FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

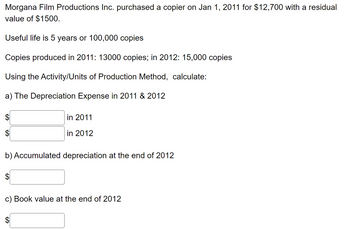

Transcribed Image Text:Morgana Film Productions Inc. purchased a copier on Jan 1, 2011 for $12,700 with a residual

value of $1500.

Useful life is 5 years or 100,000 copies

Copies produced in 2011: 13000 copies; in 2012: 15,000 copies

Using the Activity/Units of Production Method, calculate:

a) The Depreciation Expense in 2011 & 2012

$

in 2011

in 2012

b) Accumulated depreciation at the end of 2012

c) Book value at the end of 2012

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Irons Delivery Inc. purchased a new delivery truck for $45,000 on January 1, 2013. The truck is expected to have a $3,000 residual value at the end of its 5-year useful life. Irons uses the units-of-production method of depreciation. Irons expects the truck to run for 160,000 miles. The actual miles driven in 2013 and 2014 were 40,000 and 36,000, respectively. Required: Hide Prepare the journal entry to record depreciation expense for 2013 and 2014. 2013 Dec. 31 (Record units-of-production depreciation expense) 2014 Dec. 31 (Record units-of-production depreciation expense)arrow_forwardOn August 1, 2015, Toy inc. purchosed a new piece of equipment that cost$25000. The estimoted useful ife is five years and the estimated residual value is 52,500 . During the five years of useful life the equpment is expected to produce 10.000 units. If the company uses the double declining bolance method of depreciation, what is the depreciation expense for the yeat ended December 31 , 2016 ? Mutiple Croice $15,000 $5,400 $8,333 $6,000 None of the other atfenatives aro correctarrow_forwardOn January 1, 2016, D Company acquires for $100,000 a new machine with an estimated useful life of 10 years and no residual value. The machine has a drum that must be replaced every five years and costs $20,000 to replace. The company uses straight-line depreciation. Under IFRS, what is depreciation for 2016? a. $10,000. b. $10,800. c. $12,000. d. $13,200.arrow_forward

- On January 2, 2011, Jansing Corporation acquired a new machine with an estimated useful life of five years. The cost of the equipment was $40,000 with a residual value of $5,000. Prepare a complete depreciation table under the two depreciation methods listed below. Straight-line. 200 percent declining-balance. 150 percent declining-balance with a switch to straight-line when it will maximize depreciation expense.arrow_forwardCalculate the depreciation expense in the year of 2014 by using Straight line method Asif Company acquired machinery on January 1, 2014 with an amount AED84,000. The useful life of the machinery is expected to be 4 years. The salvage value at the end of the life of the machinery is expected to be AED4,000. The machinery can produce maximum 80,000 units during its useful life.arrow_forwardDepreciation and Rate of Return Burrell Company purchased a machine for $33,000 on January 2, 2016. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $16,500 each year. The tax rate is 25%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight-line and the double-declining-balance depreciation methods. Assume that the machine is the company's only asset. Straight-line method. Do not round intermediate calculations. Round final answers to two decimal places. 2016 25 % 2017 32.14 2018 45 % 2019 75 % 2020 225 Double-declining-balance depreciation method. Do not round intermediate calculations. Round final answers to two decimal places. 2016 % 2017 2018 2019 % 2020 %arrow_forward

- Linton Company purchased a delivery truck for $S34,000 on January 1, 2014. The truck has an expected salvage value of $2,000, and is expected to be driven 100,000 miles over its estimated useful life of 10 years. Actual miles driven were 19,000 in 2014 and 16,000 in 2015. Instructions a) Compute depreciation expense for 2014 and 2015 using (1) the straight-line method and (2) the units-of-activity method (b) Assume that Linton uses the straight-line method, Prepare the journal entry to record 2014 depreciation.arrow_forwardAlpesharrow_forwardZorzi Corporation purchased a Machine on January 1 2017 for $80 000. The machinery is estimated to have a salvage value of $8 000 after a useful life of 8 years. Compute the depreciation expense using the Straight-line method for 2017 O S8.900 O $9.000 O $9 100 O $9.200arrow_forward

- Zorzi Corporation purchased a Machine on January 1, 2017 for $80,000. The machinery is estimated to have a salvage value of $8,000 after a useful life of 8 years. Compute the depreciation expense for 2017 using the sume of the years didgets method assuming the machine was purchased on October 1, 2017 O $2,500 O $12.000 O S7.500 O $10,000arrow_forwardOn August 31, 2017, Advanced Automotive purchased a copy machine for $62,500. Advanced Automotive expects the machine to last for five years and to have a residual value of $2,500. Compute depreciation expense on the machine for the year ended December 31, 2017, using the straight-line method. Begin by selecting the formula to calculate the company's depreciation expense on the machine for the year ended December 31, 2017. Then enter the amounts and calculate the depreciation expense. (Abbreviation used: Acc. = accumulated. Do not round intermediary calculations. Only round the amount you input for straight-line depreciation to the nearest dollar.) Straight-line | ]x( / 12) = depreciationarrow_forwardPlease avoid solution image based thnxarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education