FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

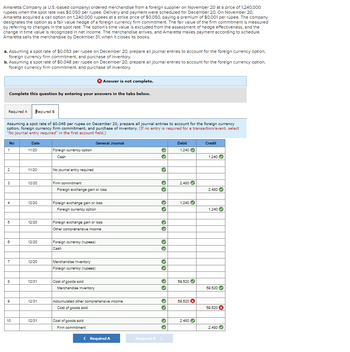

Transcribed Image Text:Amaretta Company (a U.S.-based company) ordered merchandise from a foreign supplier on November 20 at a price of 1,240,000

rupees when the spot rate was $0.050 per rupee. Delivery and payment were scheduled for December 20. On November 20,

Amaretta acquired a call option on 1,240,000 rupees at a strike price of $0.050. paying a premium of $0.001 per rupee. The company

designates the option as a fair value hedge of a foreign currency firm commitment. The fair value of the firm commitment is measured

by referring to changes in the spot rate. The option's time value is excluded from the assessment of hedge effectiveness, and the

change in time value is recognized in net income. The merchandise arrives, and Amaretta makes payment according to schedule.

Amaretta sells the merchandise by December 31, when it closes its books.

a. Assuming a spot rate of $0.053 per rupee on December 20, prepare all journal entries to account for the foreign currency option,

foreign currency firm commitment, and purchase of inventory.

b. Assuming a spot rate of $0.048 per rupee on December 20, prepare all journal entries to account for the foreign currency option,

foreign currency firm commitment, and purchase of inventory.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Reqiured B

Assuming a spot rate of $0.048 per rupee on December 20, prepare all journal entries to account for the foreign currency

option, foreign currency firm commitment, and purchase of inventory. (If no entry is required for a transaction/event, select

"No journal entry required" in the first account field.)

General Journal

Required A

No

1

2

3

4

5

6

7

8

9

10

Date

11/20

11/20

12/20

12/20

12/20

12/20

12/20

12/31

12/31

12/31

Foreign currency option

Cash

No journal entry required

Firm commitment

Foreign exchange gain or loss

Foreign exchange gain or loss

Foreign currency option

Foreign exchange gain or loss

Other comprehensive income

Foreign currency (rupees)

Cash

Merchandise Inventory

Foreign currency (rupees)

Cost of goods sold

Merchandise Inventory

Accumulated other comprehensive income

Cost of goods sold

Cost of goods sold

Firm commitment

< Required A

33

33

33

33

››

33

33

Reqiured B >

Debit

1,240 ✓

2,480

1,240

59,520

59,520 X

2,480

Credit

1,240

2,480

1,240

59,520

59,520 X

2,480

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help mearrow_forwardUse the information below to answer the questions that follow. Japanese yen Japanese yen 6 month Australian dollar Australian dollar 3 month U.S. $ EQUIVALENT .00916 .00899 .7748 .7751 a. Yen b. Australian dollar c. Dollar relative to yen d. Dollar relative to A$ CURRENCY PER U.S. $ 109.20 111.21 1.2907 1.2902 a. Is the yen selling at a premium or a discount? b. Is the Australian dollar selling at a premium or a discount? c. Do you expect the value of the dollar to increase or decrease relative to the value of the yen? d. Do you expect the value of the dollar to increase or decrease relative to the value of the Australian dollar?arrow_forwardOwefixarrow_forward

- Express this quotation in an indirect form where the dealer is presenting prices to buy and sell the USD - that is make sure this currency is treated as the "foreign currency". USD/HRK 7.3658 / 7.3708 a. 7.3658 / 7.3708 O b. None of the other options O c.0.1357/0.1358 O d. 0.1358/0.1357 O e. 7.3708/ 7.3658arrow_forwardАсcount Typе Opening Deposit Rate(APR) APY Checking - Variable Rate $0 0.25% 0.25% Money Market - Variable Rate $250.00 1.00% 1.01% Summer Cash - Variable Rate $0 0.99% 1.00% Holiday Cash - Variable Rate $0 0.75% 0.75%arrow_forward! Required information Problem 11-1A (Algo) Short-term notes payable transactions and entries LO P1 [The following information applies to the questions displayed below.] Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 April 20 Purchased $38,000 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 9%, $35,000 note payable along with paying $3,000 in cash. July 8 Borrowed $60,000 cash from NBR Bank by signing a 120-day, 11%, $60,000 note payable. _?____Paid the amount due on the note to Locust at the maturity date. Paid the amount due on the note to NBR Bank at the maturity date. November 28 Borrowed $24,000 cash from Fargo Bank by signing a 60-day, 8%, $24,000 note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. Year 2 _______ Paid the amount due on the note to Fargo Bank at the maturity date. Problem 11-1A (Algo) Part 3 3.…arrow_forward

- i need the answer quicklyarrow_forwardPls explain everything how the answer is obtained steps and concept are mandatory plsarrow_forwardAlberta Company accepts a credit card as payment for $450 of services provided for the customer. The credit card company charges a 4% handling charge for its collection services. Select the answer that shows how the entry to record the sale would affect Alberta's financial statements. A. B. C. D. Assets = 432 432 432 450 Multiple Choice O O о о Balance Sheet Liabilities + NA NA ΝΑ NA Option A Option B Option C Option D Stockholders' Equity 432 432 432 450 Income Statement Revenue - 432 450 450 450 Expense = Net Income ΝΑ 18 18 ΝΑ 432 432 432 450 Statement of Cash Flows 432 OA 432 OA NA ΝΑarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education