Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

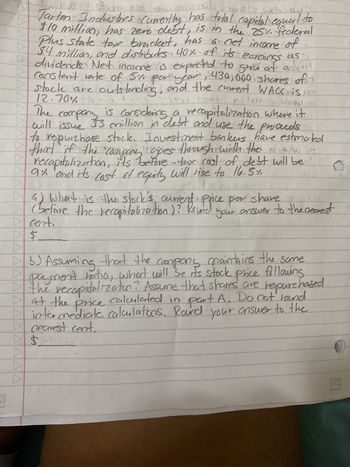

Transcribed Image Text:Tarton Industries currently has total capital equal to $10 million, has zero debt, is in the 25% federal-plus-state tax bracket, has a net income of $4 million, and distributes 40% of its earnings as dividends. Net income is expected to grow at a constant rate of 5% per year. 430,000 shares of stock are outstanding, and the current WACC is 12.70%.

The company is considering a recapitalization where it will issue $3 million in debt and use the proceeds to repurchase stock. Investment bankers have estimated that if the company goes through with the recapitalization, its before-tax cost of debt will be 9% and its cost of equity will rise to 16.5%.

a) What is the stock’s current price per share (before the recapitalization)? Round your answer to the nearest cent.

b) Assuming that the company maintains the same payout ratio, what will be its stock price following the recapitalization? Assume that shares are repurchased at the price calculated in part A. Do not round intermediate calculations. Round your answer to the nearest cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- BA eBook Tartan Industries currently has total capital equal to $6 million, has zero debt, is in the 25% federal-plus-state tax bracket, has a net income of $4 million, and distributes 40% of its earnings as dividends. Net income is expected to grow at a constant rate of 6% per year, 480,000 shares of stock are outstanding, and the current WACC is 14.00%. The company is considering a recapitalization where it will issue $5 million in debt and use the proceeds to repurchase stock. Investment bankers have estimated that if the company goes through with the recapitalization, its before-tax cost of debt will be 9% and its cost of equity will rise to 16.5%. a. What is the stock's current price per share (before the recapitalization)? Do not round intermediate calculations. Round your answer to the nearest cent. $ b. Assuming that the company maintains the same payout ratio, what will be its stock price following the recapitalization? Assume that shares are repurchased at the price…arrow_forwardOcasa Ltd. Just paid a dividend of $6.00 per share next year, and that the dividend will grow at the same rate as its profits. High profits are expected during this period, with the first three years of growth estimated to be 13%, 11% and 10% respectively, before returning to constant long+ term industry growth rate of 6% per year. The firm’s cost of equity is 15%. i. What is the firm’s share price today (P0)? ii. What is the expected share price next year (P1)? iii. Calculate the dividend yield for year 2. iv. Calculate the current capital gains yield (year 1).arrow_forwardBased on market values, Gubler's Gym has an equity multiplier of 168 times. Shareholders require a return of 1179 percent on the company's stock and a pretax return of 5.06 percent on the company's debt. The company is evaluating a new project that has the same risk as the company itself. The project will generate annual aftertax cash flows of $321,000 per year for 9 years. The tax rate is 21 percent. What is the most the company would be willing to spend today on the project? Multiple Choice $1,802,338 $1,953,295 $1,919,325 $1,864,487 $2,264,479arrow_forward

- please help! asaparrow_forwardMokoko Ltd. is considering a number projects and thus need to estimate its cost of capital in order to estimate their NPV. The company’s current dividend is $2.25 per share, which has grown steadily at 6% each year for over a decade and is expected to continue doing so. Its stock currently trades at $26 and there are 2 million shares outstanding. The company’s 100,000 preferred shares trade at $22 and pay annual dividends of $3. Cash and marketable securities on the company’s balance sheet total $30.5 million and the firm pays a tax rate of 30%. Their existing long-term debt (face value of $100 million, semi-annual payments) pays a 9.5% coupon and has 12 years remaining before maturity. Due to current conditions, the required rate of return (yield to maturity) on this debt is 11% and any new debt issuance would be required to offer the same yield to investors (there is no term premium for 1 year vs 12 year debt). What is Mokoko Ltd's Debt/Equity ratio? Assuming the firm wants to…arrow_forwardNHL Inc.’s current return on equity (ROE) is 20%, its current book equity per share is $50, and it pays out half of its earnings as dividends. Both the ROE and payout ratio will stay constant for the next two years. After year 2, competition will force ROE down to 8%, and NHL will increase its payout ratio to 75%. The cost of capital is 10%. What is NHL’s stock price today?arrow_forward

- Zippy Pasta Corporation (ZPC) has a constant growth rate of 7 percent. The company retains 30 percent of its earnings to fund future growth. ZPC’s expected EPS (EPS1) and ks for various capital structures are given below. Debt/Total Assets (%) Expected EPS (RM) ks (%) 20% $2.50 15.0% 30 3.00 15.5 40 3.25 16.0 50 3.75 17.0 70 4.00 18.0 Required: What is the optimal capital structure for ZPC? Show all of your working and explain your answer. (Hints: Capital structure is at…arrow_forwardRichard Adkerson, CEO of Freeport McMoRan (ticker symbol: FCX), expects his company’s dividends to constantly grow by 3.4% annually. Today, one share of FCX is worth $30.50 and investors holding the stock require a return of 10.5%. Next year, FCX annual dividend will be: a. $2.09 b. $1.96 c. $2.17 d. $2.39 e. $2.24arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education