FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

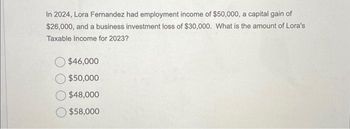

Transcribed Image Text:In 2024, Lora Fernandez had employment income of $50,000, a capital gain of

$26,000, and a business investment loss of $30,000. What is the amount of Lora's

Taxable Income for 2023?

$46,000

$50,000

$48,000

$58,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare the journal entries to record income tax expense, deferred income taxes and income taxes payable for 2025.arrow_forwardnearrow_forwardWhich of the following items IS included in gross income? O Municipal bond interest O Unemployment compensation received Scholarship for tuition and books O Inherited propertyarrow_forward

- Question 12: In general, when the number of withholding allowances increases for an employee who has completed a pre-2020 Form W-4, the federal income tax withholding Answer: A. decreases В. increases also C. is not affected D. decreases for some and increases for othersarrow_forwardWhat will be the total tax (Federal + Provincial) for a taxable income of $92,340? Do calculation and choose answer. (Use the Federal Tax Rates for 2023 and Sample Question.) $28,447.08 $21,913.54 $18,642.60 $25,228.96arrow_forwardH8. A- Describe what a progressive tax system and what a flat tax system are. B- Discuss the pros and cons of using these systems as the basis for our federal income tax bracketsarrow_forward

- For the current year, the maximum percentage of social security benefits which might be included In a taxpayer's gross income is? A, 50% 85% 0% 65% 100%arrow_forwardHow is the taxable gains arc calculated?arrow_forwardWhat will be the total tax (Federal + Provincial) for a taxable income of $295,319? Do calculation and choose answer. (Use the Federal Tax Rates for 2023 and Sample Question.) $108,775.82 $103,820.37 $98,794.01 $112,519.88arrow_forward

- Which of the following are deducted from gross taxable income todetermine net taxable income? a - Severance payments b - Registered Retirement Savings Plan contributions c - Health carepremiums d - Charitable donationsarrow_forwardRefer to the 2023 individual rate schedules in Appendix C. Required: What are the tax liability, the marginal tax rate, and the average tax rate for a married couple filing jointly with $66,900 taxable income? What are the tax liability, the marginal tax rate, and the average tax rate for a single individual with $192,300 taxable income? What are the tax liability, the marginal tax rate, and the average tax rate for a head of household with $461,300 taxable income?arrow_forwardB11. The amount in Box 1 of Form W-2 for taxable wages will always equal the amount in Box 3 of Form W-2 for Social Security wages. True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education