Malaysia personal income tax

The income of any person, including a company, accruing in or derived from Malaysia or received in Malaysia from outside Malaysia is subject to income tax or in other words all individuals are liable to tax on income accrued in, derived from or remitted to Malaysia. April 30th is the deadline for the submission of income tax returns for the individual taxpayer without a business income in Malaysia, while June 30th is for those with business income in Malaysia.

While reading the newspaper on tax issue reminded abu that he has not filled in his income tax form as yet. Tax computation has been a burden on abu’s shoulder and fatima has been talking and reminding abu to fill in his BE form before the deadline expires at the end of April.Abu is currently pursuing his study on a Master Degree on a part-time basis at the local university. Being a part-time student requires him to juggle between work and assignment at the same time. Due to time and work constraint, Lokman normally has to study and do his assignment at home. Based on that limitation.have 2 kids dand his wife have occupation

- Income RM54000 annual

- Sick mother medicine RM6000

- LIFE INSURANCE : RM2465.04

- MEDICALCARD: RM2271.84

- SAVING SCCHEME FOR CHILD EDUCATON RM2400

- EMPLOYEES PROVIDENT FUND RM2623.20

- zakatRM480

You are required to

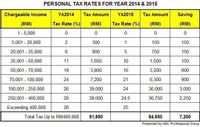

Calculate how much tax he shall pay for the year 2015.

Step by stepSolved in 2 steps

- For tax purpose, in what circumstances are individuals and companies treated as residents of Australia? Explainbased on the the Income Tax Assessment Act 1936 (Cth) and relevant case law.arrow_forwardFor tax purpose, in what circumstances are individuals and companies treated as residents of Australia? Explain based on the the Income Tax Assessment Act 1936 (Cth) and relevant case law.arrow_forwardTree Inc. is a branch of Todd Corporation located in Foreignland. The corporate tax rate in Foreignland is 20% in year 1, and 23% in years 2 and 3. The corporate tax rate in the U.S. is 21% for all years. Below is additional information about different amounts: Year 1 Year 2 Year 3 Foreign Source Income 74000 94000 104000 Foreign Taxes Paid 14800 21620 23920 U.S. tax before FTC 15540 19740 21840 Questions: 1. What is the foreign tax credit allowed in the U.S. for each of the years? 2. What is the U.S. tax liability for each of the years? 3. In Year 3, how much excess foreign tax credit can Todd Corportation carry back?arrow_forward

- Badges of trade are used to determine A. if an individual is UK resident or not B. whether or not a trade exists C. how much tax an individual should pay D. the age of a taxpayer 10. Unused pension allowance can be carried forward up to A. 1 year B. 3 years C. 2 years D. 6 yearsarrow_forward4. A, non-resident citizen, has the following income within and without the Philippines for 2018: Abroad Within the Phil 70,000 Interest income from depository bank under expanded foreign currency deposit system in Philippines Dividend income Royalty income-others Business income-net of expenses Interest income-bank deposits 90,000 50,000 200,000 30,000 60,000 40,000 300,000 40,000 What is the total final income tax due of A?arrow_forwardFederal income taxes have a significant effect on businesses and investors, and affect the personal decisions of every taxpayer in the United States. If we consider that the tax rates of corporations and individuals can reach up to 37% of contributions, certainly, all transactions have their tax impact. Argument about Internal Revenue Services of USA. Do you think the tax filing requirements that the IRS demands of taxpayers is fair? Why?arrow_forward

- Determine the taxable income for the year. (PHILIPPINES)arrow_forwardWhen is the taxation year in Canada? What is the determining factor of establishing what income is subject to taxation in Canada? Why is Elections Canada question on Tl? Why is the Foreign Tax question on the Tl?arrow_forwardUS Tax law contains a two-pronged system for taxing the US source income of foreign persons. Briefly explain this system.arrow_forward

- Badges of trade are used to determine A. if an individual is UK resident or not B. whether or not a trade exists C. how much tax an individual should pay D. the age of a taxpayer 10. Unused pension allowance can be carried forward up to A. 1 year B. 3 years C. 2 years D. 6 years.arrow_forwardDIGITAL TAX IN MALAYSIA Starting 1 January 2020, the government began imposing a digital services tax (DST) of six per cent on foreign digital service providers (FSPs) in Malaysia. Based on the given required to produce the write up on Digital Service Tax (DST) in Malaysia. Below is the content of your write up. Make sure you answer is genuine and not googleable You are required to write up on administration of digital tax of ; - Chargeable person - Taxable period - Threshold - Submission of return - Offence and penaltiesarrow_forwardMichigan has a State Income Tax of 4.25%. Some states in the US, because of a revenue source, do not take State Income Tax out of the workers checks. List the states in the US that the workers in those states do not pay State Income Tax. I only want State Income Tax please! (this is accounting)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education