FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

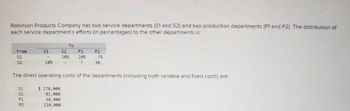

Transcribed Image Text:Robinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of

each service department's efforts (in percentages) to the other departments is:

To

From

S1

S1

S2

P1

P2

-

10%

20%

?%

S2

10%

?

30

The direct operating costs of the departments (including both variable and fixed costs) are:

៨៨៩៩

P1

$ 270,000

81,000

68,000

210,000

Transcribed Image Text:your bookmarks here on the bookmarks toolbar. Manage bookmarks...

-Cost Allocation

Saved

Check my work mode: This shows what is correct or incorrect for the work

Mc

Graw

Hill

O

*

་་ ས་Pས་་་"དོ"t སྦྲ'"བྱ་J {'"" P'་དདསų་་

To

From

S1

S2

P1

P2

S1

S2

10%

20%

?%

10%

?

30

The direct operating costs of the departments (including both variable and fixed costs)

S1

S2

៨៨៩៩

P1

P2

$ 270,000

81,000

68,000

210,000

F1

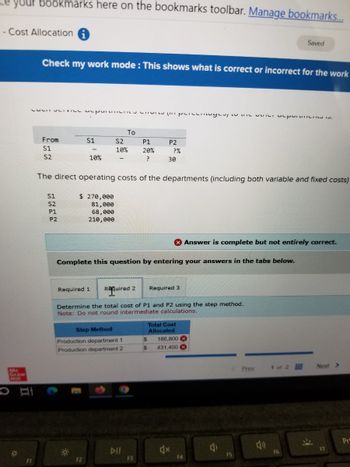

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Determine the total cost of P1 and P2 using the step method.

Note: Do not round intermediate calculations.

Total Cost

Step Method

Allocated

Production department 1

$

186,800

Production department 2

$

431,400

F2

IC

114

Prev

1 of 2

Next >

Pr

F3

F4

FS

F6

F7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Robinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department’s efforts (in percentages) to the other departments is: To From S1 S2 P1 P2 S1 - 10% 20% %? S2 10% - %? 30% The direct operating costs of the departments (including both variable and fixed costs) are: S1 $ 225,000 S2 75,000 P1 62,000 P2 180,000 Required: 1. Determine the total cost of P1 and P2 using the direct method. 2. Determine the total cost of P1 and P2 using the step method. 3. Determine the total cost of P1 and P2 using the reciprocal method.arrow_forwardRobinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (in percentages) to the other departments is: To From S1 S1 S2 P1 P2 - 10% 20% ?% S2 10% ? 30 The direct operating costs of the departments (including both variable and fixed costs) are: ៨៨៩៩ P1 $ 270,000 81,000 68,000 210,000arrow_forwardRobinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department’s efforts (in percentages) to the other departments is: From To S1 S2 P1 P2 S1 — 20 % 30 % ? % S2 20 % — ? 40 The direct operating costs of the departments (including both variable and fixed costs) are: S1 $ 220,000 S2 74,000 P1 61,000 P2 175,000 Required: 1. Determine the total cost of P1 and P2 using the direct method. 2. Determine the total cost of P1 and P2 using the step method. 3. Determine the total cost of P1 and P2 using the reciprocal method.arrow_forward

- Robinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department’s efforts (in percentages) to the other departments is: From To S1 S2 P1 P2 S1 — 20 % 30 % ? % S2 20 % — ? 40 The direct operating costs of the departments (including both variable and fixed costs) are: S1 $ 255,000 S2 85,000 P1 66,000 P2 200,000 Required: 1. Determine the total cost of P1 and P2 using the direct method. 2. Determine the total cost of P1 and P2 using the step method.arrow_forwardRobinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (in percentages) to the other departments is: To From S1 S1 - S2 10% P1 P2 20% ?% 10% ? 30 52 The direct operating costs of the departments (including both variable and fixed costs) are: $1 $ 270,000 S2 81,000 P1 68,000 es P2 210,000 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the total cost of P1 and P2 using the step method. Note: Do not round intermediate calculations. Step Method Production department 1 Production department 2 Total Cost Allocatedarrow_forwardRobinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (in percentages) to the other departments is: From S1 52 52 P1 20% 30% ? The direct operating costs of the departments (including both variable and fixed costs) are: S1 S1 S2 P1 P2 - 20% $ 200,000 73,000 60,000 170,000 To 2. Step method. 3. Reciprocal method. Required: Determine the total cost (including direct operating costs) of P1 and P2 using the: 1. Direct method. Required 1 Required 2 P2 Production department 1 Production department 2 ?% Answer is not complete. Complete this question by entering your answers in the tabs below. 40 $ $ Determine the total cost of P1 and P2 using the direct method. (Do not round intermediate calculations.) Total Cost Allocated Required 3 180,000 X 184,600 xarrow_forward

- Robinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (in percentages) to the other departments is: Fron s1 52 The direct operating costs of the departments (including both variable and fixed costs) are: s1 20% s1 52 PL P2 To $ 170,000 68,000 54,000 140,000 52 P1 20% 30% 2 P2 2% Production department 1 Production department 2 40 Required: 1. Determine the total cost of P1 and P2 using the direct metholt. 2. Determine the total cost of P1 and P2 using the step method. 3. Determine the total cost of P1 and P2 using the reciprocal method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Determine the total cost of P1 and P2 using the direct method. (Do not round intermediate calculations.) Total Cost Allocatedarrow_forwardRobinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (in percentages) to the other departments is: From S1 S2 S1 S2 To P1 10% 20% ? 10% S1 S2 P1 P2 – P2 $225,000 75,000 62,000 180,000 ?% The direct operating costs of the departments (including both variable and fixed costs) are: 30 Required: 1. Determine the total cost of P1 and P2 using the direct method. 2. Determine the total cost of P1 and P2 using the step method. 3. Determine the total cost of P1 and P2 using the reciprocal method.arrow_forwarded Robinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (in percentages) to the other departments is: From S1 52 $1 S1 S2 P1 P2 20% $2 20% $ 220,000 74,000 61,000 175,000 To P1 30% ? The direct operating costs of the departments (including both variable and fixed costs) are: Required 1 Required 2 P2 Production department 1 Production department 2 ?% Required: 1. Determine the total cost of P1 and P2 using the direct method. 2. Determine the total cost of P1 and P2 using the step method. 3. Determine the total cost of P1 and P2 using the reciprocal method. 40 Complete this question by entering your answers in the tabs below. $ $ Determine the total cost of P1 and P2 using the reciprocal method. (Do not round intermediate calculations. Round your final answers to whole dollars.) Required 3 Total Cost Allocated 183,548 346,458 < Required 2arrow_forward

- Robinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (In percentages) to the other departments is: From 51 52 S1 S1 S2 P1 P2 20% $ 250,000 80,000 67,000 205,000 To S2 20% P1 • P2 30% ? The direct operating costs of the departments (including both variable and fixed costs) are: ?% 48 Production department 1 Production department 2 Required: 1. Determine the total cost of P1 and P2 using the direct method. 2. Determine the total cost of P1 and P2 using the step method. 3. Determine the total cost of P1 and P2 using the reciprocal method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the total cost of P1 and P2 using the direct method. (Do not round intermediate calculations.) Total Cost Allocated Required 3arrow_forwardABC Company has three product lines-D, E, and F. The following information is available: Sales revenue Variable costs D Operating income (loss) E F $90,000 $40,000 $31,000 (40,000) (15,000) (10,000) Contribution $50,000 $25,000 $21,000 margin Fixed costs (20,000) (15,000) (23,000) $30,000 $10,000 $(2000) The company is deciding whether to drop product line F because it has an operating loss. Assuming fixed costs are unavoidable, if ABC drops product line F, what effect will this have on operating income?arrow_forwardDiamond Company has three product lines, A, B, and C. The following financial information is available: Item Product Line A Product Line B Product Line C Sales $ 52,000 $ 100,000 $ 23,000 Variable costs $ 31,200 $ 53,000 $ 14,375 Contribution margin $ 20,800 $ 47,000 $ 8,625 Fixed costs: Avoidable $ 5,400 $ 14,500 $ 6,300 Unavoidable $ 4,100 $ 10,000 $ 3,100 Pre-tax operating income $ 11,300 $ 22,500 $ (-775 ) Diamond is thinking of dropping Product Line C because it is reporting an operating loss. Assuming the company drops Product Line C and does not replace it, pre-tax operating income for the firm will likely: Multiple Choice Be unchanged Increase by $2,025 Increase by $2,325 Decrease by $2,325 Decrease by $4,350arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education