Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

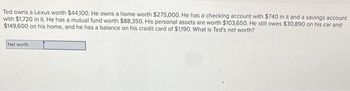

Transcribed Image Text:Ted owns a Lexus worth $44,100. He owns a home worth $275,000. He has a checking account with $740 in it and a savings account

with $1,720 in it. He has a mutual fund worth $88,350. His personal assets are worth $103,650. He still owes $30,890 on his car and

$149,600 on his home, and he has a balance on his credit card of $1,190. What is Ted's net worth?

Net worth

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jimmy has fallen on hard times recently. Last year he borrowed $343,000 and added an additional $73,000 of his own funds to purchase $416,000 of undeveloped real estate. This year the value of the real estate dropped dramatically, and Jimmy’s lender agreed to reduce the loan amount to $316,000. For each of the following independent situations, indicate the amount Jimmy must include in gross income: (Leave no answer blank. Enter zero if applicable.) Problem 5-60 Part-c (Algo) c. The real estate is worth $277,800 and Jimmy has $47,200 in other assets but no other liabilities. Amount Included in Gross Incomearrow_forward2. Assume that you are a swap dealer and have just acted as a counterparty in an interest rate swap. The notional principal for the swap was $8 million and you are now obligated to make 6 annual payments of 4% interest. The floating rate that you will receive annually is LIBOR + 1%. The LIBOR is expected to be 2.6% for year 1, 2.8% for year 2, and 3.5% thereafter. Compute the net present value of your swap agreement at a discount rate of 6%?arrow_forwardMitch and Bill are both age 75. When Mitch was 23 years old, he began depositing $1300 per year into a savings account. He made deposits for the first 10 years, at which point he was forced to stop making deposits. However, he left his money in the account, where it continued to earn interest for the next 42 years. Bill didn't start saving until he was 46 years old, but for the next 29 years he made annual deposits of $1300. Assume that both accounts earned an average annual return of 4% (compounded once a year). Complete parts (a) through (d) below. A) How much money does Mitch have in his account at age 75? B) How much money does Bill have in his account at age 75. C) Compare the amounts of money that Mitch and Bill deposit into their accounts. Mitch deposits _ in his accunt and Bill deposits _ in his account. D) Draw a onclusion about the parable. Choose the correct answer. -Bill ends up with more money in his account than Mitch because he makes more deposits than…arrow_forward

- At the start of the year, Josh has assets worth $500,000. He has debts worth $350,000. Over the year, he earns $200,000 of which he pays $50,000 in tax. He spends $50,000 on goods and services. He pays interest on his debt at 10% of $350,000. He pays off $30,000 of his debts.His assets go up in value by $25,000. What is his net worth at the end of year.arrow_forwarda mother earned $15000.00 from royalties on her cookbook. She set aside 20% of this for a down payment for a new home. The balance will be used for her son's future education. She invested a portion of the money in a bank certificate of a deposit (cd account) that earns 4% and the remainder in a savings bond that earns 7%. IF the total interest earned after one year is $720.00, how much money was invested at each rate?arrow_forwardThis year, Major Healy paid $35,750 of interest on a mortgage on his home (he borrowed $715,000 to buy the residence in 2015; $815,000 original purchase price and value at purchase), $5,500 of interest on a $110,000 home equity loan on his home (loan proceeds were used to buy antique cars), and $8,250 of interest on a mortgage on his vacation home (borrowed $165,000 to purchase the home in 2010; home purchased for $412,500). Major Healy's AGI is $220,000. How much interest expense can Major Healy deduct as an itemized deduction? Interest Deductiblearrow_forward

- Ralph has two accounts with South Trust National Bank. Over the summer, he mows lawns and deposits his earnings weekly into his savings account. Ralph also eats out every day and uses the money in his checking account to pay for his meals. Besides these two transactions, he does not deposit or withdraw funds from either of these accounts.The amount in his savings account over time is represented in the table below. He spends$50 on food each week, and after three weeks, he has $1,600 in his checking account. Ralph Saving Account Weeks Total Amount 0 2 700 6 1100 12 1700 Part A How much money was in his saving account initially (at week zero)? Show how you determine your answer. Part B Create an equation to model Ralph’s savings account and create another equation to model Ralph’s checking account. After how many weeks will he have more money in his saving account?arrow_forwardSheldon put $500 into a certificate of deposit at his bank. In six months the value of the CD is $620. What is his ROI? Penny invested $10,000 into the stock market. She sold the stock two days later for $13,500. What is her ROI? Leonard bought a bond for $5,000 and sold it for $5,300 four years later. What is his ROI? Howard bought a house for $250,000 and sold it for $227,000 ten years later. What is his ROI? Raj bought a tractor for $25,000 and sold it for $32,000 one year later. What is his ROI? Amy put $50 in a savings account. A year later the balance on the account is $58. What is her ROI?arrow_forwardKristian purchased a new home for $200,000. He put down $50,000 in cash and took out a mortgage for the rest. At the time of closing, he also paid $1,000 for title insurance, $500 in recording fees, and the bank required that he place $2,500 in an escrow account for property taxes. What is the basis of the home?arrow_forward

- Kathleen, age 56, works for MH Incorporated in Dallas, Texas. Kathleen contributes to a Roth 401(k), and MH contributes to a traditional 401(k) on her behalf. Kathleen has contributed $30,000 to her Roth 401(k) over the past six years. The current balance in her Roth 401(k) account is $50,000 and the balance in her traditional 401(k) is $40,000. Kathleen needs cash because she is taking a month of vacation to travel the world. Answer the following questions relating to distributions from Kathleen's retirement accounts assuming her marginal tax rate for ordinary income is 24 percent. a. If Kathleen receives a $10,000 distribution from her traditional 401(k) account, how much will she be able to keep after paying taxes and penalties, if any, on the distribution? (answer is not 6200)arrow_forwardJenny's net worth increased from $600,000 to $750,000 this year. During the year, she inherited $50,000 in stocks and bonds. Jenny earned a salary of $80,000 and saved $10,000 of her salary in her 401(k) plan. Jenny contributed $3,000 to her IRA from her checking account. She also used $5,000 from her money market to purchase new bedroom furniture. Her investments grew by $75,000. Assuming these are all of her transactions, what was the principal reduction on her mortgage? $5,000 $10,000 $15,000 $20,000 $25,000arrow_forwardBao and Mary Jane Lee have a yearly income of $93 comma 842 and own a house worth $127 comma 900, two cars worth a total of $ 28 comma 195 and furniture worth $14 comma 085. The house has a mortgage of $85 comma 677 and they have a car loan with an outstanding balance of $5 comma 822. Utility bills, totaling $181 for this month, have not been paid. Calculate their net worth, and explain what it means.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education