FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

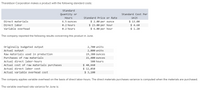

Transcribed Image Text:Tharaldson Corporation makes a product with the following standard costs:

Standard

Quantity or

Standard Cost Per

Hours

Standard Price or Rate

Unit

$ 2.00 per ounce

$ 23.00 per hour

$ 6.00 per hour

$ 13.00

$ 4.60

$ 1.20

Direct materials

6.5 ounces

Direct labor

0.2 hours

Variable overhead

0.2 hours

The company reported the following results concerning this product in June.

Originally budgeted output

Actual output

2,700 units

2,800 units

Raw materials used in production

19,380 ounces

Purchases of raw materials

21,400 ounces

Actual direct labor-hours

500 hours

Actual cost of raw materials purchases

$ 40,660

$ 12,050

$ 3,100

Actual direct labor cost

Actual variable overhead cost

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead rate variance for June is:

Transcribed Image Text:Multiple Choice

$100 U

$112 U

$112 F

$100 F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardThe following data is give for the Walker Company: Budgeted production 1,000 units Actual production 980 units Materials: Standard price per lb $2.00 Standard pounds per completed unit 12 Actual pounds purchased and used in production 11,800 Actual price paid for materials $23,000 Labor: Standard hourly labor rate $14 per pound Standard hours allowed per completed unit 4.5 Actual labor hours worked 4,560 Actual total labor costs $62,928 Overhead: Actual and budgeted fixed overhead…arrow_forwardComputing unit costs at different levels of production Scentsation, Inc., budgeted for 12,000 bottles of perfume Oui during the month of May. The unit cost of Oui was $20, consisting of direct materials, $7; direct labor, $8; and factory overhead,$5 (fixed, $2; variable, $3).a. What would be the unit cost if 10,000 bottles were manufactured? (Hint: You must first determine the total fixed costs.)b. What would be the unit cost if 20,000 bottles were manufactured?c. Explain why a difference occurs in the unit costs.arrow_forward

- A company makes wine glasses for which the following standards have Standard Price Expected Per Unit of Input $2 per ounce $8 per hour Production of 400 glasses was expected in July, but 440 were actually made. Direct materials purchased and used were 2,100 ounces at an actual price of $2.30 per ounce. Direct labor cost for the month was $5,310, and the actual pay per hour was $9.00. been developed: Direct Materials Direct Labor Standard Inputs Expected For Each Unit of Output 5 ounces 1.5 hours Calculate: a) The direct materials variances b) The direct labor variancesarrow_forwardBelinda Company has the following budgeted variable costs per unit produced: Direct materials $ 7.50 Direct labour 2.24 Variable overhead: Supplies 0.33 Maintenance 0.17 Power 0.18 Budgeted fixed overhead costs per month include supervision of $68,000, depreciation of $71,000, and other overhead of $205,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 120,000 units, 130,000 units, and 145,000 units. 2. What is the per-unit total product cost for each of the production levels from Requirement 1? (Round each unit cost to the nearest cent.)arrow_forwardWP Corporation produces products X, Y, and Z from a single raw material input in a joint production process. Budgeted data for the next month is as follows: Product X Product Y Product Z 1,800 2,300 3,300 $16.00 $19.00 $18.00 Added processing costs per unit $ 3.00 $5.00 $5.00 Per unit sales value if processed further $ 20.00 $ 20.00 $25.00 The cost of the joint raw material input is $71,000. Which of the products should be processed beyond the split-off point? Product XProduct Y Product Z A) yes yes Units produced Per unit sales value at split-off B) yes C) no D) no no yes yes no yes no yesarrow_forward

- Please do not give solution in image format thankuarrow_forwardA manufactured product has the following information for June. Standard Quantity and Cost Actual Results Direct materials 6 pounds @ $8 per pound 45,500 pounds @ $8.20 per pound Direct labor 2 DLH @ $15 per DLH 14,600 hours @ $15.60 per hour Overhead 2 DLH @ $12 per DLH $ 186,100 Units manufactured 7,500 units (1) Prepare the standard cost card showing standard cost per unit.(2) Compute total budgeted cost for June production.(3) Compute total actual cost for June production.(4) Compute total cost variance for June.arrow_forwardMiguez Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct materials 2.3 liters $ 7.00 per liter $ 16.10 Direct labor 0.7 hours $ 22.00 per hour $ 15.40 Variable overhead 0.7 hours $ 2.00 per hour $ 1.40 The company budgeted for production of 2,600 units in September, but actual production was 2,500 units. The company used 5,440 liters of direct material and 1,680 direct labor-hours to produce this output. The company purchased 5,800 liters of the direct material at $7.20 per liter. The actual direct labor rate was $24.10 per hour and the actual variable overhead rate was $1.90 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for September is: Multiple Choice $3,675 F $3,528 U $3,528 F $3,675 Uarrow_forward

- Harris Manufacturing produces white sauce. It uses units as the cost driver for overhead. The following information was provided concerning its standard cost system for 2020: Budgeted and Standard Data Actual Data Material 1/4 lb. @ $14 per pound Produced 6,100 units Labor 1.4 hrs. @ $16 per hour Materials purchased 1,600 lbs. for $13.70/pound Total fixed overhead $84,000 Materials used 1,520 lbs. Variable overhead $6.50 per unit Labor worked 8,740 hrs. at $15.90/hour Production 6,000 units Total overhead $122,000 How much is the flexible budget for overhead for 2020? $122,000 $123,000 $127,100 $124,300 $123,650arrow_forwardTharaldson Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct materials 6.0 ounces $ 9.00 per ounce $ 54.00 Direct labor 0.7 hours $ 11.00 per hour $ 7.70 Variable overhead 0.7 hours $ 9.00 per hour $ 6.30 The company reported the following results concerning this product in June. Originally budgeted output 3,600 units Actual output 3,200 units Raw materials used in production 21,000 ounces Purchases of raw materials 20,900 ounces Actual direct labor-hours 5,000 hours Actual cost of raw materials purchases $ 42,100 Actual direct labor cost $ 13,600 Actual variable overhead cost $ 3,800 The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for June is:arrow_forwardRobinwood Fixtures manufactures two products, K4 and X7. The company prepares its master budget on the basis of standard costs. The following data are for September: Standards Direct materials Direct labor Variable overhead (per direct labor- $ 22.60 hour) Fixed overhead (per month) Expected activity (direct labor-hours) Actual resulta Direct material (purchased and used) Direct labor Variable overhead Fixed overhead Units produced (actual) pounds at 0.75 $9.40 per pound hours at 1.25 $27.40 per hour K4 $ 418,080 17,420 pounds at 11,000 $8.80 per pound hours at 14,870 $27.70 per hour $ 359,060 $ 393,740 12,340 units X7 pound at 1 $10.00 per pound 1.50 $24.40 $ 494,970 23,570 hours at $30 per hour pounds at 14,270 $10.30 per pound hours at 22,370 $34.00 per hour $ 471,212 $ 491,960 14,570 units Required: a. Prepare a variance analysis for each variable cost for each product. b. Prepare a fixed overhead variance analysis for each product. Note: For all requirements, Do not round…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education