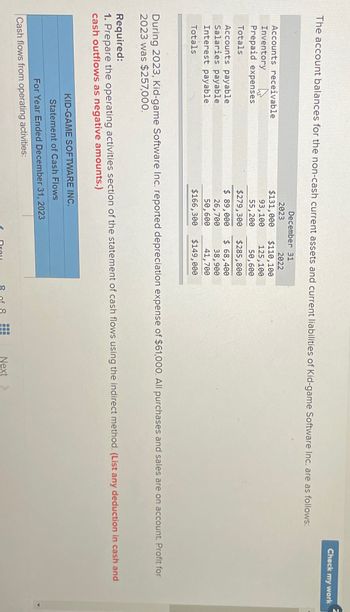

Transcribed Image Text:The account balances for the non-cash current assets and current liabilities of Kid-game Software Inc. are as follows:

Accounts receivable

4

Inventory

Prepaid expenses

Totals

Accounts payable

Salaries payable

Interest payable

Totals

December 31

2023

$131,000

93,100

55,200

$279,300

$ 89,000

26,700

50,600

$166,300

Cash flows from operating activities:

2022

$110,100

125,100

50,600

$285,800

$ 68,400

38,900

41,700

$149,000

During 2023, Kid-game Software Inc. reported depreciation expense of $61,000. All purchases and sales are on account. Profit for

2023 was $257,000.

KID-GAME SOFTWARE INC.

Statement of Cash Flows

For Year Ended December 31, 2023

Required:

1. Prepare the operating activities section of the statement of cash flows using the indirect method. (List any deduction in cash and

cash outflows as negative amounts.)

00

2₁

00

Check my work

#

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How do I create and start a balance sheet for this data?arrow_forwardCurrent assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Current liabilities Accounts payable Salaries payable Income tax payable Total current liabilities (a1) a. $8,600 Current ratio 12,900 b. Quick ratio 145,000 5,200 $171,700 $53,300 3,600 1,000 $57,900 2024 $30,100 10,300 :1 105,000 $152,300 :1 6,900 $40,400 5,000 1,000 $46,400 $27,100 7,700 100,000 During 2024, credit sales and cost of goods sold were $138,040 and $82,500, respectively. The 2023 and 2022 credit sales were $151,200 and $151,840, respectively, and the cost of goods sold for the same periods were $79,950 and $82,325, respectively. The accounts receivable and inventory balances at the end of 2021 were $6,900 and $85,000, respectively. 5,600 $140,400 Using the above data, calculate the following ratios: (Round receivables turnover ratio and average collection period to 1 decimal place, e.g. 15.2, days to sell inventory to 0 decimal places, e.g. 152 and all other answers to 2 decimal…arrow_forwardYou observe a company with the following items on the balance sheet (in thousands): Cash and equivalents 2018: $22 Cash and equivalents 2017: $23 Inventory 2018: $26 Inventory 2017: $21 Accounts receivable 2018: $144 Accounts receivable 2017: $129 Property, Plant, and Equipment 2018: $1,584 Property, Plant, and Equipment 2017: $1,663 Current Liabilities 2018: $247 Current Liabilities 2017: $291 Long-term debt 2018: $857 Long-term debt 2017: $1,494 What is the change in net working capital for the firm for these years. Answer in thousands (the same as how the numbers are presented).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education