FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:On December 31, 2020, Flounder Company acquired a computer from Plato Corporation by issuing a $557,000 zero-interest-bearing

note, payable in full on December 31, 2024. Flounder Company's credit rating permits it to borrow funds from its several lines of

credit at 10%. The computer is expected to have a 5-year life and a $63,000 salvage value.

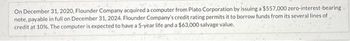

Transcribed Image Text:Date

12/31/20

12/31/21

12/31/22

12/31/23

12/31/24

Schedule of Note Discount Amortization

Debit, Interest Expense Credit,

Discount on Notes Payable

$

Carrying Amount

of Note

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 30, 2021, Kimberly Farms purchased custom-made harvesting equipment from a local producer. In payment, Kimberly signed a noninterest-bearing note requiring the payment of $60,000 in two years. The fair value of the equipment is not known, but an 8% interest rate properly reflects the time value of money for this type of loan agreement. At what amount will Kimberly initially value the equipment? How much interest expense will Kimberly recognize in its income statement for this note for the year ended December 31, 2021?arrow_forwardOn December 31, 2020, Stellar Company signed a $ 1,022,000 note to Pearl Bank. The market interest rate at that time was 11%. The stated interest rate on the note was 9%, payable annually. The note matures in 5 years. Unfortunately, because of lower sales, Stellar’s financial situation worsened. On December 31, 2022, Pearl Bank determined that it was probable that the company would pay back only $ 613,200 of the principal at maturity. However, it was considered likely that interest would continue to be paid, based on the $ 1,022,000 loan.arrow_forwardOn April 1, 2028, A Company purchased three units of baking equipment by issuing a four-year, non-interest bearing, P 3,200,000 note. The note is payable in annual installments of P 800,000. The first installment is due on March 31, 2029. There was no equivalent cash price for the equipment and the note had no ready market. The prevailing interest rate for a note of this type is 9%. The present value of 1 factor at 9% for 4 periods is 0.7084 and present value of ordinary annuity factor at 9% for 4 periods is 3.2397. How much is the total payment made on March 31, 2031?arrow_forward

- Anxious Company acquired two items of machinery. On December 31, 2020, Anxious Company purchased a machine for non-interest bearing note requiring ten payments of P500,000. The first payment was made on December 31, 2021, and the others are due annually on December 31. The prevailing rate of interest for this type of note at date of issuance was 12%. The present value of ordinary annuity of 1 @ 12% is 5.33 for nine periods and 5.65 for ten periods. On December 31, 2020, Anxious Company acquired used machinery by issuing the seller a two-year, noninterest bearing note for P3,000,000. In recent borrowing, the entity has paid a 12% interest for this type of note. The present value of 1 @ 12% for 2 years is 0.80 and the present value of an ordinary annuity of 1 @ 12% for 2 years is 1.69. What is the total cost of machiery?arrow_forwardKalibo Bank loaned P5,000,000 to Caticlan Company on January 1, 2021. The terms of the loan require principal payments of P 1,000,000 each year for 5 years plus interest at 8%. The first principal and interest payment is due on January 1, 2021. Caticlan Company made the required payments during 2022 and 2023. However, during 2023 Caticlan Company began to experience financial difficulties, requiring the Kalibo bank to reassess the collectibility of the loan. On December 31, 2020, the Kalibo bank has determined that the remaining principal payment will be collected as originally scheduled but the collection of the interest is unlikely. Kalibo Bank did not accrue the interest on Dec. 21, 2023. Present value of 1 at 8%:For one period 0.93For two periods 0.86 For three periods 0.79 1. What is the impairment loss for 2023?2. What is the interest income for 2024?3. What is the carrying amount of the loan receivable on December 31, 2024?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education