FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

PRESENT THE PROJECTS TO BE ACCEPTED WITH THE HIGHEST

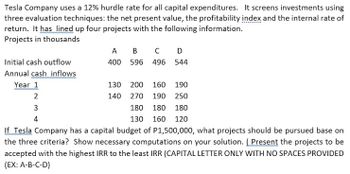

Transcribed Image Text:Tesla Company uses a 12% hurdle rate for all capital expenditures. It screens investments using

three evaluation techniques: the net present value, the profitability index and the internal rate of

return. It has lined up four projects with the following information.

Projects in thousands

A

B C D

400 596 496 544

Initial cash outflow

Annual cash inflows

Year 1

130 200

160

190

2

140

270

190 250

3

180 180

180

4

130 160 120

If Tesla Company has a capital budget of P1,500,000, what projects should be pursued base on

the three criteria? Show necessary computations on your solution. (Present the projects to be

accepted with the highest IRR to the least IRR (CAPITAL LETTER ONLY WITH NO SPACES PROVIDED

(EX: A-B-C-D)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Payback is best used to evaluate which types of projectarrow_forwardHow can we determine the Incremental Analysis for Cost-Only Projects?aarrow_forwardExplain the concept of sensitivity analysis as determined by NPV Breakeven sensitivity. How is it measured and what insights does it provide about the risk of a project? Goal seek can be used to evaluate the NPV breakeven of an input. What needs to happen next in order to evaluate and interpret the results? How do we know whether the results suggest that an input adds a little, or a lot, of risk relative to a project?arrow_forward

- How can we calculate the terminal project balance of the Project?arrow_forwardWrite the formula to evaluate the investment worth of projects?arrow_forwardWhich of the following Is not a criterlon that Is used to determine whether a project Is acceptable under the net present value method? Multiple Choice If the net present value is equal to zero If the net present value is greater than zero If the net present value is equal to the required rate of retum None of these answers are correctarrow_forward

- In calculating the Net Present Value, the project would be acceptable if the outcome was: Group of answer choices Positive Positive or Zero Zero Negativearrow_forwardWhich is the most important breakeven in the analysis of a project?arrow_forwardWhat are some possible reasons that a project might have a high NPV?arrow_forward

- using a net present value (NPV) as an investment criterion , a project is acceptable if NPV is:arrow_forwardTechnique commonly used when an uncertain single factor determines the selection of an alternative of an engineering project. O a. Uncertainty analysis O b. Breakeven analysis O. Economic analysis O d. Balanced assets analysisarrow_forwardHow can we consider the Future Worth and Project Balance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education