FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

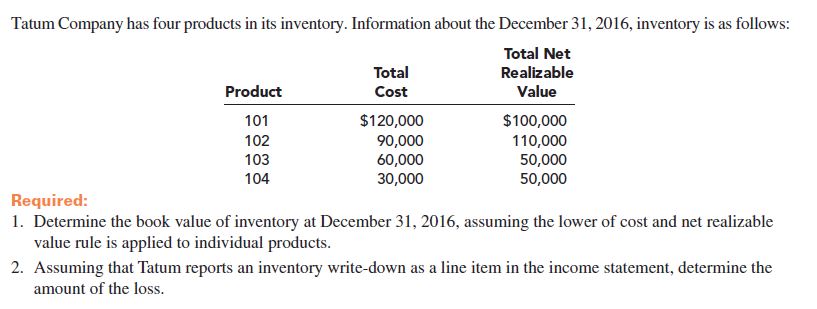

Transcribed Image Text:Tatum Company has four products in its inventory. Information about the December 31, 2016, inventory is as follows:

Total Net

Total

Cost

Realizable

Product

Value

$120,000

$100,000

101

102

90,000

60,000

30,000

110,000

50,000

50,000

103

104

Required:

1. Determine the book value of inventory at December 31, 2016, assuming the lower of cost and net realizable

value rule is applicd to individual products.

2. Assuming that Tatum reports an inventory write-down as a line item in the income statement, determine the

amount of the loss.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Crane Ltd. had the following items in inventory as at December 31, 2024: Item No. Quantity Unit Cost NRV དྷྭ སྒྲ སཱུ སྦ 340 $4.00 $4.30 370 3.00 2.90 380 8.00 9.00 400 7.00 6.80 Assume that Crane uses a perpetual inventory system. Fill in the table below for the lower of cost and net realizable value per unit, the inventory dollar amount at the lower of cost and net realizable value, and the dollar amount of the inventory at cost. ntity Unit Cost NRV Unit LC & NRV 340 $4.00 $4.30 S 370 3.00 2.90 Dollar LC & NRV 4.00 $ 2.90 1360 1073 380 8.00 9.00 8.00 3040 400 7.00 6.80 6.80 2720 Dollar Cost 1360 1110 3040 2800 $ 8193 $ 8310 Prepare any necessary adjusting entry at December 31, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry) Account Titles Debit Creditarrow_forwardNm. 152.arrow_forwardSunland Corporation had the following items in inventory as at December 31, 2023: Item No. A1 84 C2 D3 (a) Quantity 4 120 110 190 120 Inventory 1 Unit Cost $3.20 Inventory 1.70 8.50 7.50 Your answer is partially correct. Assume that Sunland uses a periodic inventory system, and that none of the inventory items can be grouped together for accounti purposes. The opening inventory on January 1, 2023, was $3,200 in total. Account Titles and Explanation Allowance to Reduce Inventory to NRV NRV $3.80 1.10 Prepare the year-end adjusting entries required to adjust to the lower of cost or net realizable value using the direct method. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts. List all debit entries before credit entries.) 10.30 7.10 (To transfer out beginning inventory balance) Allowance to Reduce Inventory to NRV (To record ending inventory at…arrow_forward

- Refer to the photoarrow_forward76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Number of Units Unit Cost Sales Beginning Inventory 260 $100 Sold 160 $140 Purchased 500 103 Sold 400 142 Purchased 420 110 Sold 370 174 Ending Inventory 250 Cost of Goods Sold FIFO $111,100 LIFO 97,900 AVG 96,805 Compare the ealculations for gross margin for A76 Company, based on the results of the perpetual inventory calculations using FIFO, LIFO, and AVG. Round intermediate calculation to 2 decimal places and final answer to nearest whole dollar. Comparison of FIFO, LIFO, AVG; Perpetual FIFO LIFO AVG Sales Revenue 24 Cost of Goods Sold Gross Marginarrow_forwardThe December 31,2016 inventory of Gwynn Company consisted of three products, for which certain information is provided below. Products Original Replace Estimated Expected Normal Profit cost cost Disposal Selling on sales cost Price A $25 $22 $6.5 $40 20% B $42 $40 $12 $48 25% C $120 $115 $25 $190 30% Instructions Compute the inventory valuation that should be reported for each product on December 31, 2016. ( I ) The lower-of-cost-or-n et realizable value (2) The lower-of-cost-or-marketarrow_forward

- sssarrow_forward13. Using the following information calculate the Cost of Goods Sold (COGS) and Ending Inventory (El) using the "FIFO Periodic/Perpetual" method. Beginning Inventory 2,400 units @$46 each Jan 5th Sold 2,000 units Jan 10th Purchased 4,000 units @, $50 Jan 15th Sold 3,500 units Jan 20th Purchased 2,000 units @$55 13. Using the facts from Problem #13, please calculate the COGS and El using the "LIFO Periodic" method. 13 Using the facts from Problem #13, please calculate the COGS and El using the "LIFO Perpetual" method. Note: This method requires a little more thought but is more in line with the actual events, in chronological order.arrow_forwardplease assistarrow_forward

- Tatum Company has four products in its inventory. Information about the December 31, 2021, inventory is as follows: Total Net Product Total Cst Realizable Value 101 102 $148,000 104,000 74,000 $114,000 124,000 64,000 64,000 103 104 44,000 Required: 1. Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. 2. Assuming that inventory write-downs are common for Tatum Company, record any necessary year-end adjusting entry. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the carrying value of inventory at December 31, 2021, assuming the lower of cost or net realizable value (LCNRV) rule is applied to individual products. Inventory Value Product Cost NRV 101 2$ 148,000 114,000 $114,000 102 104,000 124,000 104,000 103 74,000 64,000 66,000 X 104 44,000 64,000 44,000 370,000 $ 328,000arrow_forwardDetermine the ending inventory amount by applying the lower of cost or market value to a. Each inventory item of inventoryb. Total inventory The following data refer to Froning Company’s ending inventoryItem Code, Quantity, Unit Cost, Unit MarketLXC 60 $45 $48KMT 210 $38 $34MOR 300 $22 $20NES 100 $27 $32arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education