FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

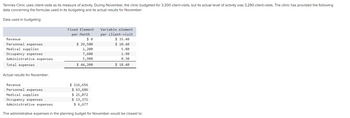

Transcribed Image Text:Tennies Clinic uses client-visits as its measure of activity. During November, the clinic budgeted for 3,300 client-visits, but its actual level of activity was 3,290 client-visits. The clinic has provided the following

data concerning the formulas used in its budgeting and its actual results for November:

Data used in budgeting:

Revenue

Personnel expenses

Medical supplies

Occupancy expenses

Administrative expenses

Total expenses

Actual results for November:

Fixed Element

per Month

Revenue

Personnel expenses

Medical supplies

Occupancy expenses

Administrative expenses

$ 29,500

1,200

7,600

5,900

$ 44,200

Variable element

per client-visit

$ 35.40

$ 10.40

5.80

1.90

0.30

$18.40

$116,656

$ 63,686

$ 21,072

$ 13,371

$ 6,677

The administrative expenses in the planning budget for November would be closest to:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Here are the 2015 revenues for the Wendover Group Practice Association for four different budgets (in thousands of dollars): Static Budget Flexible (Enrollment/ Flexible (Enrollment) Actual Utilization) Budget Budget Results $425 $200 $180 $300 a. What do the budget data tell you about the nature of Wendover's patients: Are they capitated or fee-for-service? (Hint: See the note to Exhibit 8.7.) b. Calculate and interpret the following variances: Revenue variance . Volume variance • Price variance Enrollment variance Utilization variancearrow_forwardGuareno Clinic uses client-visits as its measure of activity. During December, the clinic budgeted for 4,100 client-visits, but its actual level of activity was 4,030 client-visits. The clinic has provided the following data concerning the formulas used in its budgeting and its actual results for December: Data used in budgeting: Fixed element per month Variable element per client-visit Revenue - $ 44.70 Personnel expenses $ 35,900 $ 13.30 Medical supplies 1,600 5.30 Occupancy expenses 11,600 2.20 Administrative expenses 5,400 0.20 Total expenses $ 54,500 $ 21.00 Actual results for December: Revenue $ 178,885 Personnel expenses $ 88,515 Medical supplies $ 22,515 Occupancy expenses $ 19,960 Administrative expenses $ 6,290 The activity variance for administrative expenses in December would be closest to:arrow_forwardNonearrow_forward

- A manager is preparing a revenue budget for next month. The following is the manager’s current month actual operating results. ACTUAL OPERATING RESULTS CURRENT MONTH Revenue Source Number of Guests Average Sale per Guest Sales Restaurant 3492 $20.50 $71,586 Lounge 515 $12.00 $ 6,180 Banquet room 388 $28.50 $11,058 Total 4395 $20.21 $88,824 Create the revenue forecast for next month based on the following assumptions. Restaurant guest counts will be 3,600 with an average sale per guest of $21.00. Lounge guests to be served are estimated at 525 with a 10 percent increase in average sale per guest. The banquet room will serve 425 customers and generate $12,750 in sales. NEXT MONTH BUDGET Revenue Source Number of Guests Average Sale per Guest Sales Restaurant 3,600.00 ? ? Lounge ? ? ? Banquet room ? ? ? Total ? ? ? What will be the manager’s revenue forecast for next month?…arrow_forwardShaak Corporation uses customers served as its measure of activity. The company bases its budgets on the following information: Revenue should be $6.30 per customer served. Wages and salaries should be $22,300 per month plus $0.90 per customer served. Supplies should be $0.80 per customer served. Insurance should be $5,950 per month. Miscellaneous expenses should be $4,400 per month plus $0.20 per customer served. The company reported the following actual results for October: Customers served Revenue. Wages and salaries Supplies Insurance Miscellaneous expense Required: Prepare a report showing the company's revenue and spending variances for October. Label each variance as favorable (F) or unfavorable (U). Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Customers served Revenue Expenses: Wages and salaries Supplies Insurance 22,750 $ 177,300 $ 40,725 $…arrow_forwardSharifi Hospital bases its budgets on patient-visits. The hospital's static budget for October appears below: Budgeted number of patient-visits Budgeted variable overhead costs: Supplies (@$6.00 per patient-visit) Laundry (@$9.00 per patient-visit) Total variable overhead cost Budgeted fixed overhead costs: Wages and salaries Occupancy costs Total fixed overhead cost. Total budgeted overhead cost Multiple Choice The total overhead cost at an activity level of 8,400 patient-visits per month should be: O $280,800 $270,300 $267,900 7,700 $ 46,200 69,300 115,500 $257,400 54,900 87,000 141,900 $ 257,400arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardGrohs Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During December, the kennel budgeted for 2,500 tenant-days, but its actual level of activity was 2,530 tenant-days. The kennel has provided the following data concerning the formulas to be used in its budgeting: Fixed Element per Month Variable element per tenant-day Revenue $ 0 $33.00 Wages and salaries $ 3,800 $ 7.90 Food and supplies 1,000 11.60 Facility expenses 8,600 2.20 Administrative expenses 6,200 0.20 Total expenses $19,600 $21.90 The net operating income in the planning budget for December would be closest to: Multiple Choice A. $8,150 B. $11,914 C. $8,483 D. $11,633arrow_forwardNonearrow_forward

- Hemphill Corporation uses customers served as its measure of activity. During June, the company budgeted for 20,000 customers, but actually served 19,000 customers. The company has provided the following data concerning the formulas used in its budgeting and its actual results for June:Data used in budgeting: Fixed amount per month Variable amount per customer Revenue - $4.50 Wages and salaries $23,900 $1.40 Supplies $0 $0.80 Insurance $5,700 $0.00 Miscellaneous $5,000 $0.40 Actual results for June: Revenue $85,400 Wages and Salaries $52,700 Supplies $17,500 Insurance $5,500 Miscellaneous $12,200 Calculate revenue variance, spending variance for wages and salaries, and spending variance for insurance. Label them as favorable or unfavorable. Please show your workingsarrow_forward16. Kirnon Clinic uses client-visits as its measure of activity. During July, the clinic budgeted for 3,250 client-visits, but its actual level of activity was 3,160 client-visits. The clinic has provided the following data concerning the formulas to be used in its budgeting: Fixed element per month Variable element per client-visit Revenue $ 0 $ 39.10 Personnel expenses $ 35,100 $ 10.30 Medical supplies 1,100 7.10 Occupancy expenses 8,100 1.10 Administrative expenses 5,100 0.20 Total expenses $ 49,400 $ 18.70 The activity variance for net operating income in July would be closest to: Multiple Choice $1,086 F $1,836 F $1,836 U $1,086 Uarrow_forwardIsadore Hospital bases its budgets on patient-visits. The hospital's static planning budget for July appears below: Budgeted number of patient-visits Supplies (@ $4.60 per patient-visit) Laundry (@ $7.20 per patient-visit) 7,700 $ 35,420 55,440 Salaries 46, 200 Occupancy costs 67,760 Total $ 204,820 Actual results for the month were: Actual number of patient-visits 7,800 Supplies Laundry $38,250 $61,240 Salaries $46,190 Occupancy costs $65,650 The spending variance for supplies costs in the flexible budget performance report for the month is:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education