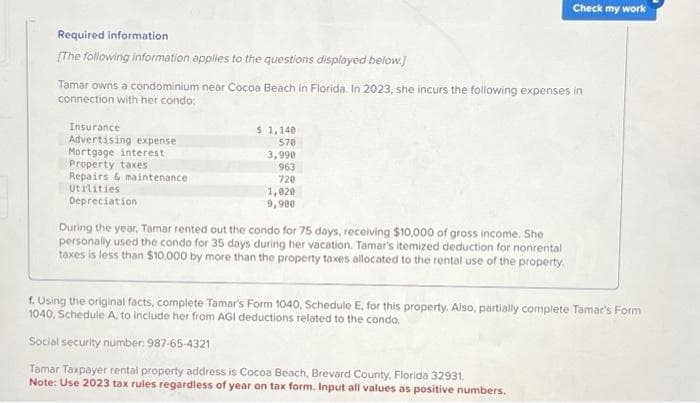

Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: Insurance Advertising expense Mortgage interest Property taxes Repairs & maintenance. Utilities Depreciation $ 1,140 570 3,990 963 720 1,020 9,900

Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in connection with her condo: Insurance Advertising expense Mortgage interest Property taxes Repairs & maintenance. Utilities Depreciation $ 1,140 570 3,990 963 720 1,020 9,900

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 3DQ

Related questions

Question

bh.4

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.)

Tamar owns a condominium near Cocoa Beach in Florida. In 2023, she incurs the following expenses in

connection with her condo:

Insurance

Advertising expense

Mortgage interest

Property taxes

Repairs & maintenance

Utilities

Depreciation

$ 1,140

570

3,990

963

720

1,020

9,900

During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She

personally used the condo for 35 days during her vacation. Tamar's itemized deduction for nonrental

taxes is less than $10.000 by more than the property taxes allocated to the rental use of the property.

Check my work

f. Using the original facts, complete Tamar's Form 1040, Schedule E, for this property. Also, partially complete Tamar's Form

1040, Schedule A, to include her from AGI deductions related to the condo.

Social security number: 987-65-4321

Tamar Taxpayer rental property address is Cocoa Beach, Brevard County, Florida 32931.

Note: Use 2023 tax rules regardless of year on tax form. Input all values as positive numbers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT