FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

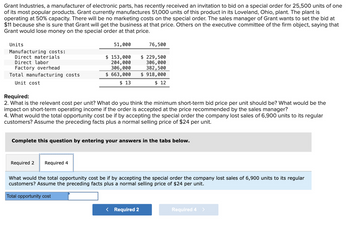

Transcribed Image Text:Grant Industries, a manufacturer of electronic parts, has recently received an invitation to bid on a special order for 25,500 units of one

of its most popular products. Grant currently manufactures 51,000 units of this product in its Loveland, Ohio, plant. The plant is

operating at 50% capacity. There will be no marketing costs on the special order. The sales manager of Grant wants to set the bid at

$11 because she is sure that Grant will get the business at that price. Others on the executive committee of the firm object, saying that

Grant would lose money on the special order at that price.

Units

Manufacturing costs:

Direct materials

Direct labor

Factory overhead

Total manufacturing costs

Unit cost

51,000

$ 153,000

204,000

306,000

$ 663,000

$ 13

Required 2 Required 4

Required:

2. What is the relevant cost per unit? What do you think the minimum short-term bid price per unit should be? What would be the

impact on short-term operating income if the order is accepted at the price recommended by the sales manager?

4. What would the total opportunity cost be if by accepting the special order the company lost sales of 6,900 units to its regular

customers? Assume the preceding facts plus a normal selling price of $24 per unit.

76,500

$ 229,500

306,000

382,500

$ 918,000

$ 12

Complete this question by entering your answers in the tabs below.

What would the total opportunity cost be if by accepting the special order the company lost sales of 6,900 units to its regular

customers? Assume the preceding facts plus a normal selling price of $24 per unit.

Total opportunity cost

< Required 2

Required 4 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Regis Company makes the plugs it uses in one of its products at a cost of P36 per unit. This cost includes P8 of fixed overhead. Regis needs 30,000 of these plugs annually, and Orlan Company has offered to sell them to Regis at P33 per unit. If Regis decides to purchase the plugs, P60,000 of the annual fixed overhead will be eliminated, and the company may be able to rent the facility previously used for manufacturing the plugs. If the plugs are purchased and the facility rented, Regis Company wishes to realize P100,000 in savings annually. To achieve this goal, the minimum annual rent on the facility must be: O P10,000 O P40,000 O P70,000 O P190,000arrow_forwardYour company has a customer who is shutting down a production line, and it is your responsibility to dispose of the extrusion machine. The company could keep it in inventory for a possible future product and estimates that the reservation value is $200,000. Your dealings on the secondhand market lead you to believe that if you commit to a price of $250,000, there is a 0.5 chance you will be able to sell the machine. If you commit to a price of $300,000, there is a 0.2 chance you will be able to sell the machine. If you commit to a price of $350,000, there is a 0.1 chance you will be able to sell the machine. These probabilities are summarized in the following table. For each posted price, enter the expected value of attempting to sell the machine at that price. (Hint: Be sure to take into account the value of the machine to your company in the event that you are not be able to sell the machine.) Posted Price Probability of Sale Expected Value ($) ($) $350,000 0.1…arrow_forwardArtisan Metalworks has a bottleneck in their production that occurs within the engraving department. Jamal Moore, the COO, is considering hiring an extra worker, whose salary will be $54,000 per year, to solve the problem. With this extra worker, the company could produce and sell 2,900 more units per year. Currently, the selling price per unit is $25.00 and the cost per unit is $7.50. $3.40 1.00 0.40 2.70 $7.50 Direct materials Direct labor Variable overhead Fixed overhead (primarily depreciation of equipment) Total Using the Information provided, calculate the annual financial Impact of hiring the extra worker. Profit $ Increase ✔arrow_forward

- Leo Consulting enters into a contract with Highgate University to restructure Highgate's processes for purchasing goods from suppliers. The contract states that Leo will earn a fixed fee of $80,000 and earn an additional $16,000 if Highgate achieves $160,000 of cost savings. Leo estimates a 50% chance that Highgate will achieve $160,000 of cost savings. Assuming that Leo determines the transaction price as the expected value of expected consideration, what transaction price will Leo estimate for this contract? Transaction price for the contractarrow_forwardHASF Furniture Inc. manufactures a moderate-price set of lawn furniture (a table and four chairs) that it sells for $500. It currently manufactures and sells 10,000 sets per year. The manufacturing costs 325 (include $185 for materials and $45 for labor per set). The overhead entirely of fixed costs. Modern furniture’s is considering a special purchase offer from a large retail firm, which has offered to buy 300 sets per year for three years at a price of $250 per set. Modern furniture has the available plant capacity to produce the order and expects no other orders or profitable alternative uses of the plant capacity. Required: Revenue increase after accepting the order Cost increase after accepting the order At what amount of profit increaes after accepting the speical orderarrow_forwardBefore Coronado could give Langston's Landscape Company an answer, the company received a special order from Benson Building & Supply for 13,500 fireplaces. Benson is willing to pay $67 per fireplace but it wants a special design imbedded into the fireplace that increases cost of goods sold by $55,350. The special design also requires the purchase of a part that costs $5,500 and will have no future use for Coronado Company. Benson Building & Supply will pick up the fireplaces so no shipping costs are involved. Due to capacity limitations, Coronado cannot accept both special orders. Which order should be accepted? Document your decision by preparing an incremental analysis for Benson's order. (Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) Reject order Revenues $ Costs Cost of Goods Sold Operating Expenses Unique part Net Income $ Coronado should accept the order from Accept order $ Net Income Increase (Decrease) $ $ $arrow_forward

- The Elberta Fruit Farm of Ontario is considering buying a cherry-picking machine to replace the part-time workers it usually hires to harvest its annual cherry crop. The machine shakes the cherry tree, causing the cherries to fall onto plastic tarps that funnel the cherries into bins. The company gathered the following information: The farm pays part-time workers $200,000 per year to pick the cherries. The cherry picker would cost $540,000, have a 8-year useful life with no salvage value, and be depreciated using the straight-line method. The cherry picker’s annual out-of-pocket costs would be cost of an operator and an assistant, $85,000; insurance, $4,000; fuel, $12,000; and a maintenance contract, $15,000. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Calculate the annual savings in cash operating costs provided by the cherry picker. 2a. Compute the cherry picker’s simple rate of return. 2b. Would…arrow_forwardCassandra Boat Builders builds and sells powerboats with a hull constructed primarily of teak wood. The boat building season is during Spring and Summer. The company begins building each boat only after a firm commitment was made by a specific buyer. Since the price of teak wood tends to fluctuate, Cassandra purchases several future contracts with different due dates during the building season to hedge the risk of fluctuating wood prices. During the 20X1 boat building season, the price of teak wood increased and reduced the Company's gross margin by $250,000. However, due to the increases in the teak wood prices, Cassandra realized a $240,00 gain on the related future contracts. Cassandra designates the futures as a cash flow hedge of an anticipated transaction. Which of the following entries (presented in summary format) should Cassandra Boat Builders make to recognize the gain from the future contracts? Multiple Choice Future contract 240,000 Gain on future…arrow_forwardMarquette receives a proposal from an outside contractor who offers to make and ship 1,500 fences directly to Marquette’s customers as orders arrive from Marquette’s sales force. When managers meet to discuss this proposal, Product Manager Will Hansen brings up the fact that they have the design for an electric fence that can be used for large animals that has never been produced. Will suggests that this may be the perfect time to launch this new product and at a selling price of $225 per unit it is sure to increase sales revenue. The production manager calculates that the idle time created by accepting the contractors offer would allow them to produce 1,000 of the new fence. The cost to produce the new fence would be $175 in variable manufacturing expense but fixed manufacturing and marketing costs would remain unchanged. The product mix would now be 1,000 of the new fence and 1,500 of the old fence. If Marquette wants to seriously consider taking the contractors offer, what in-house…arrow_forward

- Apple Incorporated, the worlds leading manufacturer of mobile phones, currently sells their cellphones for 90,000 per unit. This phone costs 60,000 to manufacture. Pineapple Company, the second leading manufacturer of cellphones, revealed that they would be unveiling a new model of phone that will sell for 70,000. This new phone contains all the features and performs at par with Apple’s phones. To keep up with the competition, Apple management believes that they should lower the price to 70,000. The Marketing Department also believes that the new price will cause sales to increase by 10% even with a new cellphone in the market. Apple currently sells 150,000 units of their phones annually. What is the target cost of Apple’s products if the target operating income is 20% of sales?arrow_forwardParker & Stone, Incorporated, is looking at setting up a new manufacturing plant in South Park to produce garden tools. The company bought some land 4 years ago for $5 million in anticipation of using it as a warehouse and distribution site, but the company has since decided to rent these facilities from a competitor instead. If the land were sold today, the company would net $9.4 million. The company wants to build its new manufacturing plant on this land; the plant will cost $13.2 million to build, and the site requires $1,410,000 worth of grading before it is suitable for construction. What is the proper cash flow amount to use as the initial investment in fixed assets when evaluating this project?arrow_forwardGrant Industries, a manufacturer of electronic parts, has recently received an invitation to bid on a special order for 25,000 units of one of its most popular products. Grant currently manufactures 50,000 units of this product in its Loveland, Ohio, plant. The plant is operating at 50% capacity. There will be no marketing costs on the special order. The sales manager of Grant wants to set the bid at $14 because she is sure that Grant will get the business at that price. Others on the executive committee of the firm object, saying that Grant would lose money on the special order at that price. Units Manufacturing costs: Direct materials Direct labor Factory overhead Total manufacturing costs Unit cost 50,000 Required 2 Required 4 75,000 $ 200,000 250,000 350,000 $ 800,000 $ 1,125,000 $ 16 $15 Required: 2. What is the relevant cost per unit? What do ou think the minimum short-term bid price per unit should be? What would be the impact on short-term operating income if the order is…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education