Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

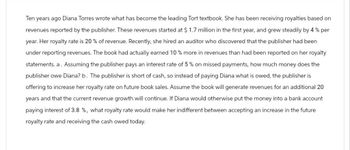

Transcribed Image Text:Ten years ago Diana Torres wrote what has become the leading Tort textbook. She has been receiving royalties based on

revenues reported by the publisher. These revenues started at $ 1.7 million in the first year, and grew steadily by 4 % per

year. Her royalty rate is 20 % of revenue. Recently, she hired an auditor who discovered that the publisher had been

under reporting revenues. The book had actually earned 10% more in revenues than had been reported on her royalty

statements. a. Assuming the publisher pays an interest rate of 5% on missed payments, how much money does the

publisher owe Diana? b. The publisher is short of cash, so instead of paying Diana what is owed, the publisher is

offering to increase her royalty rate on future book sales. Assume the book will generate revenues for an additional 20

years and that the current revenue growth will continue. If Diana would otherwise put the money into a bank account

paying interest of 3.8 %, what royalty rate would make her indifferent between accepting an increase in the future

royalty rate and receiving the cash owed today.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Los Altos, Inc. obtained a patent for a new optical scanning device. The fees incurred to file for the patent and to defend the patent in court against several companies that challenged the patent amounted to $45,000. Los Altos, Inc. concluded that the expected economic life of the patent was 12 years. Calculate the amortization expense that should be recorded in the second year. $ 0arrow_forwardWatchNU is a company that designs and manufacturers drones for military use. The supply manager is getting ready to renegotiate the contract with the security service provider that it uses for its offices and manufacturing plant. Three suppliers responded to the RFP for security services for the next three years. The current security services provider, SecurelT quoted $920,000 per year. Two suppliers that have not been used by WatchNU in the past quoted $835,000 and $742,000 respectively. The supply manager is also analyzing the costs associated with insourcing security services rather than using a supplier as a way to reduce costs and provide greater control over security. The salary and benefits for a full-time security services manager is estimated to be $91,000. Other fixed costs are estimated to be $21,000/year. Three security guards are needed 24 hours/day, 365 days per year. The salary and benefits for the security guards is $26/hour. a. What are the costs to insource the…arrow_forwardYou are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,360,000; rents are estimated at $174,080 during the first year and are expected to grow at 2.5 percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 6 percent interest for 30 years (total annual payments will be monthly payments × 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor’s expected before-tax internal rate of return on equity invested (BTIRR)? d.…arrow_forward

- Sullivan Software sells packages of a software program and one year's worth of technical support for $500. Its packaging lists the $500 sales price as comprised of a software program and technical support. All of Sullivan's sales are for cash, and there are no returns. Sullivan sells the software program separately for $475 and offers a year of technical support separately for $75. The amount of revenue that GAAP, regarding software revenue recognition, would require Sullivan to attribute to the software program (as opposed to the technical support) is (rounded): $450. $475. O $432. $400.arrow_forwardA land surveyor just starting in private practice needs a van to carry crew and equipment. He can lease a used van for $3,000 per year, paid at the beginning of each year, in which case maintenance is provided. Alternatively, he can buy a used van for $7,000 and pay for maintenance himself. He expects to keep the van 3 years at which time he could sell it for $1,500. What is the most he should pay for uniform annual maintenance to make it worthwhile buying the van instead of leasing it if his i=20%? $821.50 $425.65 $687.50 $958.25arrow_forwardMr. Harrington had a new heating system installed in his office. The balance owing to the heating company is $24,000 which includes equipment and installation fees. The heating company has agreed to let him make individual payments on the account whenever he’d like, but the final balance must be paid two years (24 months) from now. Starting today, interest will accumulate on the balance at 3.80% compounded monthly. Mr. Harrington will make a payment of $7000 4 months from now and $8000 18 months from now. What is the value of i (the periodic interest rate)? a. 0.001583 b. 1.900000 c. 0.009500 d. 0.003167arrow_forward

- Beckman Technologies, a relatively small manufacturer of precision laboratory equipment, borrowed $2 million to renovate one of its testing labs. In an effort to pay off the loan quickly, the company made four payments in years 1 through 4, with each payment being twice as large as the preceding one. At an interest rate of 10% per year, what was the size of the fi rst payment?arrow_forwardBunsen Company is involved in a consumer liability lawsuit. Company attorneys have assessed the contingent outcomes of the lawsuit. Because the attorneys think the company will probably lose the lawsuit, To prepare for this loss, Bunsen management has decided to set aside funds in an investment account that earns a 9% return rate. Furthermore, there is general agreement that there is a 60% probability the company will have to pay the defendants $6 million four years from now; a 30% probability the company will need to pay $10 million eight years from now, and a 10% probability the company will pay nothing. What amount should Bunsen accrue as a contingent liability?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. excel and formulas please show workarrow_forward

- Algor Inc. entered into a $975,000 3-year contract to maintain a client's computer system. At the end of the first year, the costs incurred on the contract were $225,000 and it was estimated that a further $520,000 would be incurred over the remaining years of the contract. What is the amount of profit that can be recognized on this contract for the first year? $196,875 $69.463 $421,875 $294.463arrow_forwardSanjeev enters into a contract that pays him $1,000 each month for six months of continuous consulting services. In addition, there is a 40% chance the contract will pay an additional $3,000, depending on the outcome of the consulting contract. Sanjeev used the most likely amount to determine transaction price. After Sanjeev has recognized revenue for two months of the contract, he changes his assessment of the chance the contract will pay him $3,000 up to 70%. How much revenue would Sanjeev recognize in the third month of the contract? $2,500 O $1.500 $1,850 O $1,600arrow_forwardDue to a cool spring season, Petra’s pool installation business has not had the sales she anticipated. To generate new business, Petra has decided to offer a deferred payment plan. A customer is interested in a pool installation worth $42,800. If Petra structures the contract to require a $5,000 down payment, followed by 24 equal monthly payments with the first payment due in 6 months from now, how much should those payments be if Petra’s cost of capital is 4.8% compounded monthly?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education