FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

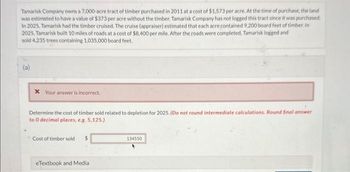

Transcribed Image Text:Tamarisk Company owns a 7,000-acre tract of timber purchased in 2011 at a cost of $1,573 per acre. At the time of purchase, the land

was estimated to have a value of $373 per acre without the timber. Tamarisk Company has not logged this tract since it was purchased.

In 2025, Tamarisk had the timber cruised. The cruise (appraiser) estimated that each acre contained 9.200 board feet of timber. In

2025, Tamarisk built 10 miles of roads at a cost of $8,400 per mile. After the roads were completed, Tamarisk logged and

sold 4,235 trees containing 1,035,000 board feet.

(a)

* Your answer is incorrect.

Determine the cost of timber sold related to depletion for 2025. (Do not round intermediate calculations. Round final answer

to 0 decimal places, e.g. 5,125.)

Cost of timber sold $

eTextbook and Medial

134550

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tree Lovers Inc. purchased 100 acres of woodland in which the company intends to harvest the complete forest, leaving the land barren and worthless. Tree Lovers paid $3,000,000 for the land. Tree Lovers will sell the lumber as it is harvested and expects to deplete it over five years (23 acres in year one, 30 acres in year two, 24 acres in year three, 10 acres in year four, and 13 acres in year five). Calculate the depletion expense for the next five years. Year 1 $ Year 2 Year 3 $ Year 4 Year 5 Prepare the journal entry for year one. If an amount box does not require an entry, leave it blank. %24 %24 %24 %24 %24arrow_forwardWildhorse Logging and Lumber Company owns 2,970 acres of timberland on the north side of Mount Leno, which was purchased in 2013 at a cost of $600 per acre. In 2025, Wildhorse began selectively logging this timber tract. In May 2025, Mount Leno erupted. burying the timberland of Wildhorse under a foot of ash. All of the timber on the Wildhorse tract was downed. In addition, the logging roads, built at a cost of $152,200, were destroyed, as well as the logging equipment, with a net book value of $272,600. At the time of the eruption, Wildhorse had logged 20% of the estimated 524,200 board feet of timber. Prior to the eruption, Wildhorse estimated the land to have a value of $210 per acre after the timber was harvested. Wildhorse includes the logging roads in the depletion base. Wildhorse estimates it will take 3 years to salvage the downed timber at a cost of $653,000. The timber can be sold for pulp wood at an estimated price of $2 per board foot. The value of the land is unknown, but…arrow_forwardConcord Company owns 9,000 acres of timberland purchased in 2009 at a cost of $1,470 per acre. At the time of purchase, the land without the timber was valued at $420 per acre. In 2010, Concord built fire lanes and roads, with a life of 30 years, at a cost of $88,200. Every year, Concord sprays to prevent disease at a cost of $3,150 per year and spends $7,350 to maintain the fire lanes and roads. During 2011, Concord selectively logged and sold 735,000 board feet of timber, of the estimated 3,675,000 board feet. In 2012, Concord planted new seedlings to replace the trees cut at a cost of $105,000. A-Determine the depreciation expense and the cost of timber sold related to depletionarrow_forward

- On January 1, 2003, Superior Landscaping Company paid P17,000 to buy a stump grinder. If Superior uses the grinder to remove 2,500 stumps per year, it would have an estimated useful life of 10 years and a salvage value of P4,500. The amount of depreciation expense for the year 2003, using units-of-production depreciation and assuming that 3,500 stumps were removed, is?arrow_forwardOn January 2, 2010, Sayre Company purchased a machine for $45,000. The machine has a five-year estimated useful life and a $3,000 estimated residual value. In addition, the company expects the machine to produce 200,000 units. Assuming that the machine produced 35,000 and 45,000 units during 2010 and 2011, respectively, complete the following chart. Depreciation Expense1st Year Depreciation Expense2nd Year Accumulated Depreciation Carrying (Book) Value Straight-Line Method Units-of-Production Method Double Declining Balance Methodarrow_forwardThe Giovanni Company purchased a tooling machine in 2007 for $120,000. The machine was being depreciated by the straight-line method over an estimated useful life of 20 years, with no salvage value. At the beginning of 2017, after 10 years of use, Giovanni paid $20,000 to overhaul the machine. Because of this improvement, the machine's estimated useful life would be extended an additional 5 years. What would be the depreciation expense recorded for the above machine in 2017? a.$7,333 b.$4,000 c.$6,000 d.$5,333arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education