Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

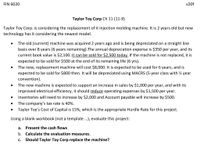

Transcribed Image Text:**FIN 6020 v20f**

**Taylor Toy Corp Ch 11 (11-9)**

Taylor Toy Corp. is considering the replacement of its injection molding machine. It is 2 years old but new technology has it considering the newest model.

- The old (current) machine was acquired 2 years ago and is being depreciated on a straight line basis over 8 years (6 years remaining). The annual depreciation expense is $350 per year, and its current book value is $2,100. It can be sold for $2,500 today. If the machine is not replaced, it is expected to be sold for $500 at the end of its remaining life (6 years).

- The new, replacement machine will cost $8,000. It is expected to be used for 6 years, and is expected to be sold for $800 then. It will be depreciated using MACRS (5-year class with ½ year convention).

- The new machine is expected to support an increase in sales by $1,000 per year, and with its improved electrical efficiency, it should reduce operating expenses by $1,500 per year.

- Inventories will need to increase by $2,000 and Account payable will increase by $500.

- The company’s tax rate is 40%.

- Taylor Toy’s Cost of Capital is 15%, which is the appropriate Hurdle Rate for this project.

Using a blank workbook (not a template …), evaluate this project:

a. Present the cash flows

b. Calculate the evaluation measures.

c. Should Taylor Toy Corp replace the machine?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Alfredo Company purchased a new 3-D printer for $90,000. This printer is expected to last for ten years, at which time, Alfredo believes it will be able to sell the printer for $15,000. Calculate yearly depreciation using the double-declining-balance method. PLEASE NOTE: All whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Year 1 Depreciation: _________________ Year 2 Depreciation: _________________ Year 3 Depreciation: _________________ Year 4 Depreciation: _________________ Year 5 Depreciation: _________________ Year 6 Depreciation: _________________ Year 7 Depreciation: _________________ Year 8 Depreciation: _________________ Year 9 Depreciation: _________________ Year 10 Depreciation: _________________arrow_forwardNew Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $500,000. The ovens originally cost $690,000, had an estimated service life of 10 years, had an estimated residual value of $40,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Problem 7-8A Part 4 4. Record the sale of the ovens at the end of the second year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardcomplete the following problem and explain how you got the numbers please. I am very confused on how solve thesearrow_forward

- eBook The Darlington Equipment Company purchased a machine 5 years ago, prior to the TCJA, at a cost of $80,000. The machine had an expected life of 10 years at the time of purchase, and it is being depreciated by the straight-line method by $8,000 per year. If the machine is not replaced, it can be sold for $5,000 at the end of its useful life. A new machine can be purchased for $170,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $55,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 100% bonus depreciation at the time of purchase. The old machine can be sold today for $55,000. The firm's tax rate is 25%. The appropriate WACC is 9%. a. If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outflow should be indicated by a minus sign. Round your answer to…arrow_forwardSt. Johns River Shipyards' welding machine is 15 years old, fully depreciated, and has no salvage value. However, even though it is old, it is still functional as originally designed and can be used for quite a while longer. A new welder will cost $181, 500 and have an estimated life of 8 years with no salvage value. The new welder will be much more efficient, however, and this enhanced efficiency will increase earnings before depreciation from $28,000 to $73, 500 per year. The new machine will be depreciated over its 5- year MACRS recovery period, so the applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52 %, 11.52 %, and 5.76%. The applicable corporate tax rate is 25%, and the project cost of capital is 10%. What is the NPV if the firm replaces the old welder with the new one? Do not round intermediate calculations. Round your answer to the nearest dollar. Negative value, if any, should be indicated by a minus sign. F1 Inflation Adjustments The Rodriguez Company is…arrow_forwardRequired information [The following information applies to the questions displayed below.] Speedy Delivery Company purchases a delivery van for $38,400. Speedy estimates that at the end of its four-year service life, the van will be worth $6,200. During the four-year period, the company expects to drive the van 201,250 miles. Actual miles driven each year were 52,000 miles in year 1 and 58,000 miles in year 2. Required: Calculate annual depreciation for the first two years of the van using each of the following methods. (Do not round your intermediate calculations.) 2. Double-declining-balance. Annual Year Depreciation 1 2arrow_forward

- pm.3arrow_forwardRequired information [The following information applies to the questions displayed below.] Speedy Delivery Company purchases a delivery van for $38,400. Speedy estimates that at the end of its four-year service life, the van will be worth $6,200. During the four-year period, the company expects to drive the van 201,250 miles. Actual miles driven each year were 52,000 miles in year 1 and 58,000 miles in year 2. Required: Calculate annual depreciation for the first two years of the van using each of the following methods. (Do not round your intermediate calculations.) 3. Activity-based. Annual Year Depreciation 1arrow_forwardHelp!!!arrow_forward

- Supreme Auto Service opened a new service center three decades ago. At the time the center was preparing to open, new equipment was purchased totaling $355,000. Residual value of the equipment was estimated to be $45,000 after 20 years. The company accountant has been using straight-line depreciation on the equipment. (a) How much was the annual depreciation for the original equipment (in $)? $ (b) If the hydraulic lift had originally cost $10,650, what would its residual value (in $) be after 20 years? $ (c) After six years of operation, the original hydraulic lift was replaced with a new model that cost $23,000. Book value was allowed for the old machine as a trade-in. What was the old hydraulic lift's book value when the replacement machine was bought (in $)? $ (d) What was the book value of the equipment inventory at the six-year point, substituting the new hydraulic lift for the original after the new lift had joined the inventory (in $)? Enter a numberarrow_forwardRequired information [The following information applies to the questions displayed below.] Speedy Delivery Company purchases a delivery van for $38,400. Speedy estimates that at the end of its four-year service life, the van will be worth $6,200. During the four-year period, the company expects to drive the van 201,250 miles. Actual miles driven each year were 52,000 miles in year 1 and 58,000 miles in year 2. Required: Calculate annual depreciation for the first two years of the van using each of the following methods. (Do not round your intermediate calculations.) 1. Straight-line. Annual Year Depreciation 1 2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education