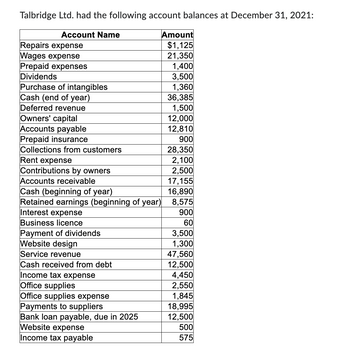

What is total assets on this company's

What is total current liabilities on this company's balance sheet?

What is the correct order for the current liabilities section of the balance sheet?

a. Accounts payable, payments to suppliers, deferred revenue, income tax payable

b. Bank loan payable, Income tax payable, Accounts payable, Deferred revenue

c. Accounts payable, Income tax payable, Payments to suppliers

d. Accounts payable, Deferred revenue, Income tax payable

e. Accounts payable, Income tax payable

Enter the letter that corresponds to your choice. (A B C D E)

What is total liabilities on this company's balance sheet?

What is total equity on this company's balance sheet?

What is the correct order for the equity section of the balance sheet?

a. Owners' Capital, Retained earnings

b. Retained earnings, Owners' capital

c. Retained earnings, Owners' capital, Profit

d. Retained earnings, Profit, Owners' capital

e. Owners' capital, Retained earnings, Profit, Dividends

Enter the letter that corresponds to your choice. (A B C D E)

What is the correct title for this company's statement of

a. Talbridge Ltd., Statement of Cash Flows, December 31, 2021

b. December 31, 2021, Statement of Cash Flows, Talbridge Ltd.

c. Talbridge Ltd., December 31, 2021, Statement of Cash Flows

d. Talbridge Ltd., Statement of Cash Flows, Year ended December 31, 2021

e. Statement of Cash Flows, Talbridge Ltd., Year ended December 31, 2021

Enter the letter that corresponds to your choice. (A B C D E)

a. Operating, Investing, Financing, Change in cash

b. Investing, Operating, Financing, Change in cash

c. Financing, Investing, Operating, Change in cash

d. Investing, Operating, Financing

e. Change in cash, Investing, Operating, Financing

Enter the letter that corresponds to your choice. (A B C D E)

Step by stepSolved in 1 steps

- Why would companies perform a set-off of assets and liabilities?arrow_forwardA primary focus of financial reporting about a company's performance during an accounting period is information related to the company's: a. Balance Sheet b. Income Statement c. Comprehensive Income d. Cash Flowsarrow_forwardWhat key financial aspects do accounting ratios measure?arrow_forward

- What are the total assets ? what is the net worth? how much does the company owe? whag is the company's account balance ?arrow_forwardHow do firms use current liabilities, including accounts payable, accruals, lines of credit, commercial paper and short-term loans, to finance current assets?arrow_forwardWhat is one of the possible choices for financing a company’s operations and how do we account for the amount we owe and the payments we must make on the debt?arrow_forward

- What are the the main classifications/types of accounts? Income statement accounts Balance sheet accounts Revenues and expenses Assets, liabilities, equity, revenues, expensesarrow_forwardIdentify the financial statement on which each of the following accounts would appear: the income statement, the retained earnings statement, or the balance sheet: a. Insurance Expense b. accounts receivable c. office supplies d. sales revenue e. common stock f. notes payablearrow_forwardIn which of the following types of accounts are increases recorded by credits? Question 8 options: Revenue, Dividends Liability, Revenue Dividends, Asset Expense, Liabilityarrow_forward

- Which of the following would be found on a company's balance sheet? -accounts receivable -interest expense - property, plant, and equipment -long-term debt A- I and IV only B- I, II, and III only C- I, II and IV only D- I, III and IV onlyarrow_forwardWhich of the following correctly describes how accounts payable will appear on the financial statements? Multiple Choice O O Liability on the balance sheet Asset on the balance sheet Expense on the income statement Revenue on the income statementarrow_forwardIdentifying and Classifying Financial Statement Items For each of the following items, indicate whether they would be reported in the balance sheet (B) or income statement (1). (a) Machinery (b) Supplies expense (c) Inventories (d) Sales (e) Common stock (f) Factory buildings (g) Receivables (h) Taxes payable (i) Taxes expense (i) Cost of goods sold (k) Long-term debt (1) Treasury stock ◆ ◆ ◆ ♦ ♦ ◆ ◆ ♦ ♦arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education