FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please dont use any

It's strictly prohibited.

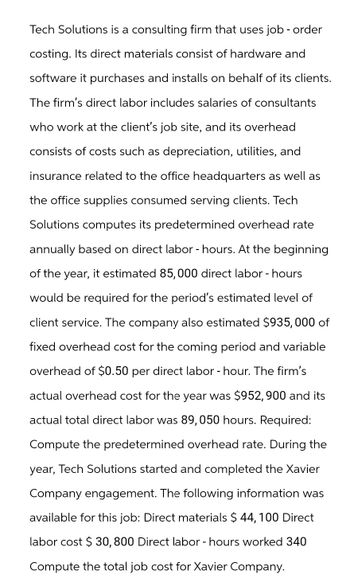

Transcribed Image Text:Tech Solutions is a consulting firm that uses job - order

costing. Its direct materials consist of hardware and

software it purchases and installs on behalf of its clients.

The firm's direct labor includes salaries of consultants

who work at the client's job site, and its overhead

consists of costs such as depreciation, utilities, and

insurance related to the office headquarters as well as

the office supplies consumed serving clients. Tech

Solutions computes its predetermined overhead rate

annually based on direct labor - hours. At the beginning

of the year, it estimated 85,000 direct labor - hours

would be required for the period's estimated level of

client service. The company also estimated $935,000 of

fixed overhead cost for the coming period and variable

overhead of $0.50 per direct labor - hour. The firm's

actual overhead cost for the year was $952, 900 and its

actual total direct labor was 89, 050 hours. Required:

Compute the predetermined overhead rate. During the

year, Tech Solutions started and completed the Xavier

Company engagement. The following information was

available for this job: Direct materials $ 44, 100 Direct

labor cost $ 30, 800 Direct labor - hours worked 340

Compute the total job cost for Xavier Company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Search Google images for bad data visualizations. Post a link to the image.Describe what is inaccurate or misleading about the visualization. Replace the inaccurate and misleading information with what you think makes the image a good visualization.arrow_forwardIm having an issue with this problem. Thank you!arrow_forward3. Which of the following is not a computer facility control? (a) Place the data processing center where unauthorized individuals cannot gain entry to the facility. (b) Limit access to the data processing center all employees of the company. (c) Buy insurance to protect against loss of equipment in the computer facility. (d) Use advanced technology to identify individuals who are authorized access to the data processing center. 4.For internal control over computer program changes, a policy should be established requiring that: (a) All proposed changes be approved by a responsible individual and logged. (b) The programmer designing the change should be responsible for ensuring that the revised program is adequately tested. (c) All program changes be supervised by the information system control group. (d) To facilitate operational performance, superseded portions of programs should not be deleted from the program run manual. 5. Auditing "around the computer": (a) Assumes that accurate…arrow_forward

- Explain with an example why any computer-based application control cannot function on its own and why its effectiveness depends on a set of general controls.arrow_forwardPiracy, however, is the direct copy of a company’s product and is unethical. Piracy is most prevalent in the video, music, perfume, and designer clothing industries, and is not a replacement for new-product development. Think about and discuss: Does the AMA Statement of Ethics address this issue? Go to ama.org/codesofconduct and review the statement. Then write a paragraph on what the AMA Statement of Ethics contains that might relate to knock-off products.arrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education