The operations vice president of Security Home Bank has been interested in investigating the efficiency of the bank’s operations. She has been particularly concerned about the costs of handling routine transactions at the bank and would like to compare these costs at the bank’s various

branches. If the branches with the most efficient operations can be identified, their methods can be studied and then replicated elsewhere. While the bank maintains meticulous records of wages and other costs, there has been no attempt thus far to show how those costs are related to the various services provided by the bank. The operations vice president has asked your help in conducting an activity-based costing study of bank operations. In particular, she would like to know the cost of opening an account, the cost of processing deposits and withdrawals, and the cost of processing other customer transactions.

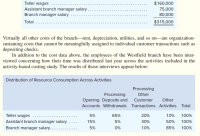

The Westfield branch of Security Home Bank has submitted the following cost data for last year:

Required:

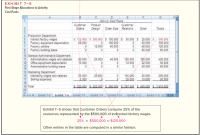

Prepare the first-stage allocation for the activity-based costing study. (See Exhibit 7–6 for an example of a first-stage allocation.)

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 6 images

- Susan Small, CPA has Medium Corporation as an audit client. Medium has asked Small to create and install a new computerized payroll system. Because Small does not have the appropriate level of expertise, she referred Medium to Compusystems, Inc., a local software consulting company. Small has an arrangement where she is paid ten percent of any fee received by Compusystems from her referrals. Small has disclosed this to her client. Required: The situation above involves a possible violation of the AICPA's Code of Professional Conduct. State the rule in question and explain why or why not there is a violation of the code. You need not refer to the rule number, but should clearly describe the rule in question.arrow_forwardIn the scenario, where employer has been putting more emphasis on controlling costs for the various businesses. With the slowing of overall spending in one sector, while ordering managers to closely monitor expenses, selling several companies and giving vice presidents greater responsibility for statements of financial positions. Whatpositive and negative consequences might this pose to the company in future fraud prevention? Outline at least three of each type.arrow_forwardPlease read the following and identify any internal control principles that may be violated in the Jane Hardware store.(identify what could go wrong and what controls Jane Hardware should put in place to prevent it) Jerry Finch has worked for Jane Hardware for many years, Jerry has been a model employee. He has not taken a vacation in over three years, always stating that work was too important. One of Jerry's primary jobs at the store is to open mail and list the checks received. He also collects cash from customers at the store's outdoor nursery area. There are times that things are so hectic that Jerry does not bother to use the register, simply making change from cash he carries with him. When things slow down at the store Jerry often offers to help Cindy(the Accounting Clerk) post payments to the customer's accounts receivable ledger. Cindy is always happy to receive help since she is also quite busy and because Jerry is such a careful worker.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education