FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

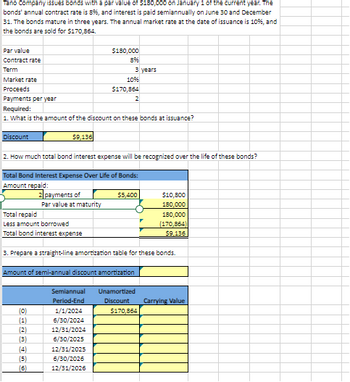

Transcribed Image Text:Tano Company issues bonds with a par value of $180,000 on January 1 of the current year. The

bonds' annual contract rate is 8%, and interest is paid semiannually on June 30 and December

31. The bonds mature in three years. The annual market rate at the date of issuance is 10%, and

the bonds are sold for $170,864.

Par value

Contract rate

Term

Market rate

Proceeds

Payments per year

Required:

1. What is the amount of the discount on these bonds at issuance?

Discount

Total repaid

Less amount borrowed

Total bond interest expense

$9,136

2. How much total bond interest expense will be recognized over the life of these bonds?

Total Bond Interest Expense Over Life of Bonds:

Amount repaid:

GUEUNEO

(0)

2 payments of

Par value at maturity

(2)

(3)

(4)

(5)

(6)

Amount of semi-annual discount amortization

$180,000

896

3. Prepare a straight-line amortization table for these bonds.

Semiannual

Period-End

3 years

10%

$170,864

2

1/1/2024

6/30/2024

12/31/2024

6/30/2025

12/31/2025

6/30/2026

12/31/2026

$5,400

Unamortized

Discount

$10,800

180,000

180,000

(170,864)

$9.136

$170,864

Carrying Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- NoleCo issues bonds on January 1, 20X1. The bonds mature ten years from this date and pay interest semi-annually on June 30 and December 31 each year. The face value of the bonds is $500,000 and the coupon/stated rate is 6%. The market rate on the issue date is 5%. The bonds were issued for $538,973 The carrying value of these bonds on December 31, 20X1 (after the interest payment on that date) is: $533,248 $536,591 $541,265 $500,000 $535,883arrow_forwardQuatro Company issues bonds dated January 1, 2021, with a par value of $760,000. The bonds' annual contract rate is 10%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 8 %, and the bonds are sold for $799, 828. What is the amount of the premium on these bonds at issuance? How much total bond interest expense will be recognized over the life of these bonds? Prepare an effective interest amortization table for these bondsarrow_forwardNoleCo issues bonds on January 1, 20X1. The bonds mature ten years from this date and pay interest semi-annually on June 30 and December 31 each year. The face value of the bonds is $800,000 and the coupon/stated rate is 10%. The market rate on the issue date is 11%. The bonds were issued for $752,198.Required: Complete the three parts below.Part A: The interest expense that NoleCo should recognize on June 30, 20X1 is:$40,000$44,000$37,610$42,112$41,371Part B: The interest expense that NoleCo should recognize on December 31, 20X1 is:$41,295$41,446$40,000$42,206$44,000Part C: The carrying value of these bonds on December 31, 20X1 (after the interest payment on that date) is:$800,000$753,569$755,015$752,198$756,516arrow_forward

- A company issues bonds with a par value of $370,000. The bonds mature in 5 years and pay 8% annual interest in semiannual payments. The annual market rate for the bonds is 6%. Compute the price of the bonds on their issue date. The following information is taken from present value tables: Present value of an annuity (series of payments) for 10 periods at 3% Present value of an annuity (series of payments) for 10 periods at 4% Present value of 1 (single sum) due in 10 periods at 3% Present value of 1 (single sum) due in 10 periods at 4% Table Values are Based on: n = i = Cash Flow Par (maturity) value Interest (annuity) Price of bonds Table Value Amount Present Value 8.5302 8.1109 0.7441 0.6756arrow_forward30arrow_forwardOn January 1, a company issues bonds dated January 1 with a par value of $230,000. The bonds mature in 3 years. The contract rate is 7%, and interest is paid semiannually on June 30 and December 31. The market rate is 8%. Using the present value factors below, the issue (selling) price of the bonds is: number of periods interest rate (n)= 3 636 Multiple Choice (i)= 7.0% 3.5% 8.0% 4.0% $236,032. $223,968. $230,000. $42,199. $181,769. Present Value of an Annuity (series of payments) 2.6243 5.3286 2.5771 5.2421 Present value of 1 (single sum) 0.8163 0.8135 0.7938 0.7903arrow_forward

- Quatro Company issues bonds dated January 1, 2021, with a par value of $880,000. The bonds' annual contract rate is 13%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 12%, and the bonds are sold for $901,670. What is the amount of the premium on these bonds at issuance? How much total bond interest expense will be recognized over the life of these bonds? Prepare a straight-line amortization table for these bonds.arrow_forwardOn January 1, a company issues bonds dated January 1 with a par value of $260,000. The bonds mature in 3 years. The contract rate 59%, and interest is paid semiannually on June 30 and December 31. The market rate is 10%. Using the present value factors below, the issue (selling) price of the bonds is: number of periods interest rate (n)= 3 6 3 6 Multiple Choice (i)= 9.0% 4.5% 10.0% 5.0% $266,602. $59,386. Present Value of an Annuity (series of payments) 2.5313 5.1579 2.4869 5.0757 Present value of 1 (single sum) 0.7722 0.7679 0.7513 0.7462arrow_forwardHartford Research issues bonds dated January 1 that pay interest semiannually on June 30 and December 31. The bonds have a $39,000 par value and an annual contract rate of 8%, and they mature in 10 years. (Table B.1, Table B.2, Table B.3, and Table B.4) Note: Use appropriate factor(s) from the tables provided. Round all table values to 4 decimal places, and use the rounded table values in calculations. Required: Consider each separate situation. 1. The market rate at the date of issuance is 6%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their issuance. 2. The market rate at the date of issuance is 8%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their issuance. 3. The market rate at the date of issuance is 10%. (a) Complete the below table to determine the bonds' issue price on January 1. (b) Prepare the journal entry to record their…arrow_forward

- am. 106.arrow_forwardOn January 1, a company issues bonds dated January 1 with a par value of $350,000. The bonds mature in 5 years. The contract rate is 7%, and interest is paid semiannually on June 30 and December 31. The market rate is 8% and the bonds are sold for $335,819. The journal entry to record the first interest payment using straight-line amortization is: Multiple Choice Debit Interest Expense $10,831.90; debit Discount on Bonds Payable $1,418.10; credit Cash $12,250,00 Debit Interest Expense $13,668.10, credit Discount on Bonds Payable $1,418.10, credit Cash $12,250.00 Debit Interest Expense $12,250.00, credit Cash $12.250.00 Debit interest Expense $13,668.10; credit Premium on Bonds Payable $1,418.10; credit Cash $12,250,00 Debit interest Payable $12.250.00; credit Cash $12.250.00arrow_forwardMontana Inc. issued $900,000 of 12-year bonds with a stated rate of 8% when the market rate was 9%. The bonds pay interest semi-annually. Assume that the bonds were issued for $883,386. Prepare an amortization table for the first three payments. Semiannual Interest Period Semiannual Interest Expense Semiannual Interest Payment Amortization of Discount Ending Carrying Value 1 2 3 PLEASE NOTE: All dollar amounts will be rounded to whole dollars using "$" and commas as needed (i.e. $12,345).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education