FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

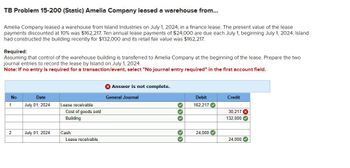

Transcribed Image Text:TB Problem 15-200 (Static) Amelia Company leased a warehouse from...

Amelia Company leased a warehouse from Island Industries on July 1, 2024, in a finance lease. The present value of the lease

payments discounted at 10% was $162,217. Ten annual lease payments of $24,000 are due each July 1, beginning July 1, 2024. Island

had constructed the building recently for $132,000 and its retail fair value was $162,217.

Required:

Assuming that control of the warehouse building is transferred to Amelia Company at the beginning of the lease. Prepare the two

journal entries to record the lease by Island on July 1, 2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

No

1

2

Date

July 01, 2024

July 01, 2024

Lease receivable

Cost of goods sold

Building

Cash

Lease receivable

Answer is not complete.

General Journal

333

Debit

162,217✔

24,000✔

Credit

30,217 X

132,000 ✓

24,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 2 ABC Company signed a ten-year noncancelable lease agreement to lease a storage building to a lessee under a sales type lease at the start of this year. At the conclusion of each year, the agreement demanded equal rental payments. The building's fair market value is P7,530,000. The building's carrying amount, on the other hand, is P6,420,000. The structure has a twelve-year projected economic life and no residual value. The title to the building will be transferred to the lessee at the end of the lease. The yearly rental was established by ABC to ensure a 12% return on investment. The lessee is aware of the lessor's implicit rate. The entire yearly lease payment includes P300,000 in executory costs for property taxes. What is the minimum annual lease payment? b. What is the total annual lease payment?arrow_forwardBrief Exercise 21A-6 Metlock Company leased equipment from Costner Company, beginning on December 31, 2016. The lease term is 6 years and requires equal rental payments of $24,035 at the beginning of each year of the lease, starting on the commencement date (December 31, 2016). The equipment has a fair value at the commencement date of the lease of $120,000, an estimated useful life of 6 years, and no estimated residual value. The appropriate interest rate is 8%. Prepare Metlock’s 2016 and 2017 journal entries, assuming Metlock depreciates similar equipment it owns on a straight-line basis.arrow_forwardExercise 15-14 (Algo) Lessor; operating lease; effect on financial statements [LO 15-4] At January 1, 2024, Café Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. • The lease agreement specifies annual payments of $21,000 beginning January 1, 2024, the beginning of the lease, and on each December 31 thereafter through 2031. • The equipment was acquired recently by Crescent at a cost of $180,000 (its fair value) and was expected to have a useful life of 13 years with no salvage value at the end of its life. Crescent records depreciation using the straight-line method. . Because the lease term is only nine years, the asset does have an expected residual value at the end of the lease term of $76,604. • Crescent seeks a 8% return on its lease investments. By this arrangement, the lease is deemed to be an operating lease. Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1)…arrow_forward

- Item4 Item 4 At January 1, 2021, Café Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. The lease agreement specifies annual payments of $32,000 beginning January 1, 2021, the beginning of the lease, and at each December 31 thereafter through 2028. The equipment was acquired recently by Crescent at a cost of $243,000 (its fair value) and was expected to have a useful life of 12 years with no salvage value at the end of its life. (Because the lease term is only 9 years, the asset does have an expected residual value at the end of the lease term of $73,596.) Crescent seeks a 9% return on its lease investments. By this arrangement, the lease is deemed to be a finance lease. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided. Round your intermediate calculations to the nearest whole dollar amount.) Required:1. What will be the effect of the lease on Café Med’s…arrow_forwardDogarrow_forwardDomesticarrow_forward

- 32...continue On January 1, 2017, Metlock Corporation signed a 3-year noncancelable lease for several computers. The terms of the lease called for Metlock to make annual payments of $4,500 at the beginning of each year, starting January 1, 2017. The computers have an estimated useful life of 3 years and a $480 unguaranteed residual value. The computers revert back to the lessor at the end of the lease term. Metlock uses the straight-line method of depreciation for all of its property, plant, and equipment. Metlock’s incremental borrowing rate is 11%, and the lessor’s implicit rate is unknown. Prepare all necessary journal entries for Metlock for this lease through January 1, 2018. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit choose a transaction date…arrow_forwardProblem 3 On January 1, 2022, ABC Company signed into a leasing arrangement with XYZ Company for a machine that was valued at P3,500,000 in ABC's financial records. The lease runs through December 31, 2028 and every year on January 1st, payments of P855,300 are required. The seven percent interest rate set in the lease is deemed reasonable and appropriate compensation for ABC's use of its money. The machine will have a 7-year life, no residual value, and will be depreciated on a straight line basis, according to XYZ. The lease is designed to be a sales lease. For the fiscal year ending December 31, 2022, determine the following: a. ABC's gross income from sales b. ABC's interest income c. ABC's pretax total income from the leasearrow_forwardHardevarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education