FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Tano issues bonds with a par value of $94,000 on January 1, 2017. The bonds' annual contract rate is 6%, and interest is paid

semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 8%

and the bonds are sold for $89,071.

1. What is the amount of the discount on these bonds at issuance?

2. How much total bond interest expense will be recognized over the life of these bonds?

3. Prepare an amortization table using the straight-line method to amortize the discount for these bonds.

Complete this question by entering your answers in the tabs below.

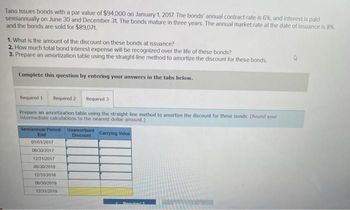

Required 3

Prepare an amortization table using the straight-line method to amortize the discount for these bonds. (Round your

intermediate calculations to the nearest dollar amount.)

Required 1 Required 2

Semiannual Period- Unamortized

Discount

End

01/01/2017

06/30/2017

12/31/2017

06/30/2018

12/31/2010

06/30/2019

12/31/2019

Carrying Value

Required 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Stanford issues bonds dated January 1, 2021, with a par value of $253,000. The bonds' annual contract rate is 6%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 8%, and the bonds are sold for $239,733. 1. What is the amount of the discount on these bonds at issuance?2. How much total bond interest expense will be recognized over the life of these bonds?3. Prepare an effective interest amortization table for these bonds.arrow_forwardQuatro Company issues bonds dated January 1, 2021, with a par value of $760,000. The bonds' annual contract rate is 10%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 8 %, and the bonds are sold for $799, 828. What is the amount of the premium on these bonds at issuance? How much total bond interest expense will be recognized over the life of these bonds? Prepare an effective interest amortization table for these bondsarrow_forwardMindsetta Music Inc. issued bonds on March 1, 2020, with a par value of $420,000. The bonds mature in 15 years and pay 14.00% annual interest in two semiannual payments. On the issue date, the annual market rate of interest for the bonds turned out to be 16%. (Table attached for reference) 1. What is the semiannual interest payment for these bonds? 2. How many semiannual interest payments will be made on these bonds over their life? 3. Are the bonds issued at discount, premium, or par? 4. Estimate the market value of the binds as the date they were issued 5. Journal entry: Record the sales of bonds at discount on the original issue datearrow_forward

- Stacy Company issued five-year, 8% bonds with a face value of $6,000 on January 1, 2016. Interest is paid annually on December 31. The market rate of interest of January 1, 2016, is 6%, and the proceeds from the bond issuance equal $6,505. What is the premium amortization?arrow_forwardQuatro Company issues bonds dated January 1, 2021, with a par value of $880,000. The bonds' annual contract rate is 13%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 12%, and the bonds are sold for $901,670. What is the amount of the premium on these bonds at issuance? How much total bond interest expense will be recognized over the life of these bonds? Prepare a straight-line amortization table for these bonds.arrow_forward21. On January 1, 2018, when the market rate of interest was 6% (APR), Habs Company issued two-year bonds with a maturity value of $1,000. The bonds have a 4% stated rate (APR) and pay interest semiannually on June 30 and December 31. sdr 11467 M = 4 a) Calculate the bond's issue price and its discount as of the date of issue. b) How much of the bond's discount is amortized after the first coupon is paid?arrow_forward

- please step by step solution.arrow_forwardOn January 1, 2020, XYZ Co. issued a bond with a $400,000 par (face) value. The bond is a 5-year bond and will mature on December 31, 2025. The bond has a contract rate of interest of 5% and interest is paid semi-annually on June 30 and December 31 of each year. On January 1, 2020, the market rate of interest for bonds was 6%. The issue price of the bond was $382,942. The journal entry to record issuance of the bond would be: Debit Credit Cash $382,942 Discount on B/P 17,058 Bonds Payable $400,000 prepare the journal entry to record the first interest payment on XYZ Co.'s bond on June 30, 2020 using the straight-line method. (Show your work in each step using the recommended approach.)arrow_forwardOn April 1, 2016, Lerner Corporation issued $120,000 of five-year, 10% bonds at a market (effective) interestrate of 8%. Interest is payable semiannually on April 1 and October 1What is the amount of the semi-annual interest payment?Will the bonds be issued at a discount or premium?Present Value of the Semiannual Interest PaymentInterest RateNumber of PeriodsFactorPresent Value of the Interest PaymentsPresent Value of the Bond Face AmountInterest RateNumber of PeriodsFactorPresent Value of the FaceBonds ProceedsAmount of Discount or Premiumarrow_forward

- Stanford issues bonds dated January 1, 2021, with a par value of $247,000. The bonds' annual contract rate is 6%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 8%, and the bonds are sold for $234,048. 1. What is the amount of the discount on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare an effective interest amortization table for these bonds. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an effective interest amortization table for these bonds. Note: Round all amounts to the nearest whole dollar. Semiannual Interest Period-End 01/01/2021 06/30/2021 12/31/2021 06/30/2022 12/31/2022 06/30/2023 12/31/2023 Total Cash Interest Bond Interest Paid Expense Discount Amortization < Required 2 Unamortized Discount Carrying Value Required 3arrow_forwardOn January 1, 2015, Loop Raceway issued 600 bonds, each with a face value of $1,000, a statedinterest rate of 5% paid annually on December 31, and a maturity date of December 31, 2017. Onthe issue date, the market interest rate was 6 percent, so the total proceeds from the bond issuewere $583,950. Loop uses the straight-line bond amortization method and adjusts for any roundingerrors when recording interest in the final year.Required:1. Prepare a bond amortization schedule.2. Give the journal entry to record the bond issue.3. Give the journal entries to record the interest payments on December 31, 2015 and 2016.4. Give the journal entry to record the interest and face value payment on December 31, 2017.5. Assume the bonds are retired on January 1, 2017, at a price of 98. Give the journal entries torecord the bond retirement.arrow_forwardplease fill the pictures out Quatro Company Issues bonds dated January 1, 2021, with a par value of $790.000. The bonds' annual contract rate Is 9%, and Interest Is pald semiannually on June 30 and December 31. The bonds mature In three years. The annual market rate at the date of Issuance Is 8%, and the bonds are sold for $810.694. 2 How much total bond Interest expense will be recognized over the Iife of these bonds? 3. Prepare a straight-line amortization table for these bonds.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education