FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

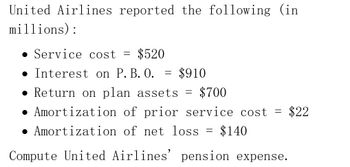

Transcribed Image Text:United Airlines reported the following (in

millions):

• Service cost = $520

• Interest on P. B. O.

=

$910

=

$700

• Return on plan assets

• Amortization of prior service cost

• Amortization of net loss

=

$140

=

$22

Compute United Airlines' pension expense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Compute AMR corporations pension expense????arrow_forwardGiven answer accounting questionarrow_forwardAMR Corporation (parent company of American Airlines) reported the following (in millions). Service cost $366 Interest on P.B.O. 737 Return on plan assets 593 Amortization of prior service cost 13 Amortization of net loss 154 Compute AMR Corporation's pension expense.arrow_forward

- AMR Corporation (parent company of American Airlines) reported the following (in millions). Service cost Interest on P.B.O. $368 739 Return on plan assets 595 Amortization of prior service cost 15 Amortization of net loss 156 Compute AMR's pension expense. (Enter amount in dollars, e.g. 55,000,000.) Pension expensearrow_forwardGive me correct answer with explanation.harrow_forwardexpert of general accounting answerarrow_forward

- Nonearrow_forwardThe following refers to the pension spreadsheet (columns have missing amounts) for the current year for Ng Enterprises. ($ in millions) Debit(Credit) PBO Plan Assets Prior Service Cost Net (Gain)/Loss Pension Expense Cash Net Pension (Liability)/Asset Beginning balance 450 60 55 50 Service cost (85) Interest cost (25) Expected return on assets 55 Gain/loss on assets 3 Amortization of: Prior service cost Net gain/loss (1) Loss on PBO (65) Contributions to fund 40 Retiree benefits paid Ending balance (530) 54 122 What were the retiree benefits paid?arrow_forwardKk.5arrow_forward

- The Shasti Corporation reported the following for the year ending December 31, 20X1: Service cost: $142,610 Plan assets, January 1, 20X1: $1,200,000 Prior service cost amortization: $21,150 Expected return on plan assets: 9% Actual return on plan assets: 8.5% Pension expense: $175,760 Actuarially determined discount rate: 8% What was the projected benefit obligation on January 1, 20X1? Multiple Choice $1,500,000 $1,425,000 $1,200,000 $1,333,333arrow_forward2 ($ in thousands) Discount rate, 7% Expected return on plan assets, 8% Actual return on plan assets, 7% Service cost, current year January 1, current year: Projected benefit obligation Accumulated benefit obligation Plan assets (fair value)" Prior service cost- AOCI (current year amortization, $30) Net gain- AOCI (current year amortization, $12) There were no changes in actuarial assumptions. December 31, current year: Cash contributions to pension fund, December 31, current year Benefit payments to retirees, December 31, current year Required: 1. Determine pension expense for the current year. $ 500 3,250 2,950 3,350 420 520 435 460 2. Prepare the journal entries to record (a) pension expense, (b) gains and losses (if any), (c) funding, and (d) retiree benefits for the current year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine pension expense for the current year. Note: Amounts to be deducted should be indicated with a minus sign.…arrow_forwardOwearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education