FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Assume that the Violin Division was evaluating whether it would accept a special sales order for 30 violins at $430 per unit.

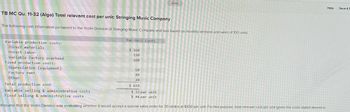

Transcribed Image Text:TB MC Qu. 11-32 (Algo) Total relevant cost per unit: Stringing Music Company

The following cost information pertained to the Violin Division of Stringing Music Company and was based on monthly demand and sales of 100 units:

Variable production costs:

Direct materials

Direct labor

Variable factory overhead

Fixed production costs:

Depreciation (equipment)

Factory rent

Other

Per-Unit Costs

Saved

$ 160

190

100

60

88

20

Total production cost

$618

Variable selling & administrative costs

$32 per unit

Fixed selling & administrative costs

$44 per unit

Assume that the Violin Division was evaluating whether it would accept a special sales order for 30 violins at $430 per unit. For this purpose, total relevant cost per unit (given the costs stated above) is:

Help Save & B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Leo Consulting enters into a contract with Highgate University to restructure Highgate’s processes for purchasing goods from suppliers. The contract states that Leo will earn a fixed fee of $66,000 and earn an additional $13,000 if Highgate achieves $130,000 of cost savings. Leo estimates a 70% chance that Highgate will achieve $130,000 of cost savings. Assuming that Leo determines the transaction price as the expected value of expected consideration, what transaction price will Leo estimate for this contract? Transaction price for the contract ?arrow_forwardDiamond Boot Factory normally sells its specialty boots for $34 a pair. An offer to buy 85 boots for $30 per pair was made by an organization hosting a national event in Norfolk. The variable cost per boot is $12, and special stitching will add another $2 per pair to the cost Determine the differential income or loss per pair of boots from selling to the organization. Should Diamond Boot Factory accept or reject the special offer?arrow_forwardOriole Company sells 455 units for $290 each to Sheffield Inc. for cash. Oriole allows Sheffield to return any unused product within 30 days and receive a full refund. The cost of each product is $174. To determine the transaction price, Oriole decides that the approach that is most predictive of the amount of consideration to which it will be entitled is the most likely amount. Using the most likely amount, Oriole estimates that ten (10) units will be returned, the costs of recovering the units will be immaterial, and the returned units are expected to be resold at a profit. What amount of refund liability should Oriole record at the time of sale? $1740 O $2900 $1160 O $0arrow_forward

- Muskoka Tools Depot is selling snow blowers for $720.00 each. The same model blowers are being offered by Dixie Appliances for $504.00 each. What rate of discount should Muskoka Tools Depot offer to match the lower price? The variable costs to manufacture a digital appliance are $260 per appliance and the selling price is $850 per appliance. The fixed costs are $46,520 per month. a. Calculate the contribution margin per appliance. Round to the nearest cent b. Calculate the number of appliances that need to be sold per month to break even.arrow_forwardMobile Homes has an annual demand of 10,000 units for a small refrigerator. The supplier sells the units for $100 in order quantities below 124 and for $95 in order quantities above 125 units. The order cost is $5, and the annual holding cost is 10% of unit value. a) In what quantities should the item be purchased with an all-units quantity discount? b) If an incremental quantity discount schedule is in effect, how many refrigerators should Gursoy order each time an order is placed? c) Compare the cost savings for parts a) and b) with respect to the original case without discount. Which schedule is better?arrow_forwardA company operates in a competitive marketplace. They look to the market to determine their selling price. It looks like the market will bear a price of $438. The company has a goal of earning 10% return on sales on each unit. What would their target cost be? Round your answer to the nearest whole dollar.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education