Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

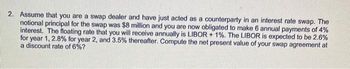

Transcribed Image Text:2. Assume that you are a swap dealer and have just acted as a counterparty in an interest rate swap. The

notional principal for the swap was $8 million and you are now obligated to make 6 annual payments of 4%

interest. The floating rate that you will receive annually is LIBOR + 1%. The LIBOR is expected to be 2.6%

for year 1, 2.8% for year 2, and 3.5% thereafter. Compute the net present value of your swap agreement at

a discount rate of 6%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You signed a 10-year interest swap (principal USD 1,000,000) with annual payments to pay LIBOR USD and receive fixed CHF. The quote is CHF 6%- 6.1% The spot rate at the time of the was CHF 0.9/ USD. Two years later you want to unwind the swap. The USD interest rate is 4% and the CHF interest rate is also 4%. What is the value of the swap in USD if the spot rate is 0.9? (round to the nearest $)arrow_forwardA financial institution has entered into a swap where it agreed to receive quarterly payments at a rate of 4% per annum and pay the SOFR three - month reference rate on a notional principal of $100 million. The swap now has a remaining life of 12 months. Assume the risk - free rates with continuous compounding (calculated from SOFR) for 2 month, 5 months, 8 months, and 11 months are 1.7%, 2.5%, 3.6%, and 3.8%, respectively. Assume also that the continuously compounded risk - free rate observed for the last two months is 2.5%. Estimate the value of the swap.arrow_forwardYou signed a 15-year interest swap (principal USD 1,000,000) with annual payments to pay fixed USD and receive fixed EUR. The quotes are: USD 5.1%-5.15% EUR 10%- 10.05% The spot rate at the time of the was USD 1.00/ EUR. Two years later you want to unwind the swap. The USD interest rate is 4% and the EUR interest rate is also 4%. What is the value of the swap in USD if the spot rate is 1.09? (round to the nearest $)arrow_forward

- Design a swap. see image attached.arrow_forwardYou are thinking about entering into a 3 year plain vanilla swap with annual payments and a notional principal of $5,000,000. If you plan to pay the fixed rate on the swap what would you expect to pay if annual interest rates are listed below per annum with continuous compounding? Year Rate 1 3.00% 2 3.50% 3 4.50% A) $53,221.46 B) $150,000.00 C) $183,333.33 D) $227,411.44 E) $372,407.89 The answer is D. Show all work to reach D, no Excel.arrow_forwarda. Calculate the intrinsic value for each of the following call options. (Round your answers to 2 decimal places.) Company RJay RJay Sell-Mart Xenon Time to Expiration (months) RJay RJay Sell-Mart Xenon 1 2 Time to Company Expiration (months) 5 6 LO Strike 1 2 5 6 60 70 60 7.50 b. Now assume that the effective annual interest rate is 7.18%, which corresponds to a monthly interest rate of 0.58%. Calculate the present value of each call option's exercise price and the adjusted intrinsic value for each call option. (Round your answers to 2 decimal places.) Strike SO 60 70 60 7.50 62.77 62.57 67.80 6.48 Intrinsic Value SO 62.77 62.57 67.80 6.48 PV(X) Adjusted Intrinsic Valuearrow_forward

- (b) Calculate the effective interest rate paid by Vri.com and Yadine in the following swap. Vri.com: Borrower rated AA that can borrow for three years at either 5% fixed or LIBOR plus 50 basis points. Borrower rate BBB that can borrow for three years at either 8% fixed or Yadine: LIBOR plus 150 basis points. 5%+1% Vri.com Yadine LIBOR +50 5% fixed LIBOR +arrow_forwardExplain in detail how a five year plain vanilla interest rate swap with a notional value of $1,000,000 and a price of 3% can be used: (Illustrate with diagrams) i) To speculate on changes in interest rates; ii) To s hedge against the risk of an increase in interest rates.arrow_forwardVijayarrow_forward

- Suppose that at the present time, one can enter 5-year swaps that exchange LIBOR for 5%. An off-market swap would then be defined as a swap of LIBOR for a fixed rate other than 5%. For example, a firm with 11% coupon debt outstanding might like to convert to synthetic floating-rate debt by entering a swap in which it pays LIBOR and receives a fixed rate of 11%. What up-front payment will be required to induce a counterparty to take the other side of this swap? Assume notional principal is $95 million. (Do not round intermediate calculations. Round your final answer to the nearest dollar amount.)arrow_forwardA company FORTIS, issued a 5 years loan with a gloating rate EURIBOR + 0.75%. It sets up a fixed / variable swap with a bank. The quotation of the swap is as follows: 5-year swap: EURIBOR /3.75%. What is the cost of borrowing of this company after swap? a. 0.75%b. 4.5%c. EURIBOR + 4.5%d. None of the abovearrow_forwardSome time ago a swap dealer entered into a Forward Rate Agreement (FRA) that has a notional value of $25,000,000. The swap dealer agreed to pay 4.96% based on quarterly compounding and receive Libor. Libor zero rates (based on continuous compounding are given below. a. What is the value of the FRA to the swap dealer assuming it begins in 9 months and lasts for 3 months? + b. Provide an example which shows exactly how the swap dealer can hedge its position in the FRA. Maturity (months) Zero Rate (%) 4 6 4.54 5 5.5 12 15arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education