FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

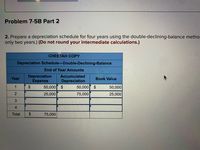

Can you tell me why this keeps saying that the answer is incomplete? I’ve already depreciated the asset down to its residual value.

Transcribed Image Text:Problem 7-5B Part 2

2. Prepare a depreciation schedule for four years using the double-declining-balance metho

only two years.) (Do not round your intermediate calculations.)

CHEETAH COPY

Depreciation Schedule-Double-Declining-Balance

End of Year Amounts

Depreciation

Expense

Accumulated

Year

Book Value

Depreciation

1

2$

50,000

2$

50,000

2$

50,000

2

25,000

75,000

25,000

4

Total

2$

75,000

![Required information

Problem 7-5B Determine depreciation under three methods (LO7-4)

[The following information applies to the questions displayed below.]

Cheetah Copy purchased a new copy machine. The new machine cost $100,000 including installation. The company

estimates the equipment will have a residual value of $25,000. Cheetah Copy also estimates it will use the machine for

four years or about 8,000 total hours. Actual use per year was as follows:

Year

Hours Used

1

3,000

2,000

1,200

2,800

3

Problem 7-5B Part 2

2. Prepare a depreciation schedule for four years using the double-declining-balance method. (Hint: The asset will be depreciated in

only two years.) (Do not round your intermediate calculations.)

CHEETAH COPY

Depreciation Schedule-Double-Declining-Balance

End of Year Amounts

< Prev

Next >

of 8

FEB

24

30](https://content.bartleby.com/qna-images/question/5f440a4a-a87c-43e8-9c30-e4890b6a6760/7c1fc7a5-41b4-4e5e-b538-2164bccf3974/2t7qxre_thumbnail.jpeg)

Transcribed Image Text:Required information

Problem 7-5B Determine depreciation under three methods (LO7-4)

[The following information applies to the questions displayed below.]

Cheetah Copy purchased a new copy machine. The new machine cost $100,000 including installation. The company

estimates the equipment will have a residual value of $25,000. Cheetah Copy also estimates it will use the machine for

four years or about 8,000 total hours. Actual use per year was as follows:

Year

Hours Used

1

3,000

2,000

1,200

2,800

3

Problem 7-5B Part 2

2. Prepare a depreciation schedule for four years using the double-declining-balance method. (Hint: The asset will be depreciated in

only two years.) (Do not round your intermediate calculations.)

CHEETAH COPY

Depreciation Schedule-Double-Declining-Balance

End of Year Amounts

< Prev

Next >

of 8

FEB

24

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Define and discuss survivorship bias and selection bias, and how they affect reported returns of illiquid assets.arrow_forwardWhy must we have an entry to remove fully depreciated fixed assets (no salvage value) from the books if there is no profit or loss on the disposal?arrow_forwardDo the fixed assets lose their value even though they continue to function and contribute to the engineering projects? Explain how?arrow_forward

- The key difference between amortization and depreciation is that amortization charges off the cost of an intangible asset, while depreciation does so for a tangible asset. True Falsearrow_forwardWhat are the requirements of depreciating an asset?arrow_forwardLand is not an asset we depreciate. Explain what it is not treated as an asset we depreciate?arrow_forward

- Discussionarrow_forwardFixed assets have their expenses spread out over time with depreciation. Why aren't they fully expensed at the time they are purchased?arrow_forward1. What are the three main factors used in determining depreciation of a fixed asset? 2. What is the double-declining balance method and what are the benefits of it?arrow_forward

- Why is the cost of certain kinds of property not recoverable at all by way of depreciation, depletion, or amortization deductions? In addition to answering that question, give three examples of the kinds of assets that are not subject to “cost recovery”.arrow_forwardDescribe the Costs of Defending Intangible Rights.arrow_forwardWhen do the depreciation expenses lose some of their value? Why?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education