FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

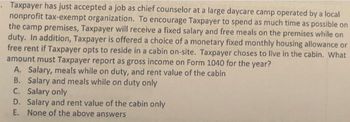

Transcribed Image Text:. Taxpayer has just accepted a job as chief counselor at a large daycare camp operated by a local

nonprofit tax-exempt organization. To encourage Taxpayer to spend as much time as possible on

the camp premises, Taxpayer will receive a fixed salary and free meals on the premises while on

duty. In addition, Taxpayer is offered a choice of a monetary fixed monthly housing allowance or

free rent if Taxpayer opts to reside in a cabin on-site. Taxpayer choses to live in the cabin. What

amount must Taxpayer report as gross income on Form 1040 for the year?

A. Salary, meals while on duty, and rent value of the cabin

B.

Salary and meals while on duty only

C. Salary only

D. Salary and rent value of the cabin only

E. None of the above answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Robyn is a taxpayer painted her office, which she uses for her business purposes. Shehas paid $7,000 to a professional painter to paint her office. As ‘part of the deal’ Robynreceives a free holiday package worth $1,500 from the painting business. How muchdeduction can Robyn claim and under which section?arrow_forwardA qualifying individual for the purposes of the child and dependent care expenses credit includes all of the following except: Multiple Choice A dependent under the age of 13. An adult child who is incapable of caring for himself/herself, who lived with the taxpayer for at least half of the year. A dependent child, age of 17 who attends school full time. A spouse who is incapable of caring for himself/herself, who lived with the taxpayer for at least half of the year.arrow_forwardSarah is a cash-method, calendar-year taxpayer, and she is considering making the following cash payments related to her business. Calculate the after-tax cost of each payment assuming she is subject to a 37 percent marginal tax rate. Note: Do not round intermediate calculation. Problem 9-54 Part-b (Algo) b. $3,800 to reimburse the cost of meals at restaurants incurred by employees while traveling for the business. Answer is complete but not entirely correct. After-tax cost S 3,097arrow_forward

- Tim and Martha paid $7,900 in qualified employment-related expenses for their three young children who live with them in their household. Martha received $1,800 of dependent care assistance from her employer, which was properly excluded from gross income. The couple had $56,500 of AGI earned equally. Use Child and Dependent Care Credit AGI schedule. Required: What amount of child and dependent care credit can they claim on their Form 1040? How would your answer differ (if at all) if the couple had AGI of $36,500 that was earned entirely by Martha?arrow_forwardSimon rents his cottage when he and his family are not using it. It qualifies as a vacation home rental. In 2021, he had rental income of $5,200. His deductible expenses were: Advertising $350 Commissions $775 Depreciation (rental portion) $1,500 Maintenance (rental portion) $750 Mortgage interest (rental portion) $1,250 Pest control (rental portion) $300 Prior-year carryover $500 Real estate tax $800 What amount of unallowed expense will Simon carry forward to next year? $0 $500 $1,025 $1,500arrow_forwardIn each of the following independent situations, determine how much, if any, qualifies as a deduction for AGI under § 222 (qualified tuition and related expenses). If an amount is zero, enter "0". Click here to access Exhibit 9.1 Limitations for Qualified Tuition Deduction. a. Lily is single and is employed as an architect. During 2020, she spends $4,100 in tuition to attend law school at night. Her modified AGI (MAGI) is $64,000. How much is her deduction for AGI under § 222 (qualified tuition and related expenses)? b. Liam is single and is employed as a pharmacist. During 2020, he spends $2,400 ($2,100 for tuition and $300 for books) to take a course in herbal supplements at a local university. His MAGI is $81,000. How much is his deduction for AGI under § 222 (qualified tuition and related expenses)? c. Hailey is married and is employed as a bookkeeper. She spends $5,200 for tuition and $900 for books and supplies in her pursuit of a bachelor's degree in accounting. Her MAGI is…arrow_forward

- Karen Most has a federal tax levy of $2,100.50 against her. If Most is single with two personal exemptions and had a take-home pay of $499.00 this week, how much would her employer take from her to satisfy part of the tax levy?arrow_forwardA taxpayer has always lived in New Jersey, but they worked in the state fo New York during the entire year. This taxpayer is concerned because teh state wges on their W-2 for New York are teh same as box 1 in their W-2 for New Jersey. What should the taxpayer do?arrow_forwardFor purposes of the Child and Dependent Care Credit, all the following are qualified expenses except for which one? a. نن فم b. d. A $700 adult day care expense for a disabled spouse while the taxpayer workers. A $450 childcare expense while the taxpayer obtains emergency medical care. A $500 payment to a grandparent for childcare while the taxpayer is employed. A $350 payment to a day care center while the taxpayer is looking for employment.arrow_forward

- Each of the following taxpayers purchased furniture online in September of 2022, and had it delivered to their home. Which taxpayer has correctly calculated their use tax for 2022? Chandler lives in Crook County. Her furniture cost $2,221 and was delivered to her home. She calculates that she owes $133 in use tax. Landon lives in Big Horn County and he had the furniture delivered there. His cost was $869, and he thinks his use tax is $19. Cilfford lives in Niobrara County. His furniture cost $6,449 and was delivered to his home. He has determined his use tax is $258. Samantha, who lives in Laramie County, paid $4,932 for her furniture, which was delivered to her home. She believes her use tax is $493.arrow_forwardVeronica mows lawns during the summer. In 2021 she was paid directly by homeowners for her work, in some case on the basis of the completed job, in other cases at an hourly rate. Her friend Jonathan does the same work. However, he is paid at an hourly rate by a lawn maintenance company. Which of the following statements is correct? Veronica earns business income and Jonathan earns employment income. Veronica will be able to deduct more expenses than Jonathan Veronica and Jonathan both earn employment income Veronica earns business income and Jonathan earns employment income. Their deductible expenses will be the same Veronica and Jonathan both earn business incomearrow_forward(Federal Taxation, Individual Income Taxes) Janice Morgan, age 24, is single and has no dependents. She is a freelance writer. In January 2019, Janice opened her own office located at 2751 Waldham Road, Pleasant Hill, NM 88135. She called her business Writers Anonymous. Janice is a cash basis taxpayer. She lives at 132 Stone Avenue, Pleasant Hill, NM 88135. Her Social Security number is 123-45-6782. Janice's parents continue to provide health insurance for her under their policy. Janice did not engage in any virtual currency transactions during the year and wants to contribute to the Presidential Election Campaign Fund. During 2019, Janice reported the following income and expense items connected with her business. Income from sale of articles $85,000 Rent 16,500 Utilities…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education