FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

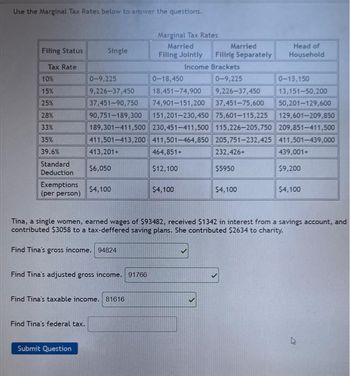

Transcribed Image Text:Use the Marginal Tax Rates below to answer the questions.

Filing Status

Tax Rate

10%

15%

25%

28%

33%

35%

39.6%

Standard

Deduction

Exemptions

(per person)

Single

Find Tina's federal tax.

413,201+

$6,050

Submit Question

$4,100

Find Tina's adjusted gross income. 91766

Find Tina's taxable income. 81616

Marginal Tax Rates

Married

Filing Jointly

0-9,225

0-18,450

0-13,150

9,226-37,450

18,451-74,900 9,226-37,450

13,151-50,200

37,451-90,750 74,901-151,200 37,451-75,600 50,201-129,600

90,751-189,300 151,201-230,450 75,601-115,225 129,601-209,850

189,301-411,500 230,451-411,500 115,226-205,750 209,851-411,500

411,501-413,200 411,501-464,850 205,751-232,425 411,501-439,000

232,426+

$5950

464,851+

$12,100

Married

Filing Separately

$4,100

Income Brackets

0-9,225

Head of

Household

$4,100

Tina, a single women, earned wages of $93482, received $1342 in interest from a savings account, and

contributed $3058 to a tax-deffered saving plans. She contributed $2634 to charity.

Find Tina's gross income. 94824

439,001+

$9,200

$4,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- FEDERAL PAYROLL TAXES Bracket ($) 0-9,700 9,701 - 39,475 39,476-84,200 84,201 - 160,725 160,726 - 204,100 204,101 - 510,300 510,301 - Marginal Tax Rate 10% 12% 22% 24% 32% 35% 37% TABLE 1: 2019 single taxpayer brackets and rates Exercise 1: Suppose your taxable income is $50,000. Compute your federal income tax. Individual Taxpayers Income Tax Bracket ($) 0-9,700 9,701 - 39,475 39,476 - 84,200 84,201 - 160,725 160,726 - 204,100 204,101 - 510,300 510,301 - Taxes Owed 10% within bracket $970 + 12% within bracket $4,543 + 22% within bracket $14,382.50 +24% within bracket $32,738.50 +32% within bracket $46,628.50 +35% within bracket $153,798.50 +37% within bracket TABLE 2: 2019 tax brackets Exercise 2: Your taxable income is $50,000. Use Table 2 to recompute your federal income tax. Exercise 3: Your taxable income is $50,000. Compute your effective tax ratearrow_forwardProblem Information Use the following tax rates, celling and maximum taxes: Employee and Employer OASDI: 6.20% $137,700 $8,537.40 Employee and Employer HI: 1.45% No limit No maximum Self-employed OASDI: 12.4% $137,700 $17,074.80 Self-employed HI: 2.9% No limit No maximum "Employee HI: Plus an additional 0.9% on wages over $200,000. Also applicable to self-employed. Rounding Rules: Unless instructed otherwise compute hourly rate and overtime rates as follows: 1. Carry the hourly rate and the overtime rate to 3 decimal places and then round off to 2 decimal places (round the hourly rate to 2 decimal places before multiplying by one and one-haif to determine the overtime rate). 2. If the third decimal place is 5 or more, round to the next higher cent. 3. If the third decimal place is less than 5, drop the third decimal place. Also, use the minimum hourty wage of $7.25 in solving these problems and all that follow. Jax Company's (a monthly depositor) tax lability (amount withheld from…arrow_forwardK @ W S F2 Antonio is single, earned wages of $44,700, received $1500 in interest from a savings account, contributed $3300 to a tax-deferred retirement plan, and took the standard deduction. Fin- gross income, adjusted gross income, and taxable income. Tax Rate 10% 12% 22% 24% 32% 35% 37% Standard Deduction #3 E Single up to $9950 up to $40,525 up to $86,375 up to $164,925 up to $209,425 up to $523,600 above $523,600 $12,550 Antonio's gross income was $ (Simplify your answer.) Antonio's adjusted gross income was $. (Simplify your answer.) Antonio's taxable income was $ (Simplify your answer.) D 80 F3 $ 4 Married Filing Jointly up to $19,900 up to $81,050 up to $172,750 up to $329,850 up to $418,850 up to $628,300 above $628,300 $25,100 F4 R F 07 dº % 5 F5 Married Filing Separately up to $9950 up to $40,525 up to $86,375 up to $164,925 up to $209,425 up to $314,150 above $314,150 $12,550 T G 6 F6 Y Head of Household up to $14,200 up to $54,200 up to $86,350 up to $164,900 up to…arrow_forward

- Duela Dent is single and had $182,400 in taxable income. Using the rates from Table 2.3, calculate her income taxes. What is the average tax rate? What is the marginal tax rate? Note: Do not round intermediate calculations and round your income tax answer to 2 decimal places, e.g., 32.16. Enter the average and marginal tax rate answers as a percent, rounded 2 decimal places, e.g., 32.16. Income taxes Average tax rate Marginal tax rate % %arrow_forwardProblem 9-13----2019The FUTA Tax (LO 9.6) Thomas is an employer with two employees, Patty and Selma. Patty's wages are $12,450 and Selma's wages are $1,310. The state unemployment tax rate is 5.4 percent. Calculate the following amounts for Thomas: Round your answer to two decimal places. a. FUTA tax before the state tax credit $ b. State unemployment tax $ c. FUTA tax after the state tax credit $arrow_forwardThank you.arrow_forward

- ans in txt formarrow_forward6. A married couple are calculating their federal income tax using the tax rate tables: Then Estimated Taxes Are If Taxpayer's Income Is Between So $16,700 $67,900 $137,050 $208,850 $372,950 But Not Over $16,700 $67,900 $137,050 $208,850 $372,950 Base TaxRate $0 10% $1,670.00 15% $9,350.00 25% $26,637.50 28% $46,741.50 33% $100,894.50 35% S0 $16,700 $67,900 $137,050 $208,850 $372,950 How much tax will they have to pay on their taxable income of $202,000? (4arrow_forwardPaul is head of household with taxable income of $ 68500 He has a $ 7000 entitled tax credit His tax bracket is 15 % up to earning $ 50,800 Standard deduction is $ 9350 exemption is $ 4050 per person what is his tax owedarrow_forward

- US Tax Law Taxpayer is single and has the following items: state taxes withheld, $7,500; property taxes $6,000; DMV, $500. His state tax deduction on schedule A would be A. $14,000 B. $13,500 C. $6500 D. $10,000 E. Some other amountarrow_forwardQuestion 3 of 10 Calvin received bimonthly paychecks of $2007.25 last year. If 17.1% of his yearly income got withheld for federal income tax, how much got withheld for federal income tax from each of Calvin's paychecks last year? O A. $82.38 O B. $34.32 O C. $343.23 O D. $823.78 LIarrow_forwardDo not give image formatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education