FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

could you help me wth those plz

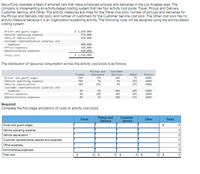

Transcribed Image Text:SecuriCorp operates a fleet of armored cars that make scheduled pickups and dellverles in the Los Angeles area. The

company is Implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Dellivery.

Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliverles for

the Pickup and Dellvery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no

activity measure because It is an organization-sustalning activity. The following costs will be assigned using the activity-based

costing system:

$ 1,148,e00

570, e00

450, e00

Driver and guard wages

Vehicle operating expense

Vehicle depreciation

Customer representative salaries and

expenses

Office expenses

Administrative expenses

480, e00

348,e00

648, e08

$ 3,620, e00

Total cost

The distribution of resource consumptlon across the activity cost pools Is as follows:

Pickup and

Delivery

35%

Custoner

Travel

Service

Other

Totals

Driver and guard wages

Vehicle operating expense

Vehicle depreciation

Customer representative salaries and

expenses

Office expenses

Administrative expenses

5ex

10%

5%

10e

70%

5%

ex

25%

100%

15%

25%

100

9ex

1e%

10e%

ex

20%

3ex

sers

100

5%

Gex

35%

100

Required:

Complete the first stage allocations of costs to activity cost pools.

Pickup and

Delivery

Customer

Service

Travel

Other

Totals

Driver and guard wages

Vehicle operating expense

Vehicle depreciation

Customer representative salaries and expenses

Office expenses

Administrative expenses

Total cost

Transcribed Image Text:The operations vice president of Security Home Bank has been Interested In Investigating the efficlency of the bank's

operations. She has been particularly concemed about the costs of handling routine transactions at the bank and would

like to compare these costs at the bank's varlous branches. If the branches with the most efficlent operations can be

Identified, their methods can be studied and then replicated elsewhere. While the bank malntalns metlculous records of

wages and other costs, there has been no attempt thus far to show how those costs are related to the varlous services

provided by the bank. The operations vice president has asked your help in conducting an activity-based costing study of

bank operations. In particular, she would like to know the cost of opening an account, the cost of processing deposits and

withdrawals, and the cost of processing other customer transactions.

The Westfield branch of Security Home Bank has submitted the following cost data for last year.

Teller wages

Assistant branch manager salary

Branch nanager salary

$ 159,e00

70,e00

88,e00

$ 317,800

Total

Virtually all other costs of the branch-rent, depreciation, utilites, and so on-are organization-sustalning costs that cannot

be meaningfully assigned to Individual customer transactions such as depositing checks.

In addition to the cost data above, the employees of the Westfield branch have been interviewed concerning how their

time was distributed last year across the activities Included in the activity-based costing study. The results of those

Intervlews appear below:

Distribution of Resource Consumption Across Activities

Processing Other

Customer

Other

Opening

Accounts

Processing Deposits

and Withdrawals

Transactions

Activities

Totals

Teller wages

Assistant branch manager salary

Branch nanager salary

4%

73%

19%

4%

100%

13%

19%

25%

43%

10e

4%

18%

78%

100%

The manager of the Westfield branch of Security Home Bank has provided the following data conceming the transactions

of the branch durling the past year:

Activity

Opening accounts

Processing deposits and withdrawals

Processing other customer transactions

Total Activity at the Westfield Branch

250 new accounts opened

52,5ee deposits and withdrawals processed

1,480 other custoner transactions processed

Required:

1. Compute the activity rates for the activity-based costing system. (Round your answers to 2 decimal places.)

Activity Cost Pool

Activity Rate

per account opened

per deposit or withdrawal

Opening accounts

Processing deposits and withdrawals

Processing other customer transactions

per other customer transaction

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education