FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

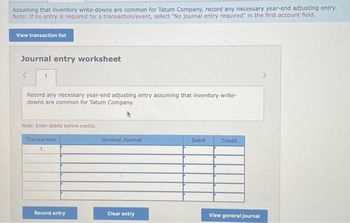

Transcribed Image Text:Assuming that inventory write-downs are common for Tatum Company, record any necessary year-end adjusting entry.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry worksheet

Record any necessary year-end adjusting entry assuming that inventory write-

downs are common for Tatum Company.

Note: Enter debits before credits.

Transaction

1

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

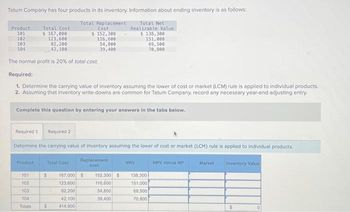

Transcribed Image Text:Tatum Company has four products in its inventory. Information about ending inventory is as follows:

Total Replacement

Cost

$

Total Net

Realizable Value

$ 138,300

151,000

152,300

116,600

54,800

69,500

39,400

70,800

Product Total Cost

101

$ 167,000

123,600

82,200

42,100

The normal profit is 20% of total cost.

102

103

104

Required:

1. Determine the carrying value of inventory assuming the lower of cost or market (LCM) rule is applied to individual products.

2. Assuming that inventory write-downs are common for Tatum Company, record any necessary year-end adjusting entry.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Determine the carrying value of inventory assuming the lower of cost or market (LCM) rule is applied to individual products.

Replacement

cost

Product

101

102

103

104

Totals

Total Cost

$

$

167.000 $ 152,300 $

123,600

116,600

82,200

54,800

42,100

39,400

414,900

NRV

138,300

151,000

69,500

70,800

NRV minus NP

Market

Inventory Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- M3arrow_forward26. The following data refer to Issue Company’s ending inventory: Item code Quantity Unit Cost Unit Market Small 100 $56 $59 Medium 420 38 44 Large 600 44 42 Extra-Large 220 64 67 How much is the inventory if the lower of cost or market rule is applied to each item of inventory?arrow_forwardA3arrow_forward

- Nonearrow_forwardValuing Inventory at Lower-of-Cost-or-Market Management of Tarry Company takes the position that under the lower-of-cost-or-market rule, the two items below are reported in ending inventory at $119,520 (total). Inventory cost is reported using LIFO. • Edgers: 2,160 in inventory; cost is $22 each; replacement cost is $16 each; estimated sale price is $30 each; estimated distribution cost is $3 each; and normal profit is 10% of sale price. • Hedge clippers: 1,440 in inventory; cost is $50 each; replacement cost is $36 each; estimated sale price is $90 each; estimated distribution cost is $28 each; and normal profit is 20% of sale price. a. Compute your inventory valuation by item and in total for the Tarry Company inventory reported above. Inventory valuation for edgers $ Inventory valuation for hedge clippers Total inventory valuation b. Prepare the entry, if any, to report inventory at the lower-of-cost-or-market. Assume that all adjustments directly impact cost of goods sold and…arrow_forwardValuing Inventory at Lower-of-Cost-or-Market Gard Inc. has compiled the following information related to its five products. Costs of disposal are estimated to be 10% of selling price, and gross profit is estimated to be 25% of the selling price. Determine the value of inventory applying the lower-of-cost-or-market rule to each individual inventory item. Note: Round each amount to the nearest dollar. #1 #2 #3 #4 #5 Estimated selling price $66 $76 $82 $100 $130 Original cost (LIFO) 45 48 60 63 90 Replacement cost 50 70 49 66 83 Inventory at the lower-of-cost-or-market $ (10) x $ (11) x $ (12) x $ (25) х $ (20) xarrow_forward

- A-2arrow_forwardThe inventory of Royal Decking consisted of five products. Information about ending inventory is as follows: Product Cost $ 50 A B 90 C 50 D 50 E 10 Product A Per Unit Costs to sell consist of a sales commission equal to 20% of selling price and shipping costs equal to 10% of cost. BUDE Required: What unit value should Royal Decking use for each of its products when applying the lower of cost or net realizable value (LCNRV) rule to units of ending inventory? C Selling Price $ 70 130 Cost 90 80 20 NRV Per Unit Inventory Valuearrow_forwardInformation pertaining to the inventory of Palette Company follows. LIFO Selling Replacement Cost Price Cost Category: Supreme Item A $5,600 $6,400 $4,800 Item B 7,200 7,200 7,680 Item C 17,600 17,600 16,800 Category: Classic Item X 28,800 28,800 30,400 Item Y 35,200 42,400 41,600 Item Z 56,000 48,000 52,800 The company has a normal profit margin of 20% of selling price and has no additional costs to complete or sell the items. What is the lower-of-cost-or-market value of the company's inventory applying the rule to (a) each individual item and (b) to each inventory category? Select one: a. Inventory item: $147,200; Inventory Category: $147,200 b. Inventory item: $150,400; Inventory Category: $150,400 c. Inventory item: $143,520; Inventory Category: $150,400 d. Inventory item: $141,120; Inventory Category: $147,520arrow_forward

- Nonearrow_forwardvalue on units in ending inventory: 20,000 per-unit product cost using absorption costing method: 130 units Dollar amount of the value of ending inventory using the absorption costing method: 2,600,000 per-unit product cost using variable costing method: 110 units dollar amount of the value of ending inventory using the variable costing method: 2,200,000 1. If you were advising the accounting department on whcih method to use, which would you recommend?arrow_forwardHan Company has three products in its ending inventory. Specific per unit data at the end of the year for each of the products are as follows: Cost Replacement cost Selling price Selling costs Normal profit Product 1 2 3 $ Cost Required: What unit values should Han use for each of its products when applying the lower of cost or market (LCM) rule to ending inventory? Product 1 $28 26 48 5 13 28 $ 98 58 Q Search Replacement cost 26 93 48 Product 2 $98 93 128 or 30 38 NRV Product 3 $58 48 60 10 20 W ENG 4x D 4:45 PM 11/27/2023arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education